Insight Focus

- India is booming; so is its cane sector.

- But India faces a sucrose shortfall in the coming years.

- This could have a major impact on the world’s food and energy markets.

My father’s grandfather was assassinated in India. He left home for work one morning and never returned to his wife or daughter. The death certificate matter-of-factly recorded the cause of death as “bullet wound”.

My most-recent visit to India was a trip to Delhi in November 2019. The air quality in the city at the time was among the worst recorded for an urban area in human history.

Speaking on a Panel at the India Sugar and Bio-Energy Conference 2023

Happily for me, the hospitality of the Indian Sugar Mills Association, International Sugar Organisation and the Government of India at the first India Sugar and Bio-Energy Conference was impeccable. Here are my thoughts on the event.

Incredible India

India is booming. GDP is growing at around 7% a year post-covid. I could see this on the ground. Even accounting for Delhi’s cleanup ahead of the G20 summit in early-September there was a newfound confidence and vibrancy in town.

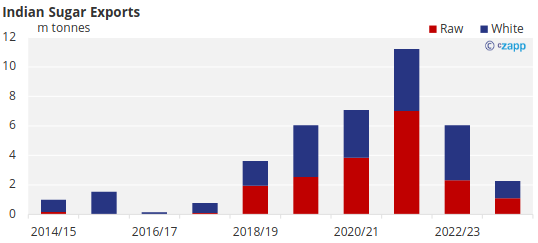

This extends to the Indian cane sector. A few years ago the sector was squeezed between high fixed cane prices and low domestic sugar prices. Sugar exports were viable only with the help of a government subsidy, which was being challenged by a range of countries at the World Trade Organization.

Toyota Show Off Flex Fuel Vehicles at the Conference

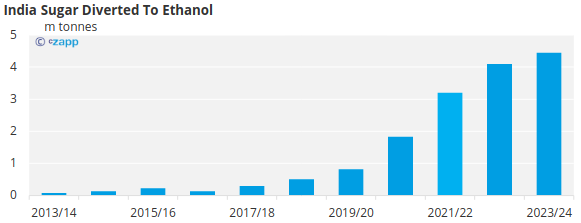

Today, the cane sector presents itself as a growing energy superpower. Nothing seems impossible. The sector is building distilleries to meet the government’s ambitious ethanol blending targets. It produces sugar to feed India and to export to the world. It’s exploring how to better use its biomass, talking of new high-value fuels like compressed biogas and sustainable aviation fuel. There’s no limit to the cane mills’ ambition. One presenter spoke of the brand equity India has developed globally by being a reliable exporter of sugar. Another spoke of plug-in hybrid electric flex fuel vehicles using 100% ethanol accounting for a growing share of the Indian car fleet in the future. Toyota demonstrated 2 new flex fuel vehicles at the event.

Trouble Ahead

And yet…

India has mastered many things, but not the weather. This year’s monsoon hasn’t brought enough rain to the Southwest, and India is facing a sucrose shortfall that threatens its plans. You could see it by what wasn’t said during the presentations. Chats in the hotel lobby and quick conversations over a coffee revealed a deep unease.

Already sugar stocks in India are low. There’s a saying that you should never believe a rumour until it’s been officially denied. In the weeks leading up to the conference the Indian government issued a press release saying that sugar stocks were “sufficient”; the first true sign of nervousness about supply ahead of 2024’s general election.

The Indian Government is Concerned about Sugar Stock Levels

More recently, the government has allowed mills to sell sugar earmarked for the domestic market in October to be released in September. 266 of 520 mills are unable to sell sugar because they’ve run out. The last thing the sector needs is a cane crop failure.

The Panel on the Indian Domestic Market

That’s exactly what’s being talked of in the Southwest of the country. One major Indian producer said that field reports put Karnataka’s output at 20-30% below last year’s, with similar losses expected in Maharashtra. Consensus among the international sugar trade was that India would make 29m tonnes of sugar in 2023/24, assuming 4-5m tonnes of sucrose was diverted to make ethanol. This is barely enough to cover domestic sugar consumption, leaving no excess for export. In the space of three seasons, India will have gone from supplying 11.4m tonnes of sugar to the world to zero.

Worse, cane plantings in the Southwest this year have been hit by the dry weather. People were talking openly about India making 30m tonnes of sucrose next year. That’s not enough to divert 5m tonnes for ethanol and to meet domestic sugar demand. What the government does next was hotly debated.

No Good Choices

The most common opinion was that the government would encourage mills to reduce the diversion of sucrose to ethanol. This would immediately free up sucrose for food production.

