Insight Focus

- Both No.11 and No.5 sugar futures have traded sideways in the past week.

- Commercial participants remain active, with producers capitalising on higher prices.

- The K/K white premium has strengthened.

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures have traded sideways over the past week near 22c/lb.

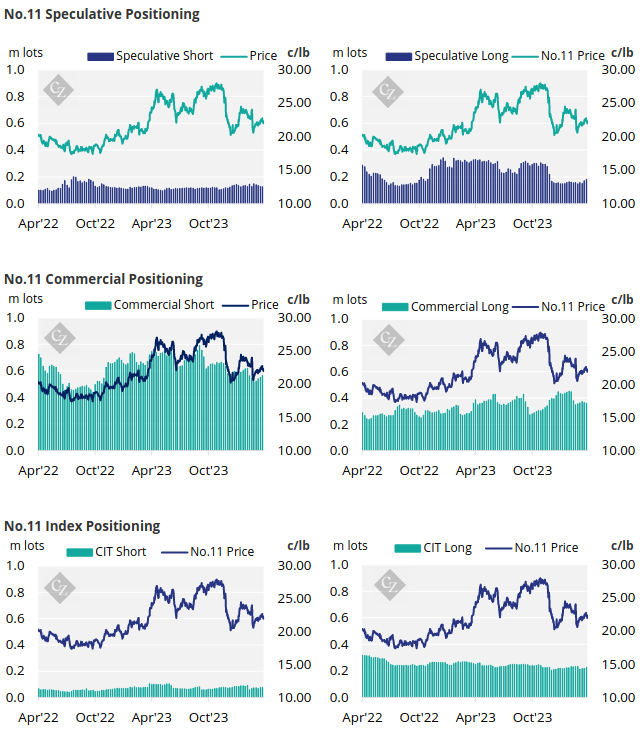

Starting with the commercial participants, producers have continued to take advantage of the higher prices, opening 13.5k lots of short positions.

Consumers on the other hand, have continued to close their positions in the face of higher prices, closing out 5.8k lots of hedges.

Raw sugar speculators have opened 11.3k lots of new long positions while closing 1.1k lots of shorts, raising the net spec position to 54.7k lots. This is the highest spec long position in raw sugar in 2024.

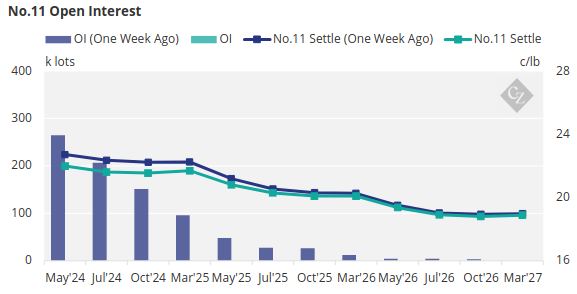

The No.11 futures curve remains flat for much of 2024 and is then gently backwardated to 2027.

London No.5 Refined Sugar Futures

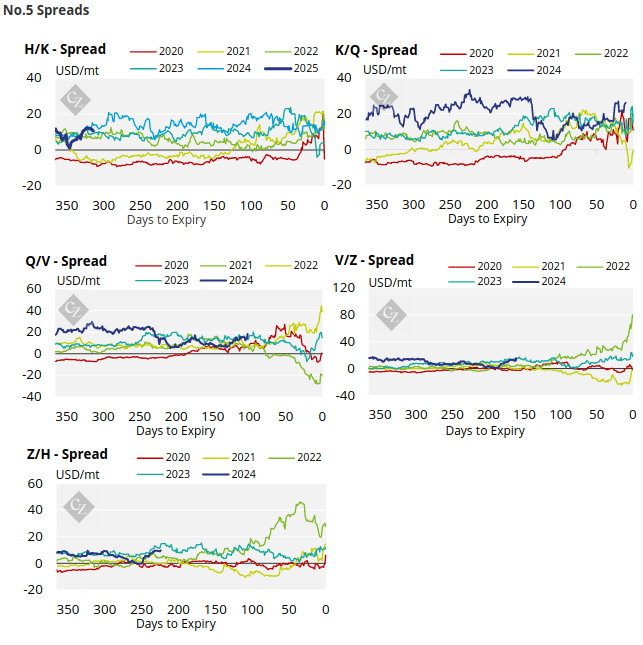

Similar to the No.11 raw sugar futures, the No.5 refined sugar futures contract has also traded sideways before weakening slightly, standing at 646.9c/lb by Friday’s close.

