Insight Focus

- CS Brazil is set to produce a record 41.5mmt of sugar this season.

- Sugar and ethanol parity have not been this high for this long ever.

- Mills are investing in more production capacity.

Centre-South (CS) Brazil is the world’s largest sugar cane growing region. It’s also the world’s largest sugar producer and sugar exporter. What happens in CS Brazil sets the tone for the whole sugar market.

In the coming 12 months we think that the world’s dependence on CS Brazil for sugar supply will grow to record levels. As much as 70% of the world’s raw sugar will come from CS Brazil in 2024, up from 55% in 2022.

The good news is that CS Brazil should make a record amount of sugar in 2023/24. The bad news is that it’s going to be difficult for CS Brazil to supply this sugar to the world as quickly as it’s needed.

In this article we are going to focus on the good news and examine why CS Brazil is set to make 41.5m tonnes of sugar in 2023/24. This is 3m tonnes more than it’s ever made before. How has the region managed to increase sugar output by 3m tonnes in 3 years?

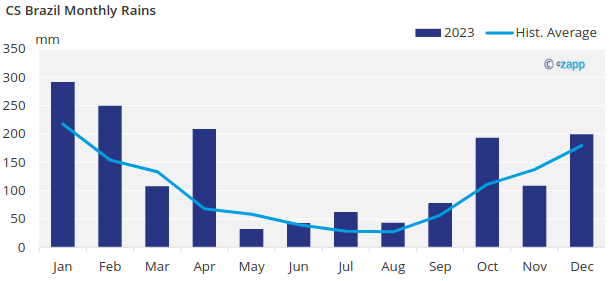

Weather

Cane is a very resilient crop. When the weather is dry agricultural yields (tonnes of cane per hectare) can fall, but to a lesser extent than in soybean or corn, for example. And the opposite is true. A higher volume of rains can have a massive impact in increasing agricultural yields.

So far this year, CS registered 1420mm of rains, which is almost 40% higher than 20-year historical average.

Cane Crush

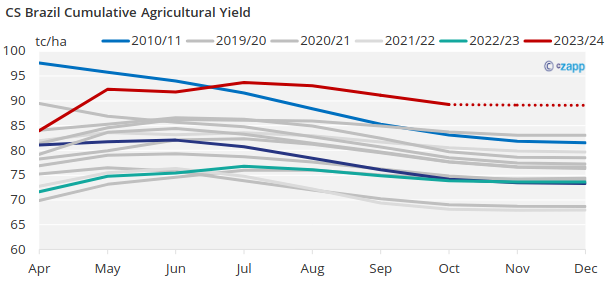

Excellent precipitation equals excellent agricultural yields. Up until October, cumulative TCH (tonnes of cane per hectare) was at 89 – this is the highest we have on our historical database that starts in 2010.

Source: Czapp/UNICA

We therefore estimate overall cane availability in CS Brazil at close to 675m tonnes this season. This is a record amount.

However, we think mills in the region only have the capacity to crush 664m tonnes if they operate at full capacity. This means there’ll be cane left uncrushed in the fields at the end of this season which can then be harvested and processed early next season. The 2024/25 campaign could therefore start quickly, as it did in 2016/17, if weather allows.

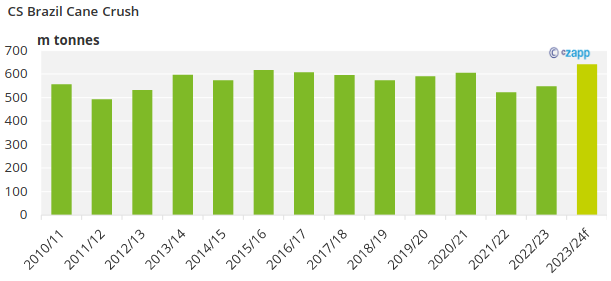

Source: UNICA

We think mills will actually crush 644m tonnes of cane this season, which is 20m tonnes more than the previous record set in 2020/21. Whether mills achieve this target depends on how much cane they can crush in Q1’24, which itself if dependent on the weather. Wet weather limits field access and so would lead to a lower cane crush.

Sugar Returns

Mills in CS Brazil can choose whether to maximise sugar production or ethanol production, depending on which product pays more. Sugar has paid more than ethanol since early 2020. However, for the past 3 seasons, sugar’s advantage over ethanol wasn’t enough to push the overall sugar mix for the region beyond 46%.

Since mid-2022, ethanol prices have been falling, while sugar prices have been rising. Sugar now pays 13c/lb more than ethanol, one of the highest premiums ever seen. Even mills far inland (who normally prefer to make ethanol because of the high inland freight to get sugar to the ports for export) are incentivized to maximise sugar output.

Not only is sugar’s premium over ethanol extremely high, but it’s been sustained for a long time. This contrasts with the sharp sugar rally in 2011. For mills, the price signal has been: SUGAR, SUGAR, SUGAR.

Sugar Mix

With the incentive to produce more sugar, CS mills have been pushing the sugar mix to the limit. Since last season, small improvements have been made to guarantee a higher flexibility to sugar. This year more sugar production projects have been announced, leading to an increase of sugar production capacity of over 2m tonnes over the next 2 years.

But this season, mills could make as much as 48.8% sugar, the highest sugar mix since 2012/13. Next year could reach 50%, but to do so mills will need to deal with massive stock pressure …

To understand why record sugar production from Brazil is not lowering sugar prices, please read our next article.