Insight Focus

- The US announces a third TRQ re-allocation of around 225,000 tonnes.

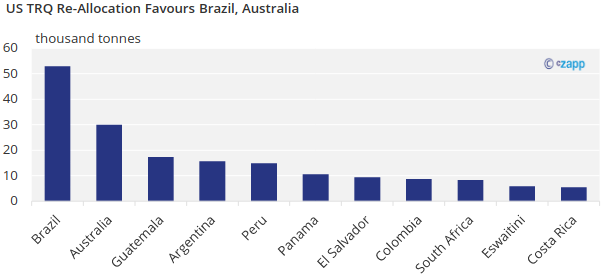

- Brazil, Australia, and Guatemala have been given the most TRQ re-allocation.

- This means a little less sugar for the world market.

The US is seeking to import more raw sugar.

It has just re-allocated 225k tonnes of its raw sugar tariff rate quota (TRQ) from countries that have indicated they won’t ship sugar to those that say they can perform. This means there’ll be a little less raw sugar available to the world market from some origins.

The world’s raw sugar market is already undersupplied, so this news makes things a little more stressed than they were before.

What is the TRQ system?

The US is one of the world’s largest sugar importers. However, its entire sugar economy operates within a unique system.

The domestic sugar market is highly controlled by the Sugar Program. The Sugar Program enforces high duty rates against world market sugar imports. However, some countries are allowed duty-free access for some of their sugar under the raw sugar TRQ.

The TRQ is 1.117 million tonnes annually and the raw sugar must have a polarization of less than 99.49 to qualify. Each country receives an allocation of the total quota. If they do not supply sufficient sugar, the quota can be re-allocated to ensure sufficient volumes arrive each year.

US Sugar Cane Hit by Drought

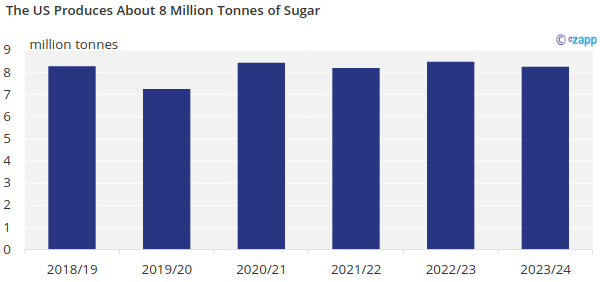

It’s a tricky time for US sugar supply. We think 2023/24 sugar production will fall from 8.5 million tonnes to 8.26 million tonnes. Louisiana is having a poor cane crop following bad weather. The US Drought Monitor claims that 44% of the Louisiana sugar cane is affected by exceptional drought, while 54% was under extreme drought. All of the cane crop in Texas is drought-affected.

Mexican Cane Crop Falters Again

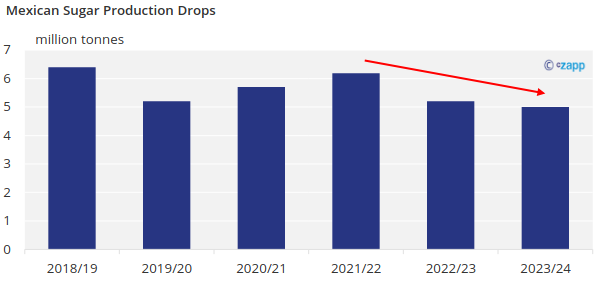

The US also has the USMCA free trade agreement with Mexico and Canada. As a result, Mexico is a major supplier of sugar to the US, but for a second consecutive year, Mexico faces a poor cane crop.

El Nino has led to heavier rain in the winter and now an arid summer, with the summer drought adversely affecting cane growth. We think Mexico will only produce 5 million tonnes of sugar in 2023/24, the lowest amount in 14 years. This means Mexico will have less sugar to ship to the US.

TRQ Re-Allocation Could Solve Problem

The US authorities have now acted to increase sugar supply via the raw sugar TRQ. Brazil, Australia and Guatemala (all major raw sugar suppliers to the world market) have received the largest increases to their TRQ access. This will therefore remove a little raw sugar availability from the world market, at a time when raw sugar futures are close to 12-year highs.