Opinions Focus

- Weakening global wheat markets may suggest optimism for buyers.

- Constructive talks for extending the Black Sea grain corridors.

- Russia retreating from Kherson and G20 comments add to Putin’s woes.

Introduction

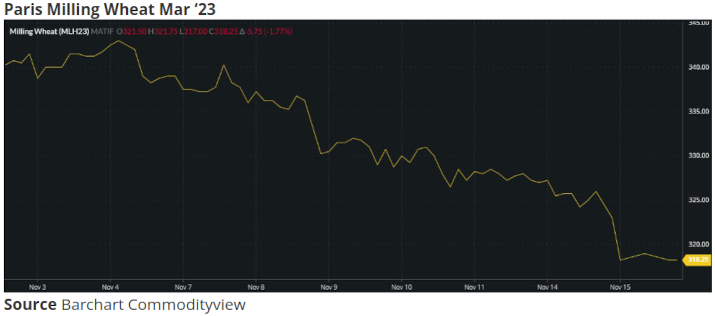

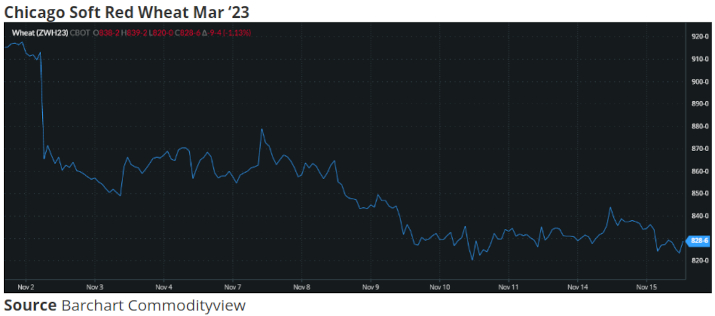

Wheat markets continue their slide since the beginning of the month, as seen in the charts below.

As we enter the final throes of 2022 there is gaining confidence in the estimates of production with most harvests completed and planting well underway in the Northern Hemisphere.

Australia and Argentina are the major wheat crops yet to harvest this year, although both face concerns, too wet or too dry respectively.

The Black Sea Situation

As we have discussed previously there seems little benefit to Putin in pulling out of the Black Sea grain corridors allowing exports from Ukrainian ports.

The deal, brokered by Turkey and the UN is reported to be in the midst of constructive talks, with a need for renewal this week given the current expiry date of 19th November.

Russia is signalling more acceptance that its own exports will be less restricted, as two major hurdles attempt to be resolved:

Firstly, being part of a war zone creates problems for ship owners heading to Russian Black Sea and Sea of Azov ports, with insurance difficulties being significant.

Secondly, sanctions imposed on Russia, not least being blocked from using the Swift payment system, has caused problems for grain and fertiliser payments.

Ukraine on the other hand is actively looking to have the deal extended for the longer term of a year, as a minimum. This would reduce concerns to the market that grain shipments will be further disrupted in the coming months.

Ukrainian President Volodymyr Zelensky is also looking to have a greater number of ports included in the corridors, allowing increased tonnes to be exported.

G20 and Global Politics

With the G20 countries meeting in Bali this week Russia appears to have reducing support on the international political stage.

The more pressure applied to Putin’s regime by either supporting or abstaining countries, for a calming of food and energy prices the more likely an end to the present high prices becomes.

With Russia’s withdrawal of troops from Kherson in recent days, there may be an increasing sense that Russia cannot win their war in Ukraine. This leaves Putin’s allies to carefully consider how they can encourage him to reduce the global economic turmoil brought about by his war impacting all.

Global Supply and Demand

The recently published USDA monthly WASDE (World Agricultural Supply and Demand Estimates), suggest a marginally higher level of production in 2022, at 782.68mmt, greater than either October or last year’s figures.

In addition, World ending stocks were increased slightly from last month, from 267.54mmt to 267.82mmt.

Reasonable weather across many parts of the Northern Hemisphere set the scene for a high level of Global production in 2023. Plantings in both Europe and the US are showing large numbers of acres, even though US crop ratings are not as good as hoped. However, it is still early days and big acres give plenty of potential for a big eventual harvest.

Conclusions

Falling markets over recent weeks has set a trend and it is often said ‘The Trend is Your Friend’.

This week should herald a continuation of the Black Sea Grain Agreement to export Ukrainian crops.

Political will, driven by countries of the G20 group, could encourage more global economic and market stability if pressure mounts on Putin from those currently seen as his allies or enablers.

Finally, there is light at the end of the tunnel with regards wheat production in 2023. Large harvests and a potential for increased World stocks will be good news to buyers across continents.

The unprecedented market turmoil of 2022 could be calming as we head towards the New Year and downward price trends signal more optimism for buyers.