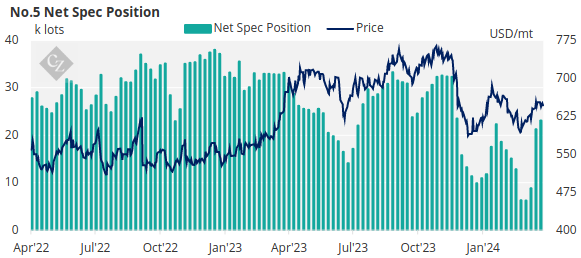

Speculators have continued to open long positions since our last update, adding 1.8k lots of new positions, bringing the net spec position up to 23.1k lots.

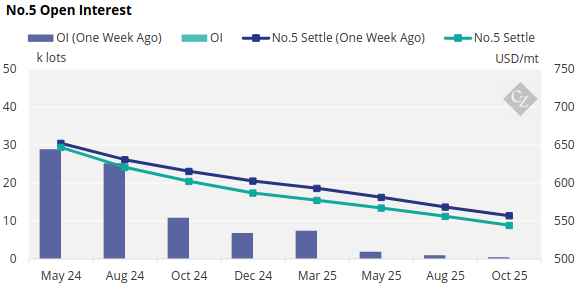

The refined sugar futures curve has also flattened out in the past week, with the curve in backwardation through to Oct’25.

White Premium (Arbitrage)

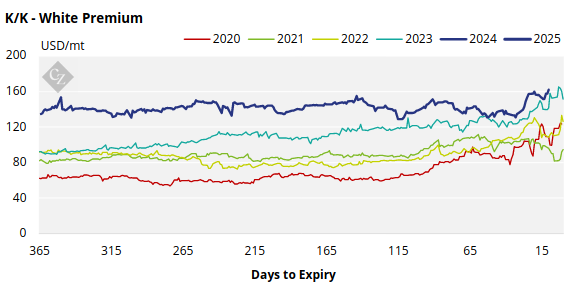

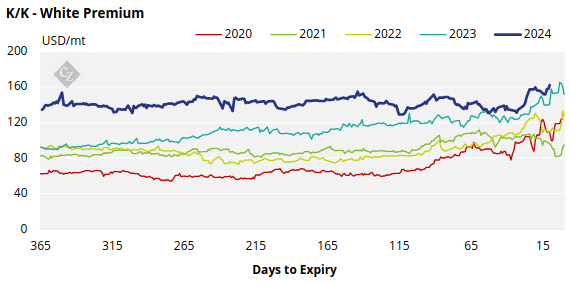

The K/K White premium has strengthened over the past week, trading at 162.1USD/mt.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

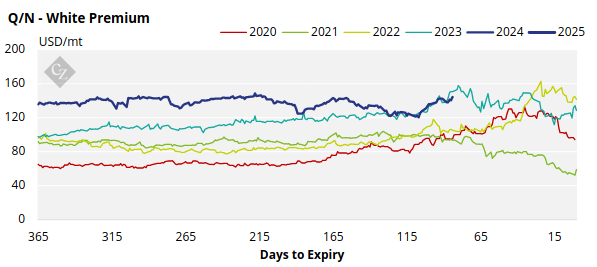

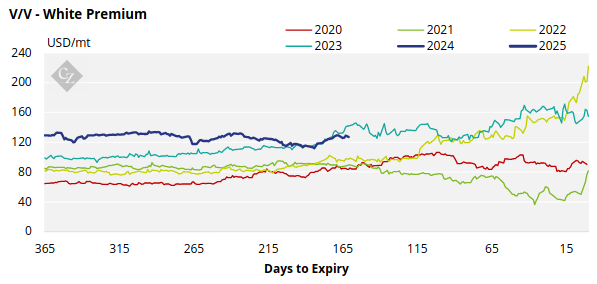

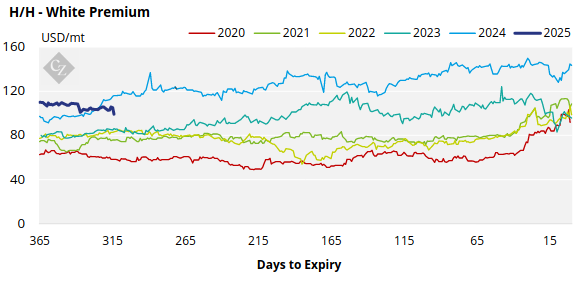

White Premium Appendix