Insight Focus

- Brazil’s soybean meal exports were up 40% in Q1 on stronger EU demand.

- Soybean oil shipments more than doubled in the same period, thanks to India’s record purchases.

- Soybean by-product exports have benefited from higher crushing margins.

Soybean Exports Hit Record High

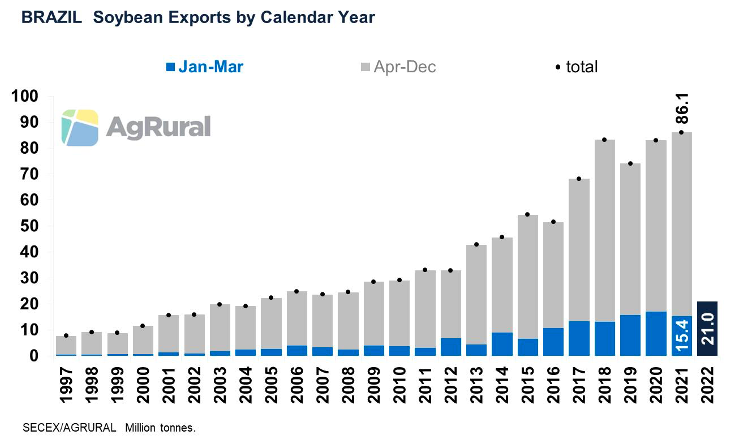

Despite Brazil’s soybean crop facing a sharp drop in 2021/22, when dry conditions reduced production from a potential 145m tonnes to 122m tonnes, Brazil’s soybean meal and oil exports reached record highs in Q1’22. This was spurred by a sharp rise in crushing margins – a result of improved demand and higher prices.

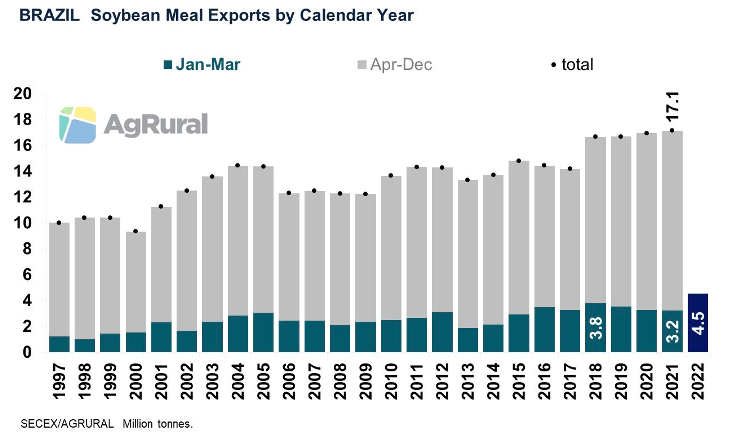

Soybean meal exports totalled 4.5m tonnes in Q1’22, up 40% on the year and the largest Q1 volume since 1997, when the Brazilian government started monitoring exports on a monthly basis. The European Union, traditionally the largest Brazilian buyer, imported 2.2m tonnes (up 32% on the year), followed by Indonesia (752k tonnes, up 16% on the year) and Thailand (619k tonnes, up 47% on the year).

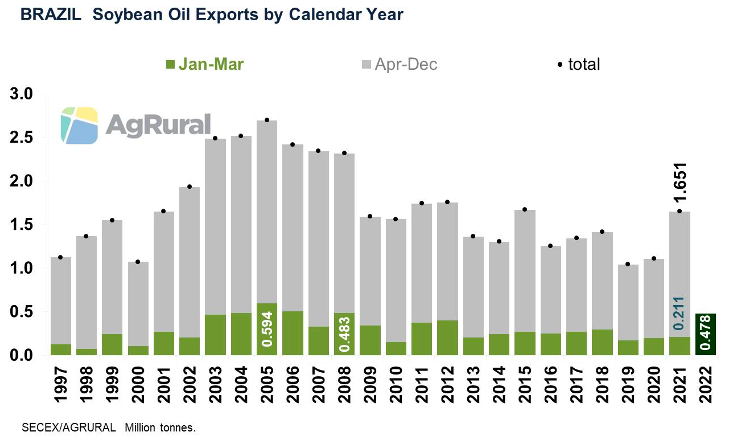

Soybean oil exports more than doubled to reach 478k tonnes in Q1’22, the largest volume since 2008. 348k tonnes of that volume went to India, up from 78k tonnes in the same period last year. The increase is explained by palm oil export restrictions imposed by Indonesia, smaller Argentinean soybean oil exports and fears of further increases in international vegetable oil prices, which have been at historical highs since last year and are now underpinned by the war in Ukraine, the world’s largest sunflower oil exporter.

But bean shipments are expected to weaken from April onwards, pressured by smaller production, a more aggressive domestic market and weaker Chinese demand. For those reasons, consultancy AgRural and federal crop agency Conab project Brazilian exports to reach only 77m tonnes in 2022, sharply down from the record of 86.1m tonnes shipped in 2021.

Abiove (Brazilian Association of Vegetable Oil Industries) also forecasts a drop in soybean exports, to 77.7m tonnes, but sees room for an increase in meal shipments, which could reach a record of 18.3m tonnes (up 6% on the year). It also sees a slight increase in oil exports, which are estimated at 1.700m tonnes, compared to 1.651m tonnes in 2021. In both cases, the larger exports would be possible at the expense of a smaller domestic consumption.

Brazilian Government Cuts Biodiesel Mandate

Although the drop in soybean meal domestic demand is controversial (not endorsed by either Conab or the USDA), domestic soybean use has been falling since 2021, when the Brazilian government reduced the biodiesel mandated blend from 13% to 10% to minimise the impact of expensive vegetable oils on diesel prices, truck freight rates and inflation.

That measure did not lead to a drop in soybean oil production, but to a shift in demand, with a decrease in domestic use and a surge in soybean oil exports. Now, in 2022, when 14% of biodiesel should be blended into the diesel sold across the country, the revised mandate continues at 10%, making room for an uptick in Brazil’s soybean oil exports.

Brazil Still Has Idle Capacity

Between 2015 and 2020, Brazilian soybean production and exports increased by 43% and 59%, respectively. Soybean crushing, in turn, grew by 16%, from 40.6m to 46.8m tonnes. The installed production capacity, however, did not change during the same period, going from 170.4k tonnes/day to 171k tonnes/day, according to Abiove.

Brazil has been able to produce more soybean meal and oil without expanding installed capacity as its crushing industry normally works with a significant idle capacity, increasing production only when market conditions are more favourable. This was the case in the first quarter of 2022. In early March, spot crushing margins at the Brazilian port of Paranaguá reached 122 USD/tonne. Now, in mid-April, they are around 60 USD/tonne and retreat further down the future curve, but remain positive until August, favouring the industry.

But a real incentive to crushing in Brazil will happen only if China changes its import profile (the country facilitates soybean imports to feed its local crushing capacity) and Brazilian legislators revise some of the country’s tax rules that penalise the domestic production of soybean meal and oil. That is particularly the case of a regulation known as “Kandir Law”, which has exempted soybean exports from a 12% state-level tax known as ICMS since 1996. That tax, however, is paid by crushing plants every time they buy soybeans from a Brazilian state other than that where they are located. When soybean meal and oil produced from those soybeans are exported, the industry receives a credit to compensate for that tax payment, but it is a slow, bureaucratic process.

Other Insights That May Be of Interest…

China Seeks New Corn Supply with Ukraine Exports Limited

Market View: Sugar & Soy Struggle for Space at Santos

Little Good News for Soybean Importers, Despite Record US Area

Explainers That May Be of Interest…