- Q4’18 data shows whites container exports at 445kmt – the lowest of the past 12 years;

- Whilst the reduction is in part due to EU competition into West Africa, CS Brazil also saw a significant reduction in sugar availability;

- Estimated sugar production for 2018/19 stands at only 8.8mmt – the lowest since 2009/10;

- Wha are the perspectives for next season?

So far…

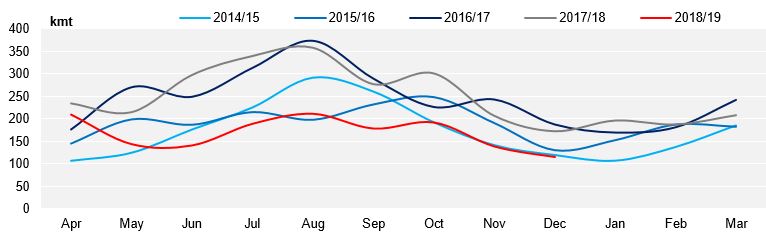

Monthly Container Exports

- Total sugar production in CS Brazil should end at 26.6mmt – 10mmt lower yoy;

- Out of this, 8.8mmt is of whites production;

- The lower output helps to explain the significant fall in container exports seen this season – apart from slower offtake;

- From April until December, container exports totalled 1.5mmt – the lowest level in 10 years;

- Q1’19 container exports should follow the same pattern, remaining at around 110kmt/month;

What to expect for 2019/20

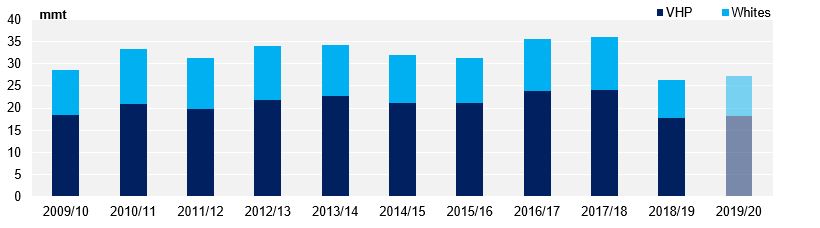

CS Brazil Production per Sugar Type

- Lower ethanol prices expected for 2019/20 should change the production mix of CS mills in regards to the previous season – when mills maximized ethanol production;

- An increase in cane allocation to sugar production is expected;

- However, sugar is not exactly paying more than the biofuel – not max sugar as well;

- Although an increase in total sugar production is indeed expected, overall whites availability should remain tight;

- If the domestic market proves to be more heated than expected, whites exports from Brazil could follow the same pattern as this season or be even lower.