Insight Focus

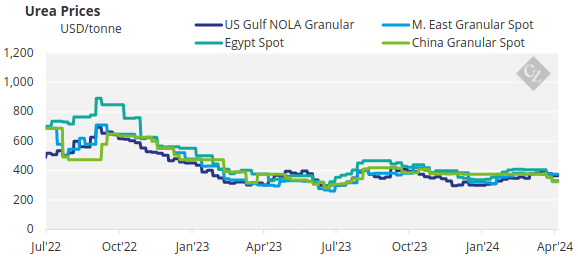

- Further urea price erosion is expected in the next couple of months.

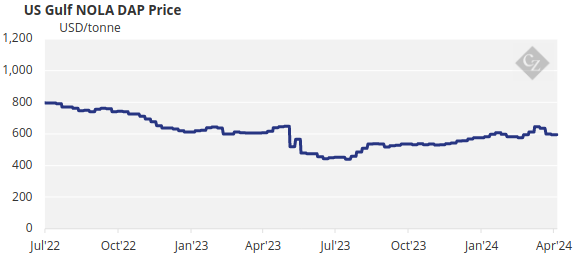

- Processed phosphate prices are decreasing with increased Chinese exports.

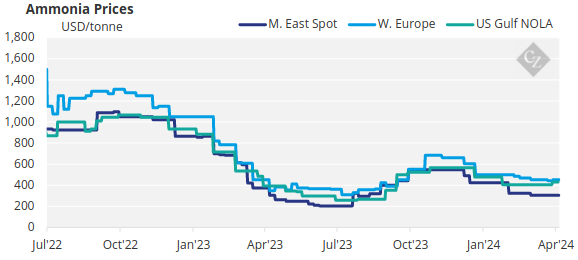

- Global ammonia markets are in surplus with lack of industrial demand.

Urea

The outlook for urea prices for the coming couple of months is bearish. There is ample urea availability worldwide and the risk from higher natural gas prices has receded, while weakening crop prices provide little incentive for buyers.

This is even before the Chinese are coming into the market which is expected from late May onwards. It is not inconceivable that we could see granular urea prices in the Middle East go below USD 300/tonne FOB.

Paper values for May in Brazil are between USD 300/tonne CFR and USD 310/tonne CFR. That in itself could be a lead indicator for what is ahead.

But in the past week, there has been an escalation in the conflict in Palestine. After an Israeli attack killed seven aid workers, there are rumours of potential retaliatory attacks by Iran. The UAE has also announced the suspension of all diplomatic ties with Israel.

About 25% of global urea exports come from the Middle East and the geopolitical tension and instability could sadly be what saves the urea price from falling off the cliff.

The India tender was a big letdown for the urea producers in that only 724,000 tonnes was committed by the trade. A robust India purchase would have been a perfect outlet for keeping urea prices from falling further.

Netbacks to the Middle East this time around were in the USD 320/tonne range depending on shipments to the east or west coast of India. Netbacks for Russian prilled urea are around the USD 270/tonne FOB.

Processed Phosphate

Global DAP/MAP markets are becoming increasingly disparate, with prices dropping in India and the US but remaining firm in Latin America and Europe.

The highlight for much of this week was once again India, where traders have pushed the market lower on the back of increased export availability from China. Indian DAP this week was at USD 560/tonne CFR, down another USD 16/tonne from last week, and USD 36/tonne down from just a few weeks ago, a price that had been carved in stone for a few months.

DAP prices in India are expected to fall further with increased Chinese availability although Chinese producers are dreaming of prices as high as USD 560/tonne FOB, which will be an impossible position with traders shoring India on a grand scale.

Still, some markets that have not been flooded with supply from China remain firm. This is particularly the case in Brazil, where MAP prices are holding at USD 570/tonne CFR, and Argentina, where DAP/MAP prices have firmed to between USD 605/tonne and USD 610/tonne CFR. Brazil now commands a premium of USD 10/tonne over India, having previously maintained a discount of USD 25-35/tonne for the best part of six months.

Potash

Most potash benchmarks were assessed unchanged this week amid limited buying activity across the globe. China’s port wholesale MOP average prices firmed to RMB 2,225/tonne FCA (USD 307/tonne) after consistently falling since the end of November 2023. Despite this promising price increase to many, the market is still heavily oversupplied, and this may be short lived.

The Pupuk Indonesia tender was awarded at USD 302/tonne CFR to two suppliers, although other suppliers are still waiting for confirmation. This fresh price input from Pupuk Indonesia may put pressure on prices in the region in the coming weeks, as the standard MOP price is currently in the range of USD 280/tonne CFR and USD 325/tonne CFR. Despite this award, demand in the region is still persistently slow due to the public holiday period.

Brazilian potash prices remained at USD 300-315/tonne CFR for the third consecutive week, as many market participants reported reluctance to buy shipments at USD 320/tonne CFR. Meanwhile, the surge in demand has levelled off. India’s long running saga on a renewed potash contract is yet to conclude with Indian buyers looking for sub-USD 300/tonne CFR levels.

The outlook for potash prices is generally bearish globally with only Brazil holding firm. That being said, Brazilian prices are expected to come under pressure over the next couple of months.

Ammonia

Another seemingly quiet week for transparent ammonia spot business came and went, with participants west of Suez likely digesting the latest Tampa settlement between Mosaic and Yara at USD 475/tonne CFR for April. News of the USD 30/tonne increase at Tampa came as little surprise given the relative tightness seen in the US domestic market in recent months, though strong seasonal demand, particularly in the northerly regions, is likely to peter out by the end of April.

Export prices out of the US Gulf also inched up in line with Tampa, with loadings taking place at both Beaumont and Freeport this week. The outlook for the ammonia market is bearish because of weak demand from leading industrial players. It is unlikely that phosphate producers alone will be sufficient to soak up all the excess volumes.