Insight Focus

- Thailand will introduce a carbon tax next year.

- Thai industry can convert from coal to biomass.

- This has the added benefit of allowing carbon credit sales.

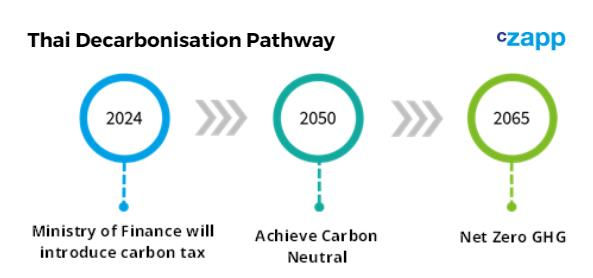

Thailand has big ambitions to reduce carbon emissions. It is aiming for greenhouse gas emissions to peak by 2030, then to be carbon neutral by 2050.

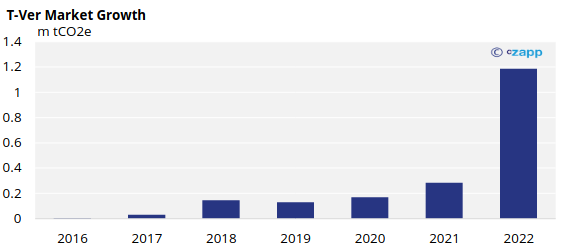

To speed the pace of decarbonization it is introducing a price for carbon through a carbon tax and a carbon credit market. The credit market (Thailand Voluntary Emission Reduction, T-VER) is already operational. The carbon tax comes into force next year. Additional impetus comes from the European Union’s Carbon Border Adjustment Mechanism (CBAM). This will apply from October 2023 and will require importers of carbon intensive materials to pay for the carbon emissions embedded in their production. If the Thai carbon price accounts for these emissions, CBAM won’t apply to Thai exports to the EU.

The Carbon Tax in Detail

The Thai Ministry of Finance is currently evaluating the carbon tax – very few details have been published.

We know that industries with substantial greenhouse gas emissions, such as those covered by the EU’s CBAM (cement, iron and steel, aluminium, fertilisers, electricity and hydrogen), will face a direct tax based on the volume of emissions made during production, as well as an indirect tax on fossil fuel use.

It also appears that the increased costs of the carbon tax on industry may be partially offset through access to green financing with lower interest rates, the opportunity to sell carbon credits and Board Of Investment tax incentives from the government.

What Can Thai Industry Do?

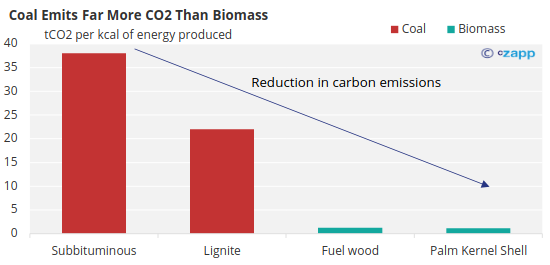

To avoid being included in the upcoming carbon tax, coal users can explore switching to greener fuels, such as biomass pellets.

Industries which switch from coal to biomass pellets as a feedstock will be able to sell T-VER carbon credits generated by the change in fuel.

In addition, companies that implement Waste Heat Recovery and Utilization under T-VER can also earn credits, though measures must be in addition to existing systems and must recover waste heat for use in the manufacturing process or in electricity generation.

T-VER traded volumes are growing quickly, and carbon prices are rising too.

CZ can help you decarbonize.

We can source biomass for you, assess how feasible it is for you to move to green steam, heat or electricity, we can help finance green investments and we can help farmers and agriculture producers pelletise biomass. Please talk to us if you’d like help.

The Scale of the Challenge

Thailand emits around 280m tonnes of carbon dioxide a year, which is around 0.7% of the world’s total.

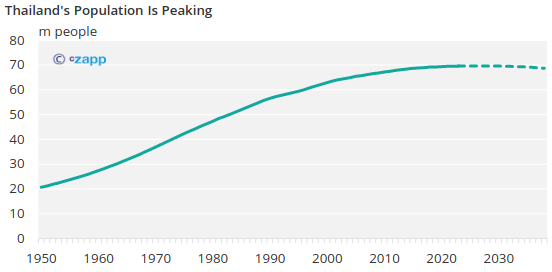

This equates to around 4 tonnes per person per year, roughly a quarter of American or Australian levels and half Chinese levels.

The Thai population will probably peak in the next few years at close to 70m people, meaning that future greenhouse gas emissions growth will come from continued economic development.

The challenge is to ensure this development is as green as possible.

The Thai government intends for the carbon tax (and carbon price from the carbon credit market) to raise awareness about greenhouse gas emissions in the industrial sector.

Solid fuels like coal are responsible for around 20% of Thailand’s electricity generation, but also around 20% of Thailand’s greenhouse gas emissions.

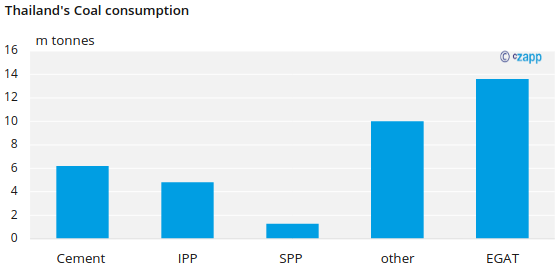

Around 50% of Thailand’s coal use is for electricity generation (20m tonnes). The cement industry accounts for a further 6.2m tonnes of coal (16% of coal use) and is covered by CBAM. Other industries, some of which are included in CBAM, accounted for a further 10m tonnes of coal.

We will continue to monitor developments in Thailand’s decarbonisation efforts.