Insight Focus

- Plenty of bullish price sentiment for sugar.

- Large CS Brazilian crop expected.

- Everyone expects problems with Brazil’s inland logistics this year.

The Dubai Sugar Conference is one of the major industry events of the year. In 2023 it was held on 27th February to 2nd March at Dubai Festival City.

Here’s what happened.

Everyone was Bullish Sugar Futures Prices

Since 2020 sugar prices have more than doubled; raw sugar today is above 20c.

Source: Refinitiv Eikon

Most traders at the conference forecast global sugar production surpluses for 2023 & 2024 and their analysis of sugar Trade Flows hints at excess supply later in the year. Yet delegates believed that by the end of the year prices could be even higher. 23c was often mentioned, 16% above today’s March’24 futures price of 19.80c. One fund manager I spoke to was rather bemused at the disconnect between the trade’s fundamental statistics and their public bullishness.

A typical retort was that although sugar prices are higher, so are seed costs, fertilizer costs, diesel costs, power costs and so on. “20c isn’t what it used to be,” as one cane miller told me.

Many food and beverage companies I spoke to were understandably alarmed by the degree of bullishness. But don’t forget that the trade will always be positive while market is backwardation. They’re being paid to source and export sugar as quickly as they can, maximizing throughput through their supply chains. This means their capital is being deployed to maximum effect, which is important given rising interest rates. For as long as the music is playing, they’ll keep dancing.

Source: Refinitiv Eikon

Beware a consensus, especially when other commodities are lagging. Speculators remain heavily long the sugar market. Will they continue to do so even if corn, copper or crude oil markets trade lower? For the time being the May’23 contract has kept sugar’s uptrend intact (just!). We’ll have to see what comes next.

Everyone Expects a Huge Centre-South Brazil Cane Crop

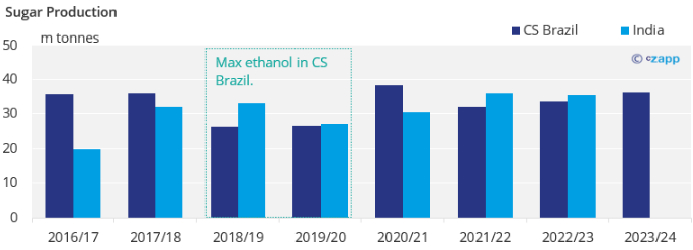

All the major traders and analysts are expecting CS Brazil to crush 590m tonnes of cane or more. This meant sugar production estimates ranged from 36m-38m tonnes. The top end of this range would be the second highest ever achieved. The room was full of happy-looking Brazilians.

It’s interesting that despite good returns on a large crop, no-one is yet talking about cane area expansion or new mills being constructed. The industry is still deleveraging and debottlenecking. It’s a worrying sign when prices more than double and the world’s largest cane region still can’t justify expanding.

One sector that is expanding is the corn ethanol sector in Brazil [link]. Local analysts Datagro were incredibly optimistic about the sector’s prospects, saying they expected corn ethanol to account for all of Brazil’s growth in ethanol demand for the rest of the decade, pushing the cane sector further towards sugar output.

Everyone Expects Nightmarish Brazilian Inland & Port Logistics

This year’s corn and soy crops in Brazil are also going to be large. Everyone was therefore nervous about delays at Brazilian ports leading to backlogs on roads and rail clogging up the inland supply chain. After all, there’s no point making all these agricultural products if you can’t deliver them to your customers.

My guess is that this problem is so widely-known it’s probably already largely accounted for in today’s raw sugar futures curve. We will find out in due course.

Incredible India

If you thought the Brazilians were optimistic about the future, you needed to talk to an Indian cane miller. The message was clear the moment the Director General of the Indian Sugar Mills Association delivered his speech wearing a Ferrari t-shirt. He said India was “anti-fragile”, while the representative from the All India Sugar Trade Association said India was now a “structural exporter”. Both were keen to stress India’s production volatility was a thing of the past.

There’s no doubt that the Indian government is pumping huge amounts of money into the cane sector. As a way of reducing sugar production surpluses, which then needed to be exported using subsidies, it’s subsidising the construction of a new cane ethanol distillation sector instead.

The government sets the price of cane mills must pay farmers and dictates that mills must accept cane from nearby farmers, meaning farmers get a guaranteed price for their crop from a guaranteed buyer. The government also sets a minimum domestic sugar price and also sets the price at which oil companies must procure ethanol, so fixing mill margins too. The entire sector is dependent on the government’s continuing largesse.

Worse, the ethanol subsidies are encouraging farmers to plant more land to cane. This cane is now being grown on land that isn’t necessarily suitable, so increasing the weather risk to the crop. In the event of a poor crop, the government can ban sugar exports (and has done this in the past).

I’m sure the Indian cane sector’s future is bright, but it’s also important to remain realistic. For a start, most people expect that India won’t export any more sugar this year beyond the 6m tonne quota that’s already been approved and sold. For next year most people expected only 5m tonnes of exports to be allowed. This is a long way from the 25m tonnes sugar exports that India shipped to the world between 2020 and 2022.

Other Snippets

Stefan Uhlenbrock of S&P Platts was brave enough to tell a collection of assorted refiners that there was too much sugar refining capacity in the Middle East. He’s almost certainly right, given the amount of capacity that’s come online in recent years. Al-Khaleej Sugar told Reuters on the conference sidelines that they were only operating at 40% capacity at the moment, blaming Indian supply.

Many people I spoke to were pessimistic about China’s ability to import a lot of raw sugar this year, citing negative import margins for all of 2023. I’m not so sure. Food security is national security. The government and refiners will find a way to make sure raw sugar shipments continue to flow even if prices don’t work on paper. Beijing doesn’t care about your fancy import model.

The International Sugar Organization is becoming increasingly vocal and combative against sugar taxation/regulation. As well they might given their members are sugar cane and beet growers. But as it becomes increasingly hard to find evidence regulation leads to any benefit even though many takes have been in place for years, so the ISO’s confidence increases.

The Dubai Sugar Conference is always a fascinating event. Nothing can replace meeting people face to face to share opinions, gossip or a drink. Next time around I will treat myself to a slightly less insane schedule (across the 3 days I had more coffees than hours sleep). Maybe I’ll see you there in 2024….?