597 words / 3 minute reading time

- Old crop wheat stocks are getting tighter with fewer offers.

- It’s dry one day and wet the next.

- Every part of the globe has a different daily story.

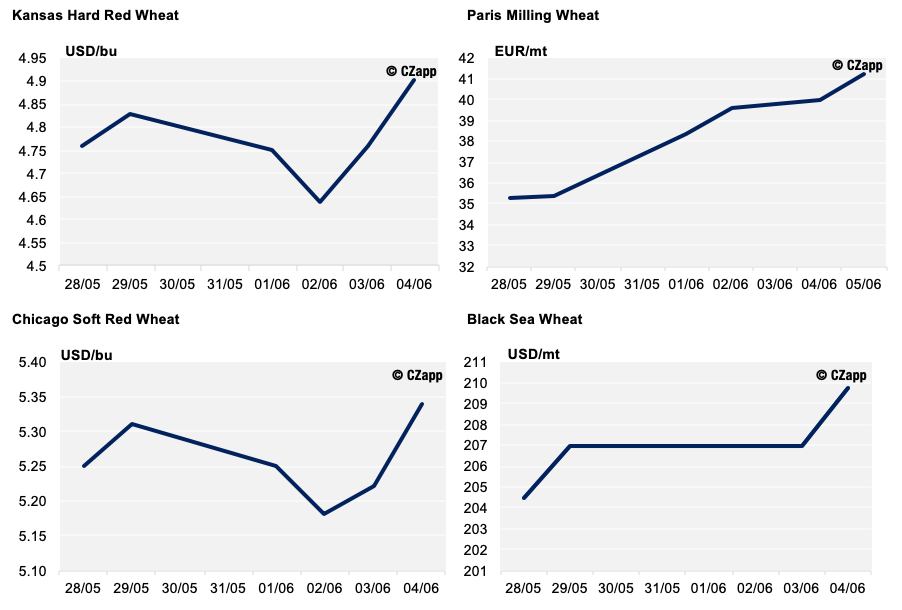

The Recent Wheat Prices

The wheat market appears to be lacking some direction over recent days as the Northern Hemisphere marketing season comes to an end and the combines start to roll for the 2020 harvest in the southerly regions.

There has been a small rally in prices, especially in the Black Sea wheat market, despite a few down days added into the mix, as stocks look to be getting tighter in Russia and the Ukraine.

Tighter Stocks and Export Offers

The Ukraine and Russia have been headline wheat news with regards export restrictions throughout the latter stages of the 2019/20 marketing year.

Ukraine officially limited wheat exports to 20.2m tonnes with a strict ban thereafter, only to retract the ban once the 20.2m tonne limit was reached.

Russia have sold wheat from State stocks and seen domestic prices rise as limits on exports have curbed overseas sales in recent weeks.

Egypt tendered for and bought wheat this week for July shipment; 120k tonnes from Ukraine. Russia would usually be in the mix and, to a lesser degree, the French.

Domestic price rises and export restrictions in Russia have put any offers there out of contention, while European soft wheat exports are running at 31.33m tonnes up from 19.24m tonnes last year. This, coupled with the French wheat crop being rated 56% good/excellent, which is a nine year low, has reduced the competitiveness of offers to Egypt.

Short term stocks are looking tight, but we are heading into harvest.

Weather Uncertainty

We have repeatedly mentioned the difficult weather this season and it has not stopped adding intrigue to the market.

Europe and the Black Sea have seen much needed rain over recent weeks, but is it enough?

It has been dry in Western Europe, but rain is apparently on its way, with Russia looking to benefit from more too.

The US is looking dry for Hard Red Wheat and crop damage from previous dry and freezing conditions is still unknown.

Crop estimates coming out are most certainly not consistent. An example this week was the Ukraine 2020 wheat crop estimated by the Government at 23.2m tonnes, ProAgro at 26.65m tonnes and the most recent USDA expectations of 28m tonnes. There is not much agreement there!

Recent reductions in the European and Russian wheat crops have added to the uncertainty.

In the Southern Hemisphere, Argentina and Australia are getting daily reports of big harvests on the way; 21m tonnes and 24m tonnes respectively. However, the crops are still being planted, so there is a very long way to go.

Where Do We Go From Here?

It’s going to be a while until we really start to get a grip on the size and quality of the Northern Hemisphere 2020 wheat crop. Meanwhile, stocks are tight and offers will be limited until new crop becomes more readily available on the market.

We have seen some upward movement in the prices as concerns for old crop wheat stocks in the Black Sea mount. Any positive or negative yield reports for harvest, as it gains pace, may allow the trade to get a handle on where we go from here.

Rain dances are ongoing, but we can safely say that the wheat market is in the lap of the weather Gods!