- European PET prices are rebounding.

- Surging crude and ocean freight have pushed up import costs.

- Resin demand is showing signs of improvement with increased travel and warmer weather.

Freight Chaos and Rising Import Prices Boost European Producers’ Confidence

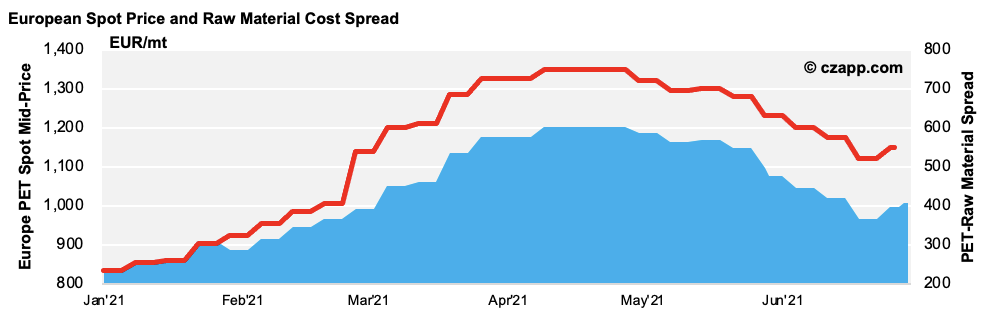

- European PET resin prices to mid-June slumped by over 200 EUR/mt versus April.

- Mid-June prices dipped to below 1,100 EUR/mt, with many converters expecting a more sustained price collapse into July.

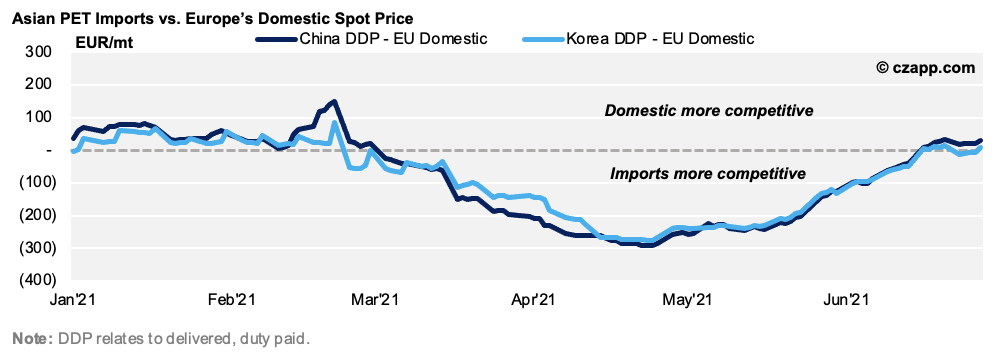

- However, surging crude prices and continued increases in ocean freight have pushed Asian import prices higher, a key benchmark for European producers.

- Rising import costs, combined with some seasonal improvement in demand, have catalysed a shift in producer confidence.

- European producer offers are now increasing steeply, partially reversing the decline in prices and margins seen over the last month.

- In the first week of July, the range of spot European offers increased significantly, with many producers no longer offering sub-1130 EUR/mt, and instead offering an average of between 1,140 and 1,160 EUR/mt.

PET Demand Shows Signs of Improvement

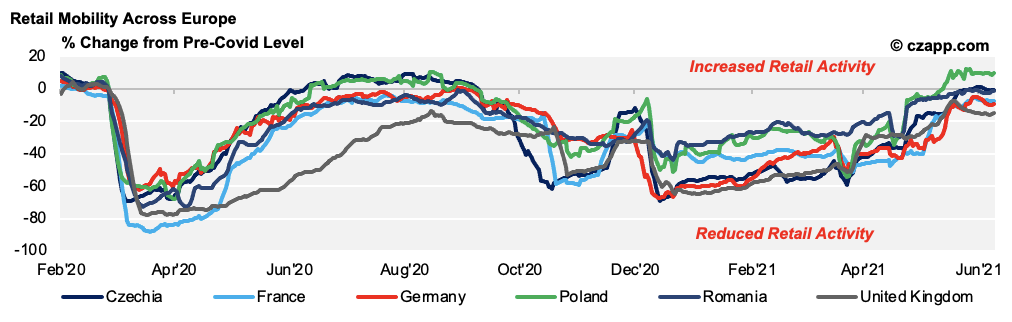

- European PET demand is showing mild improvement now travel restrictions are easing and the weather’s getting warmer.

- After a slow start to the summer, increased retail activity is helping to lift demand at the converter level.

- However, demand growth is far from uniform.

- Preform manufacturers in Poland, Czechia, and the Baltics have reported an uplift in sales, whilst things are more subdued in much of West Europe, as well as Bulgaria and Romania.

- With INEOS’s PTA production at Geel (Belgium) now fully back up and running, most European PET producers are close to full capacity.

- However, persistent delays to PTA imports are still challenging PET plants with a greater reliance on imported raw materials, a situation that should remain for some time.

- With domestic PET resin supplies beginning to normalise, the European market has become more balanced over the past month.

- As Europe’s structurally a net importer of PET resin, delayed imports continue to support demand for domestic material with short lead times.

Potential for Demand Squeeze as July Becomes Pinch Point

- Resin demand could improve through July and August as travel restrictions ease further.

- Improved PET resin demand in July and rising prices may bring more customers into the spot market.

- However, a nervous and confused market may also cause yet more hesitancy on the buyers’ part.

- A demand squeeze in July is possible, but the market should remain balanced, with imports continuing and domestic production holding strong.

- As such, domestic prices should track import parity in the near term with prices potentially strengthening further over the coming weeks.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…