The surge in interest towards veganism is fueling a significant rise in the alternative protein market, reshaping the landscape of traditional meat consumption. Exploring the concept of alternative protein and its potential to revolutionize the meat industry unveils a compelling narrative of changing dietary preferences and market dynamics.

What is Alternative Protein?

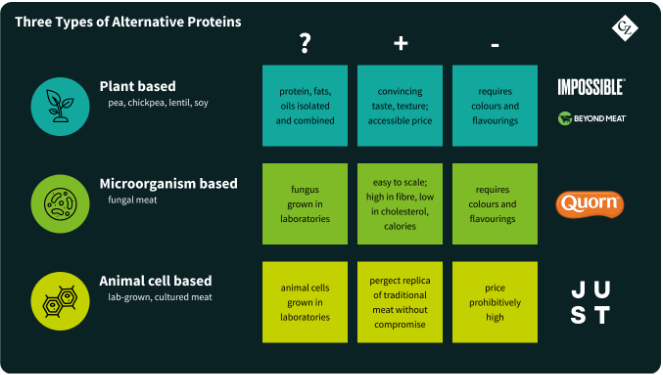

There are three main categories of alternative proteins: plant-based, fungal meats, and lab-grown meat.

Plant-based and fungal meats already occupy a large part of the market, but lab grown meat is more of a future prospect.

Why Do People Want Alternative Protein?

There are a variety of reasons why people are looking for sources of alternative proteins.

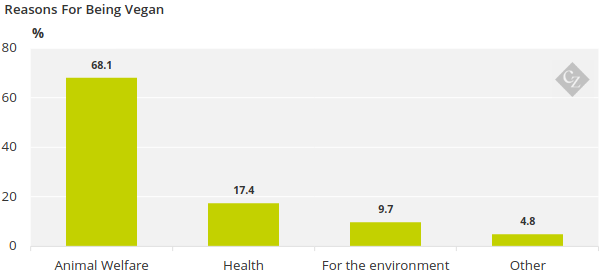

On a global scale, the most significant reason why many choose to go vegetarian is concern for animal welfare.

Source: Vomad

In Western Europe, North America and Australasia, environmental factors are the main factor.

Source: YouGov

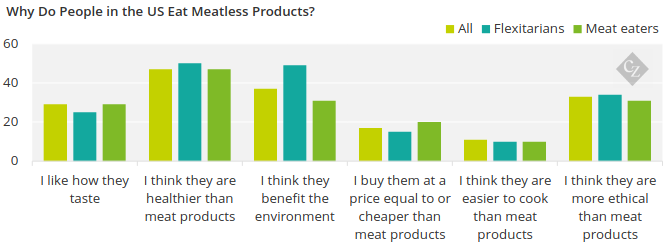

There’s also been some focus of the health issues surrounding meat, particularly red meat. These concerns tend to lead to reduced meat consumption rather than a complete switch to vegetarianism or veganism, and this is especially prevalent in East and Southeast Asia, with lots of marketing focusing on this specific element.

Thai Advertising Highlighting the Health Benefits of Plant-Based Me

Rough Translation: Delicious and Healthy

And, finally, food security is a key reason why some nations, like Singapore and South Korea, are pushing hard for meat substitutes. Nations that struggle to produce enough meat to feed their populations are turning to meat substitutes as they often require less agricultural land and reduce reliance on imports.

Food security will become an increasingly important factor as the global population grows, and demand for meat is larger and harder to fulfil.

How Much is it Worth?

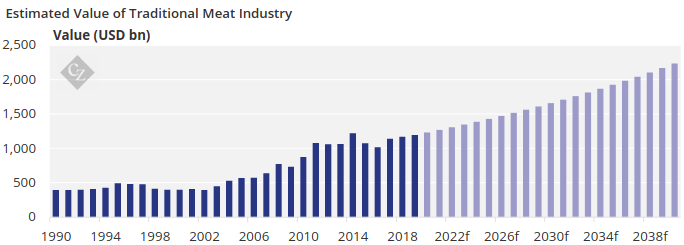

There are a range of estimates for the value of the global meat industry, but it’s currently believed to be worth over 1 trillion USD.

Using the average international export price of the past 20 years and global production levels, we think it could be worth about $2.2 trillion by 2040. These projections are conservative estimates, though, and were modelled using historical price growth rates and assumed stable production levels due to land constraints.

Source: FAO, Czapp calculations

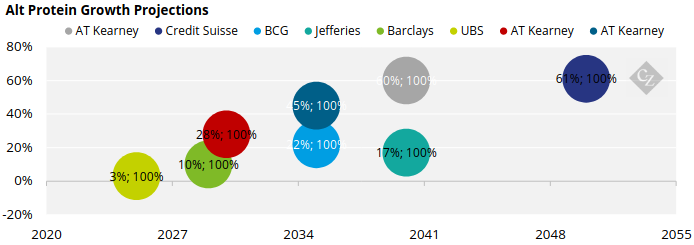

We also think the alternative meat industry could account for 11% of the global meat market by 2035, which equates to about 211 billion USD. Again, this is only a base case scenario and, with a strong upside that includes supportive regulations, the market could be worth double that. Projected growth rates also vary greatly among different consultancies and analysis firms, and range between a 22% and 45% growth rate by 2035, and a 17% to 60% growth rate by 2040.

Is it Healthier?

