Insight Focus

- The approach to Lunar New Year often provides a boost to the container shipping industry.

- But over the past few years, demand from China has been lacklustre.

- A long term behavioural change in Chinese spending would be negative for container rates.

What is Lunar New Year?

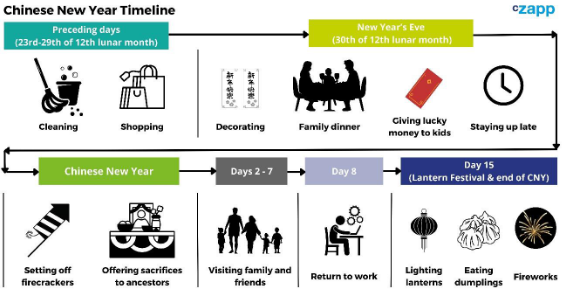

China’s Lunar New Year is a 15-day celebration that takes place in late January or early February each year. The date of the holiday changes each year because it follows the phases of the moon.

The Chinese New Year festival is the biggest celebration of the year – much like the Christmas and New Year holidays that take place in late December and early January in other parts of the world. Chinese workers are given seven days off work to celebrate over Lunar New Year.

There are several traditions associated with the celebrations, including visiting family, wearing red clothes, hanging red decorations and setting off fireworks. Special dishes are often prepared during the celebration and there are several parades.

So, what does this have to do with the container industry? Well, China is one of the biggest consumption markets in the world due to population growth and an increasing middle class.

Ahead of their New Year celebrations and week-long holiday, container demand tends to get a boost from purchasing and stocking activity. Likewise, during and after the holiday, there tends to be a lull in the container market.

Freight Rates Rise

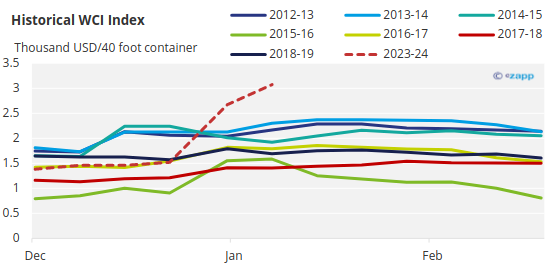

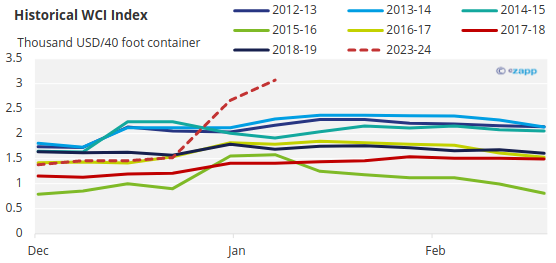

During normal years, the pickup in demand in the run up to Chinese New Year creates an increase in freight rates. During the pandemic years, however, there have been distortions in rates. This year, rates have increased significantly over the period higher due to the Red Sea crisis.

Note: Years from 2020 removed due to pandemic-related distortion

Source: Drewry

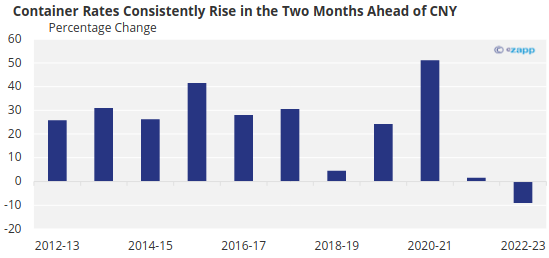

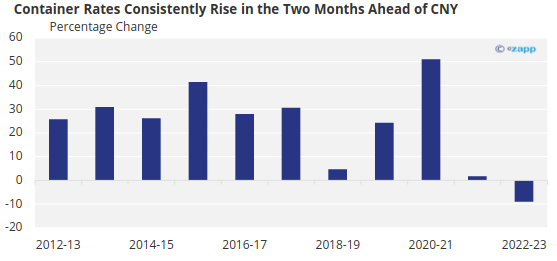

Prior to the pandemic, container rates registered a 25 to 30% rise in the months approaching Lunar New Year. However, the distortions in freight rates over the 2021 to 2023 period coupled with strict lockdowns in China that stifled demand has dampened this effect in the past two years.

Source: Drewry

Why Does This Happen?

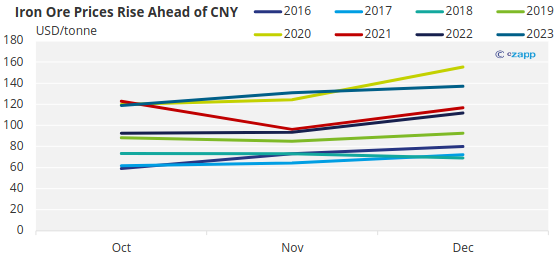

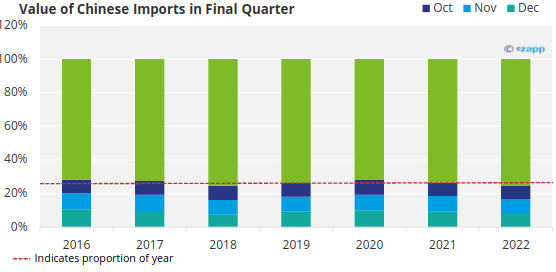

A lot of restocking in China happens in the approach to Lunar New Year. Depending on the date of the celebrations that year, this can run from November through December and into early January.

For instance, the steelmaking industry wants to ensure it has enough materials to last throughout the holiday period and potentially through the end of the quarter. As a result, iron ore demand increased and prices subsequently rise during these months.

Source: World Bank

China is by far the world’s biggest iron ore importer, but this is imported in dry bulk vessels – not containers. This means that dry bulk does see some increase in demand during the period – although the effect is not as pronounced as it is within the container industry.

Chinese New Year generates a boost for container rates over the relatively quiet December period in European and American markets.

Source: UN Comtrade

However, after the Lunar New Year celebrations begin, businesses in China essentially close down for seven days. The demand at this point drops off, and a lull continues for the rest of the first quarter.

What Issues Might Be Faced?

This year, container rates have risen well above the normal levels that were seen even before the pandemic. This is a direct result of the Red Sea crisis, which has all but cut off Chinese trade from Europe – or else made It much more expensive.

Source: Drewry

Any vessels that want to sail between the continents must either risk sailing through the Suez Canal or divert its route around the Cape of Good Hope – adding significant time and cost to its journey.

This year, China has recorded its lowest growth rate since the 1960s. This is thanks to the aftermath of strict Covid lockdowns, with people now largely choosing to save money rather than spend.

For the past two years, the CNY-related boost has been extremely weak, and this year the low growth rate signals that the same may happen again.

Source: Drewry

The implications of a behavioural change in Chinese buying habits over this period of the year would be significant for the freight industry.