Opinion Focus

- Economy shrinks in Q4 but grows again in Q1.

- Agribusiness is the engine of growth, with a record grain harvest.

- The crop should earn almost BRL 870b, the best result since 1989.

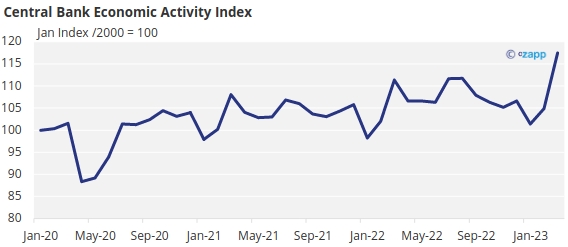

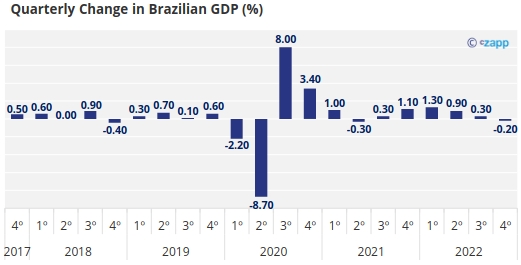

After four consecutive months of falling GDP, from October 2022 to January this year, Brazil’s Q1 preview arrived with good news. In the Central Bank’s projections, there was a growth of 2.41% in the period compared to Q4’22. When compared to the same quarter of the previous year, the variation reached 3.87%. Agribusiness accounted for 1 percentage point of this expansion, according to assessments by Bradesco bank and other institutions – the official results will be announced in July.

Source: Central Bank

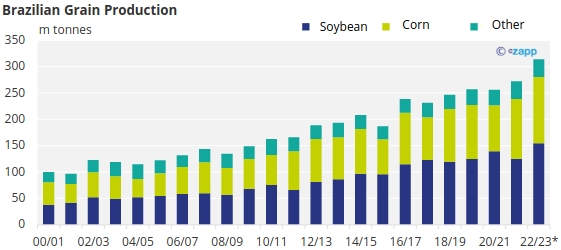

The soybean harvest, carried out mainly between February and April, has been contributing to GDP growth, says the Getúlio Vargas Foundation (FGV). The prospects for corn, sugar, coffee, and other agricultural commodities are also positive. “The strong agricultural performance, justified mainly by the record soybean harvest and its high proportion of agriculture earnings, was the great highlight of the period”, says researcher Juliana Trece, from FGV, in a note.

Grain production has been constantly revised upwards. The latest projection by the National Supply Company (Conab), released on May 11, indicates a record harvest of almost 314 million tonnes, 14.7% more than last year. Productivity should increase by 10%.

Source: Conab

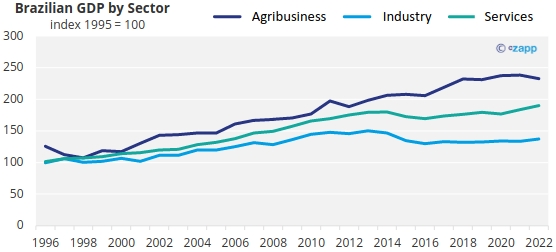

Agribusiness should have the best result since 1989, generating BRL 1.21 trillion, 4% more than last year, according to projections by the Ministry of Agriculture. The revenue forecast for agriculture alone is BRL 868.9 billion.

Source: Central Bank, IBGE

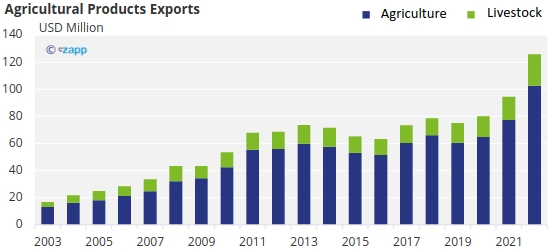

MB Agro estimates indicate that agribusiness exports should reach USD 172.5 billion this year, which represents an increase of 8% compared to 2022. The charge should be led by coffee (45% growth), sugar and ethanol (21%), paper, cellulose, and wood (9%) and soy (8%).

