This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The US Department of Agriculture said 44% of Louisiana sugar cane was in exceptional drought.

- The Texas cane crop in 100% severe drought compared to no drought in Florida.

- Corn sweetener negotiations for annual 2024 contracting are underway.

Drought in Louisiana worsened in the past week, raising concerns about sharply lower sugar cane production in the state. Spot and forward cash sugar prices were unchanged, but a firming tone was noted due to the situation in Louisiana, as well as tight raw sugar supplies globally.

The US Department of Agriculture in its assessment of the 5 September US Drought Monitor said 44% of Louisiana sugar cane was in areas of exceptional drought (the most severe rating) and 54% was in extreme drought, compared with 8% in exceptional and 92% extreme a week earlier. The Texas cane crop was in 100% severe drought, while no sugar cane was in drought areas in Florida.

Some have forecast losses of at least 200,000 tons of 2023-2024 refined cane sugar production in Louisiana, which would be about a 10% drop from the latest USDA forecast of 2,054,000 tons.

It’s a vastly different picture for most sugar beet areas where crop ratings are relatively high and mostly above year-ago levels. Of the reporting beet states, Michigan had by far the lowest good-to-excellent rating at 44% as of 3 September. Harvest was underway in Michigan, and rainfall now would be detrimental as it dilutes the sugar content in beet roots.

Beet harvest continued in the Red River Valley with favourable ratings and good sugar content indicated. Harvest was underway or about to begin in other beet states as well with full harvest by 1 October.

The current situation in the United States (mostly good beet crops and poorer than earlier forecast cane crops in Louisiana and Texas) along with the tight global sugar situation has added to uncertainty across the market. One domestic beet sugar seller was said to be aggressively pricing sugar in the Midwest for 2023-2024 to clear supplies with harvest underway. At the same time, other beet and cane sugar sellers appeared to have a firmer attitude about pricing for next year, knowing US cane sugar supplies will be down and import options may be more limited than in most recent years.

So far, listed prices for beet and cane sugar for both this year (spot) and next year are unchanged from the past few weeks. Expected weakness in October when full beet harvest is underway may be less likely as the situation in Louisiana develops. That creates a quandary for those who have not yet covered or have only partially covered their 2023-2024 sugar needs and were hoping for price weakness in October.

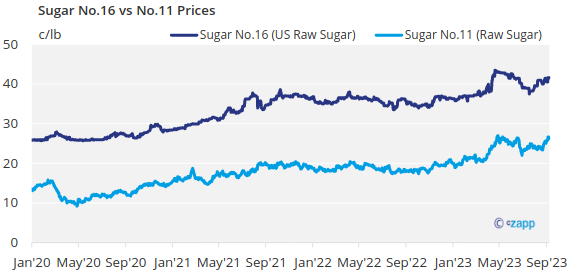

Refined sugar prices will continue to garner support from high raw sugar prices, both domestic and global. With lower production in Asia and Australia due to El Niño, Brazil continues to carry the export burden.

Corn sweetener negotiations for annual 2024 contracting were underway with buyers hoping for flat to lower prices amid market conditions considerably more in their favour compared with a year earlier when prices shot higher.