Insight Focus

- Wheat sellers often struggle with market volatility.

- Margin vs maximising profit can add emotion and complications.

- Here are some considerations to encourage good decision making.

Wheat sellers have many inner conflicts when deciding when to sell or not sell. In hindsight, market volatility can be a driver for poor sales. Simplifying the thought process can often make the selling decisions of how much and when significantly calmer and easier.

A History of Market Volatility

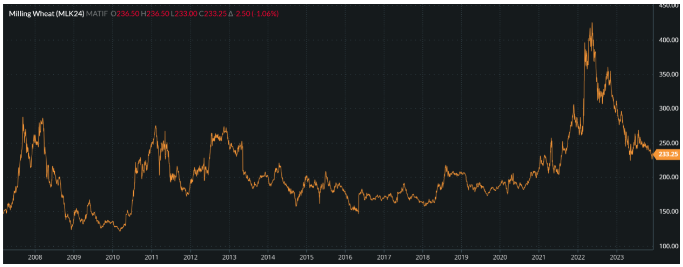

The chart below shows the price trend of Paris Matif wheat since 2007. You can see the enormous price fluctuations sellers have experienced over the last sixteen years.

Source: Barchart Commodityview

We saw a fundamental shift in wheat market volatility in 2007, as production numbers struggled and world stocks dwindled to concerningly low levels.

Many looked back at the end of that marketing year, in mid-2008, reflecting on the past year. Over 99% of people would have, in early 2007, laughed at the thought that markets would reach the astounding highs that subsequently transpired.

Source: Barchart Commodityview

That year changed perceptions and the comment ‘never say never’ has proven valid in several years since.

We again saw significant rallies for prices in 2010 and 2012, with another extraordinary, record-smashing year in 2022 following the Russian invasion of Ukraine, prompting supply panic across the globe.

Source: Barchart Commodityview

The Seller’s Inner Struggles

When assessing factors facing the seller, it is perhaps best to consider the farmer — the primary wheat grower. All other sellers in the chain can draw on these thoughts to suit their own individual needs.

The first important point to consider is that from the moment a farmer plants his wheat, he is holding a wheat ‘long’ position, assuming that there will be a harvest to reap. A long position, as a trading term, simply means that the farmer holds wheat to sell.

When considering the long holder, he can only sell this once. Having decided to sell a portion of his upcoming, or in-store crop, he cannot sell it again. An obvious fact maybe, but this can bring emotion into a sale decision.

There will be defining factors impacting the farmer’s unique requirements to sell. The key drivers are cash demands and storage capacity limitations. However, these will be no less critical than margin needs to sustain the business.

The most crucial struggle for the seller can be emotion. These drive emotional questions, such as:

- Do I sell today or tomorrow?

- Will values be higher if I wait?

- Last week prices were higher — shall I wait for those to return?

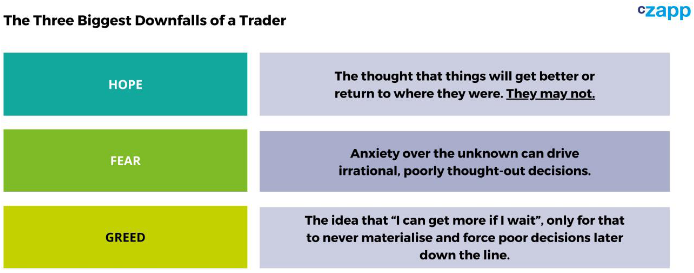

The emotional sale driver can become extremely dangerous, ultimately leading to one or more of the three biggest downfalls of any trader — hope, fear and greed.

Five Simple Steps for Selling Wheat

- A seller should always be disciplined and objective. Selling with a margin is never the wrong thing to do, even if hindsight says you could have achieved a higher price. If you make a profit, take it and move on.

- When prices are just too good to be true, they normally are. The crazy price highs of the past never lasted long. Do not hang on, as falling into the greed trap will most likely lead to missing out. Many sellers have regretted not selling over the last 12 months!

- Make decisions based upon the information available to you today. Live with your decisions and do not beat yourself up with hindsight. Simply learn a lesson for next time if there is one to learn.

- Make sales for profitable, sustainable business.

- Do not succumb to the pitfalls of hope, fear and greed!