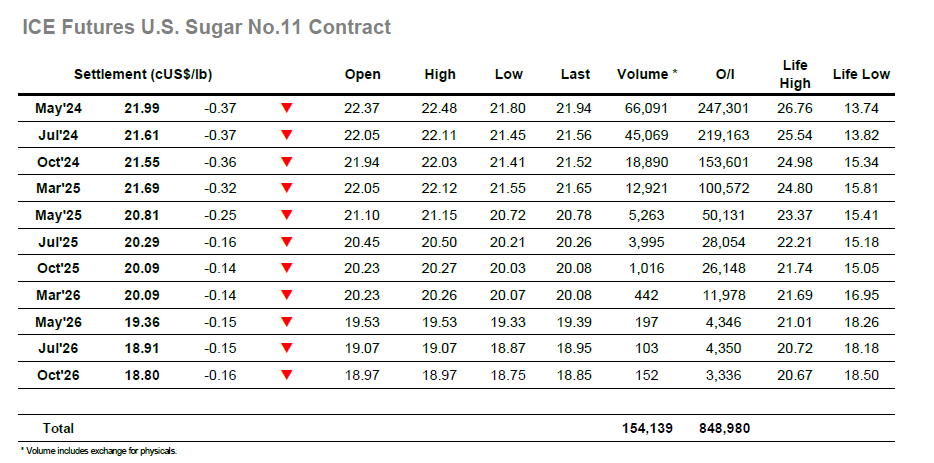

Another morning of mixed trading saw May’24 work between 22.18 and 22.48, going over the same ground as recent days on still low volumes. With values at the upper end of this band later in the morning the locals would have been hoping to be able to build back toward recent highs, however the market lacks the necessary spark at present and so ahead of the Americas morning there was a retreat down through the range. With today marking the first day of the index roll there was extra interest in the May/Jul’24 spread, though it was the outright picture which drove our movement when additional spec selling / liquidation kicked in during the early afternoon, This weeks lows were obliterated as the selling sent prices down to 21.80 across a couple of waves, illustrating the reduced confidence in the market following the recent Indian rumours. Spreads too slipped on the decline with May/Jul’24 trading down to 0.32 points, though given the scale of the flat price losses and with the index sector selling the spread this felt as though it was a resilient showing. Aside from a brief peek above 22.00 against day trader covering the market struggled to mount a recovery and played out the final stages in the 21.90’s, heading into the week quietly at 21.99. This capped off a poor week that has seen the market turn back to the range, the positive sentiment which ended March long forgotten and seemingly leaving us set for additional time within the broad range until some news of significance appears.

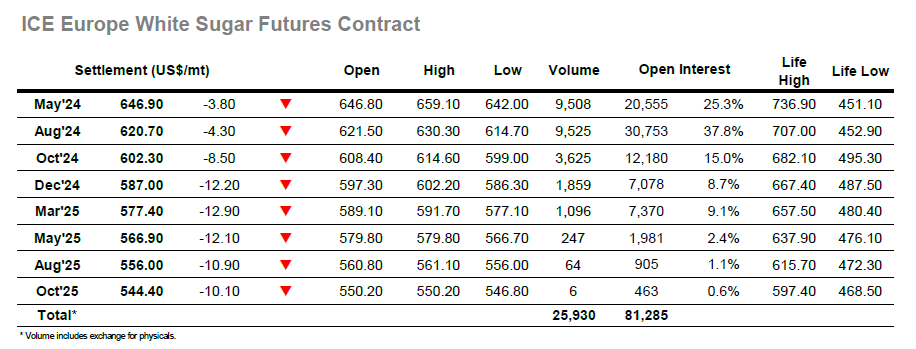

It was a stuttering start for the whites this morning with prices generally trading lower through the first 90 minutes of the session, however the recent resilience was soon shining through again and by the later morning the picture had turned more positive. White premium losses had been erased as Aug’24 climbed from the early lows to reach $630.30, however the necessary spec buying to continue the move was lacking and so prices slipped back into the range on liquidation. This changed the whole market perspective with smaller traders looking to further liquidate longs, the movement being led by US specs on the No.11 market during the early afternoon period. Session lows were recorded at $614.70 before finding a modicum of support, and while there was no significant rebound as price action continued in the teens the market was still showing strongly in relation to its counterpart, pushing the May/May’24 arb up to $163.00 and Aug/Jul’24 to $143.00. This was not the case down the board where March/March’25 showed significant weakness and fell beneath $99, the disparity between 2024 and 2025 position shown within the firmer spread values. Reaching the close the whites remained on its own path, being robustly defended to ensure an Aug’24 settlement value at $620.70, which in turn sent the Aug’24/March’25 spread out at $43.30, a whopping $8.60 gain for the day.