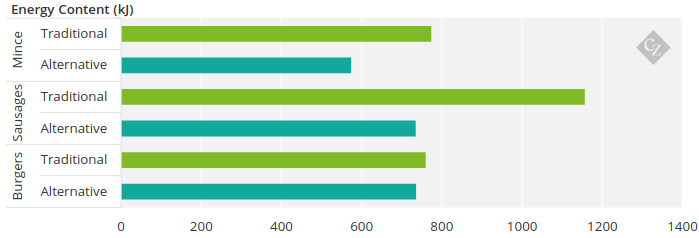

Australia’s National Institute of Health sampled alternative and traditional meats and found that energy content in alternative meats tends to be lower than that of animal products.

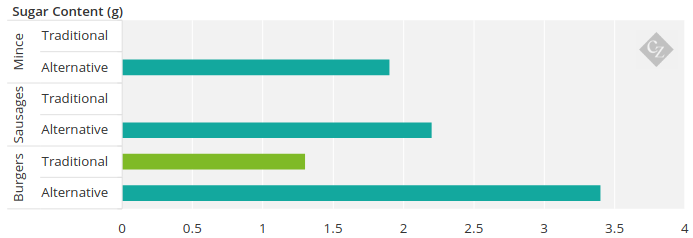

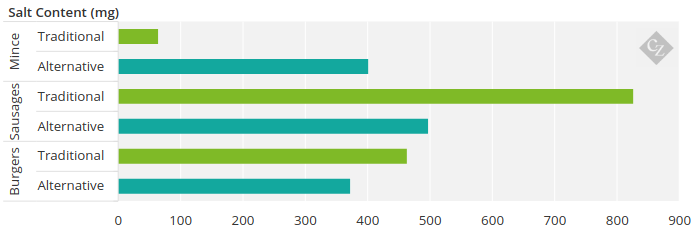

The study also found that salt and sugar content in the alternative options was often higher.

The only exception was the amount of salt found in sausages. In this instance, traditional sausages were found to contain almost double the amount of sodium as alternative protein sausages.

Many alternative protein options are also classified by the FAO as ‘ultra-processed’ due to their ingredients. As discussed, these products require flavours, thickeners, colours, emulsifiers, and protein isolates to replicate the texture and taste of animal meat, which pushed them into ultra-processed territory.

Is it More Sustainable?

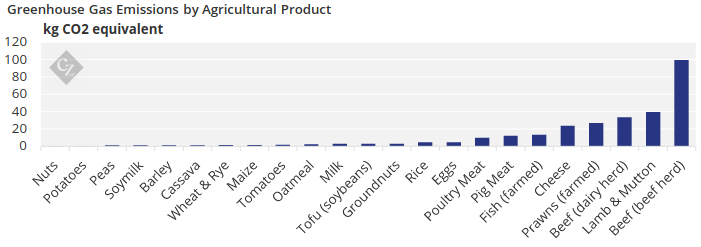

As mentioned, one of the largest drivers of meat reduction, particularly in Europe and North America, is a concern about the environmental impact of meat. Traditional meat has a significant environmental impact, largely due to land usage but also due to methane and other greenhouse gases being emitted by the animals themselves.

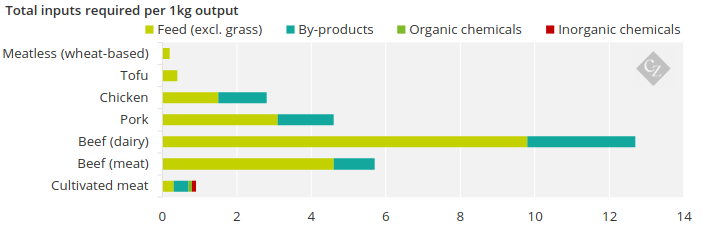

The impact is two-fold as animals also consume a lot of agricultural products. In fact, roughly 77% of the world’s soy is used as animal feed.

Source: Poore & Nemecek, 2018

The alternative protein industry certainly seems to be more efficient than the traditional meat industry in terms of inputs versus outputs. Livestock consumes a lot of grass but even when discounting this, beef, pork, and chicken all require considerably more inputs than alternative proteins for each kilogram produced.

Source: CE Delft

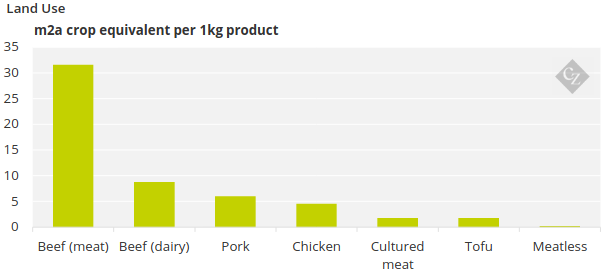

In terms of land use, meat-free and cultured meat alternatives yield much more for the land used.

Source: CE Delft

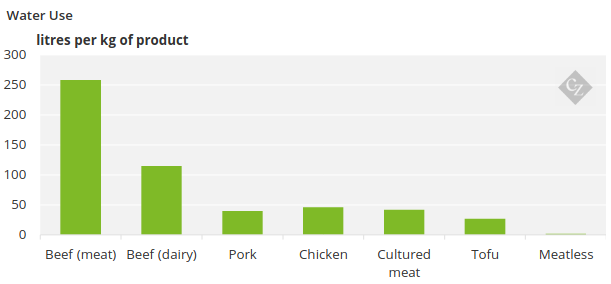

And there’s a similar story with water use, although cultured meat is on par with chicken and pork.

Source: CE Delft

Alternatives to fishing are also interesting due to their sustainability benefits. As the world population grows and becomes more developed, ocean fisheries won’t be able to support increased fish demand on their own.