Exports of soybean, the flagship of Brazilian agriculture, should add up to USD 65.58 billion. “Agribusiness will be a godsend this year”, says Gabriel Barros, chief economist at Ryo Asset.

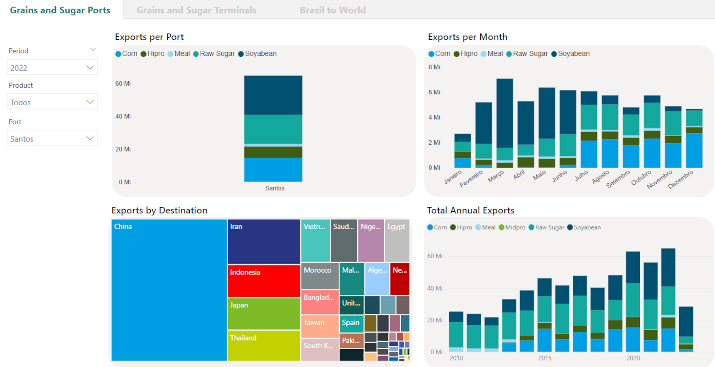

In 2022, agribusiness exports totaled USD 159.09 billion, an increase of 32% compared to the previous year. A total of 271.4 million tonnes were exported – grain sales accounted for almost 88% of that volume, according to the Secretariat for Commerce and International Relations (SCRI) of the Ministry of Agriculture and Livestock.

Source: Comex

However, sluggish GDP expansion is expected in 2023. The Central Bank projects growth of 1.2%, while institutions such as the FGV work with 0.8%. In these analyzes and forecasts, the unanimity is the weight of agribusiness: the field should represent three quarters of the expected growth for 2023, according to FGV estimates.

While the field is doing well, other sectors, including services and industry, have been losing strength, which helps explain the impact of agribusiness on the Brazilian GDP in a more challenging year for the economy.

Source: IBGE

Historically, agribusiness represents a quarter of income generation in Brazil. In 2021, agribusiness contributed 26.6% of GDP and last year, 24.8%. The increase in production costs, especially inputs such as fertilizer, weighed on agribusiness revenues in 2022. Now, with production on an upward route and a certain accommodation of costs, agribusiness is preparing to break new records of expansion and income.

This scenario could be even more positive were it not for old problems such as infrastructure bottlenecks. The limit of logistical capacity is one of the factors of greatest concern. The port of Santos, responsible for shipments of 30% of the grain exported by Brazil, handles a maximum of around 8 million tonnes solid agricultural bulk per month. The terminals of the so-called Arco Norte, including the ports of Itaqui, in Maranhão, Belém and Santarém, in Pará, have the capacity to ship up to 5.3 million tonnes per month.

Czapp interactive section: Brazilian Port logistics

Grain and sugar exporters do not hide concerns about logistical bottlenecks, with competition for space on railroads and ports. They are already concerned by queues of trucks on the roads that lead to port terminals and a longer waiting time for boarding ships, which causes an increase in costs.

More Challenges

In other segments of the economy, the scenario remains complex. Responsible for almost 80% of jobs in the country, the service sector and industry slowed down in the first quarter. The service sector, responsible for almost half of the job creation in the country, closed the first quarter with a retraction of 0.3%, while industry remained stable (0.0%). Only agribusiness, with a growth of 3%, and retail (2%) brought good news.

In the view of Itaú bank, benefits such as Bolsa Família, which was reformulated in February so that each family considered to be in a situation of poverty (monthly per capita income of up to BRL 218) receives at least BRL 600 per month, in addition to BRL 150 per child up to six years old, help explain the movement in retail. These policies, however, may have a short shelf life to stimulate the economy. With weaker economic activity and a hazy scenario in relation to the performance of several sectors, the expectation is for lower growth in the second half.

Despite the concentrated growth, since the high performance of agriculture and livestock is linked to soybean production, agribusiness should sustain a large part of the expected economic result throughout the year. In the second half, high exports of corn and sugar, which are concentrated in this period, should be decisive for the economic result.

This year, Brazil should ship 48 million tonnes of corn, according to Conab. For sugar, the expectation is for the second largest harvest in history. If the rest of the economy does not really take off, agriculture should help Brazil close the year in black.