Insight Focus

- Thai cassava farmers are incentivised to harvest crops early.

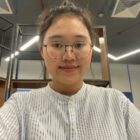

- This has resulted in steady yield declines and production stagnation.

- There is also pressure on the demand side as Laos increases production.

Early Harvest Jeopardizes Yield

Songkran is the Thai New Year festival, celebrated every year from April 13-15. It marks the end of the dry season and the beginning of the rainy season. Cassava is a major crop in Thailand, and Songkran falls at a crucial time in its growth cycle. The festival occurs when cassava plants are typically thirsty for water due to the intense heat.

This year, farmers have been harvesting cassava roots early in the hope that they can earn some income to spend during the New Year. However, by doing so, the farmer risks harvesting the roots when they are underdeveloped, which results in smaller roots and lower yields.

Currently, high market prices incentivize early harvesting despite potential yield losses.

Cassava Production Suffers

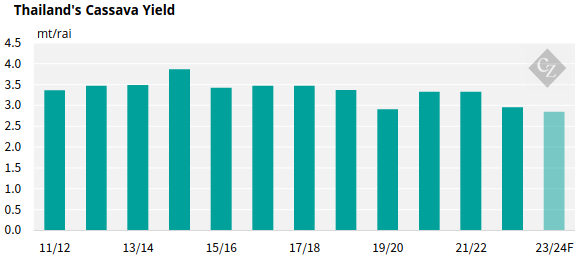

The Thai Tapioca Trade Association (TTTA) expects between 24 million tonnes and 25 million tonnes of cassava roots to be harvested this year.

This production figure is 7.5% lower than the previous year, and 26% lower than 2021/22 cassava production.

Poor yield is not the only factor contributing to lower production volumes. Other contributors to this decline include prolonged drought conditions and disease outbreaks like CMD (cassava mosaic disease (CMD) in some areas. This disease affects plant health, leading to stunted growth, and worsening yield limitations.

Competition Heats Up

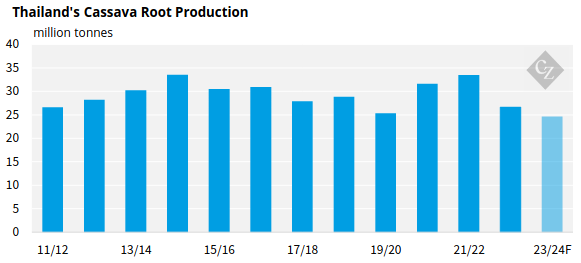

Thailand has been a key supplier of cassava starch to neighbouring countries including Laos and China in recent years. However, Laos has recently focused on the development of its domestic starch industry, which has generated a shift from reliance on imported cassava roots.

With new starch factories established domestically in recent years. There have been shifts in regional trade dynamics. With Laos becoming more self-sufficient in cassava starch production, Thailand’s exports of cassava starch to Laos have declined. Laos has also begun exporting to other regional importers such as China.

As a result, Thai cassava starch exports fell in 2023 and look set to fall again in 2024.

The Thai cassava sector is therefore in a tough environment. Falling yields are dragging down production, and higher regional competition is reducing demand from key export markets.