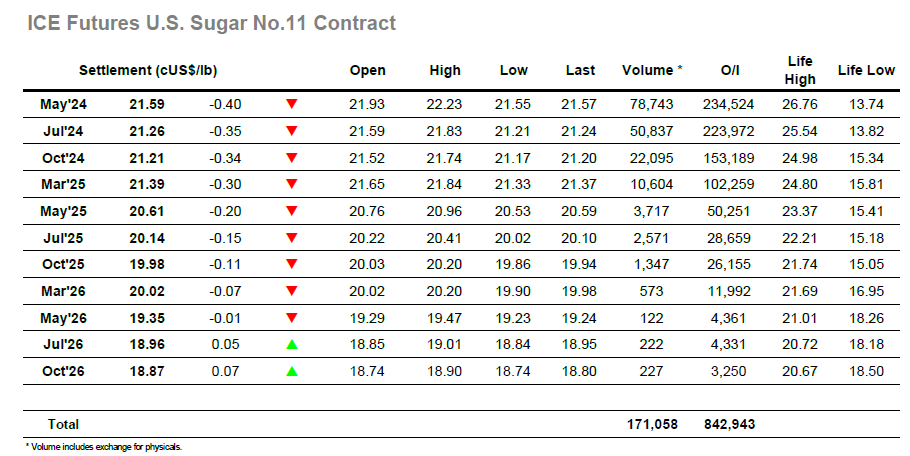

Early trading saw May’24 dropping back towards Fridays lows but having held at 21.83 the market then managed to spark a degree of day trader buying interest and return to credit. The COT report showed another growth in the net long to 54,702 lots, the largest holding so far this year, and while some of this position will have been liquidated late last week it illustrates the desire amongst smaller traders/specs to continue playing the long and defend where they are able. The efforts from longs yielded a high at 22.23 towards the end of the morning, but their lack of depth meant a return to the range soon after against long liquidation leaving the market somewhat stagnant as the US day got underway. Day 2 of the index roll window was expected to bring another decent volume for May/Jul’24, and as the spread rolling arrived so there was a slight narrowing in value back towards 0.35 points. With trade buying for the spread keeping the movement orderly it was the flat price where the greater movements were emerging, with further long liquidation from specs pushing values back down to session lows. Working beneath 21.80 triggered light sell stops and additional spec selling/liquidation to accelerate the decline and May’24 reached 21.56 before attempting to stabilise through the later part of the afternoon. The efforts simply served to stem the losses as the market tracked along slowly to a close at 21.59, with late selling leading to a session low 21.55 on the post close.

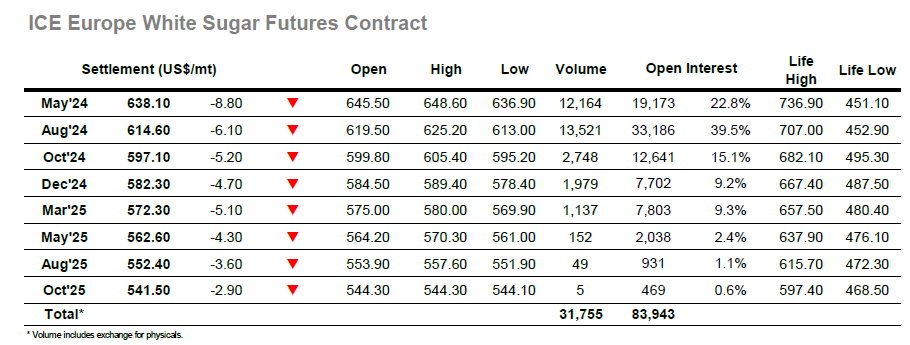

There were slightly softer values being seen as the week got underway in reaction to the No.11 movement, though it was not long before Aug’24 was again showing its resilience and pushing back up through to the mid $620’s. The rally extended to $625.20, but despite a short period of consolidation which followed the market was struggling to generate additional momentum and ahead of the US morning prices were falling back down through the range. This slide did not come at any expense to the nearby white premiums which continue to present strongly with Aug/Jul’24 holding the lower to mid-$140’s comfortably, a strong representation of the whites regardless of the outright level. The decline came in waves and proved orderly, with Aug’24 dropping to $613.00, while with just one week to go until expiry May’24 slipped to $637.60. There remains some sizable rolling for the May/Aug’24 spread with more than 5,000 lots changing hands today within a $22.00 / $28.40 band, sitting at the lower end of this band late in the afternoon as Aug’24 found defensive support ahead of the closing call. This Aug’24 buying lifted the premium back up towards $146.00, although MOC selling meant a settlement at $614.60 for the “virtual spot month” while Aug/Jul’24 settled at $145.90.