However, this isn’t an easy decision. One of the benefits of increasing the ethanol blend in gasoline is to enhance India’s energy security. India has also just helped to launch the Global Biofuels Alliance at the G20 summit. How will it meet its own ambitious E20 by 2025 goal given a major feedstock shortage? Cane mills have invested heavily in ethanol distillation. Can they withstand a loss of throughput at their new facilities?

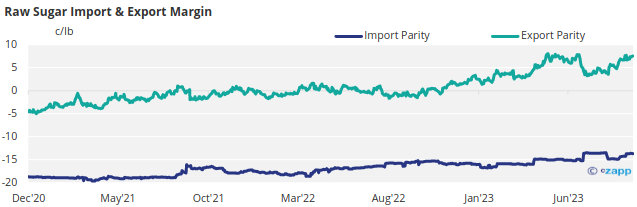

A minority opinion was that the government would opt to import sugar first. This is a nuclear option for the sugar world market. In the space of several years India would have pivoted from one of the world’s largest sugar suppliers to a sugar importer. Bull markets end when the last stressed short has been forced to buy. Might India unknowingly be that stressed short?

This also isn’t an easy decision to make. India’s domestic sugar price is one of the lowest in the world, at around $500/mt. To make importing world market raw sugar for domestic use viable, Indian prices would need to rise by almost 50%.

This is not viable ahead of a general election, so perhaps the government will need to subsidise sugar imports instead. After several years of fighting challenges against its sugar export subsidies at the World Trade Organization, it would be the ultimate irony if Indian subsidies ended up benefitting sugar exporters in Brazil, Australia, Thailand and Central America.

Might Indian Subsidies End Up Benefitting Other Sugar Exporters?

If India does import world market raw sugar, can other suppliers respond on the scale required? Centre-South Brazil is the world’s largest sugar exporting region and its sugar production is increasing. But inland logistics haven’t kept pace with agricultural output and it’s not clear if Brazil can make enough sugar available to meet global demand in 2024.

The final option is to import ethanol. Everyone I spoke to deemed this a non-starter. India intends to increase energy security through its ethanol program. Importing ethanol sets a bad precedent. India may as well drop its blend and import gasoline instead.

The USA is Seeking to Improve Ethanol Trade With India

This view might not be shared by India’s partners. Brazil has been helping India’s ethanol sector grow by sharing expertise and experience. The Brazilian cane sector would no doubt love to be able to export its surplus ethanol to India. Likewise, the United States Grains Council opened an Indian office in January 2023 to promote ethanol demand.

Where Next for Sugar?

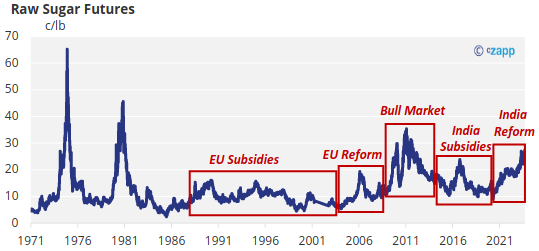

An Indian cane shortfall is clearly positive for the sugar market. The parallels with the last big sugar bull run of 2009-11 are uncanny. Back then El Nino contributed to an Indian crop shortfall leading to Indian sugar imports. Speculators pushed the market to 30c then lost confidence in their position, leading to a price collapse. Brazilian logistics problems and a short squeeze then drive prices to a multi-decade high of 36c.

The Sugar Trade Panel in Delhi

Indeed, at the conference most of the sugar trade seemed bullish on prices going into 2024. The consensus was enough to make me nervous. One Indian sugar producer asked me if I’d be a buyer at 27c. I answered that I thought sugar prices would break to new highs in the coming months, but I probably wouldn’t buy here today.

For a start, the October raw sugar futures contract expires at the end of this week. Sugar expiries are often major events for futures markets. They attract a high volume of futures trading in the weeks prior as market participants position for the expiry. Trade houses can use the 2.5-month long delivery windows to push a full quarter’s sugar supply or demand around with the price being dictated by the one moment when physical and futures prices converge. Already this year each expiry has led to a major change in sugar price direction.

Futures Expiries Are Major Events in the Sugar Market

Bull markets can also be extremely volatile. Prices in 2009-11 rallied to 30c before collapsing back to 13c ahead of the final rally to 36c. Even during that final rally, prices at one point lurched 8c lower in just two trading sessions. Something similar could easily happen today. Not for nothing did my recent 5-year price outlook show a 20c (!) price range for 2024. Producers will probably get a chance to hedge above 30c, but nimble consumers may also get a chance to hedge in the low 20 area.

Everyone also fixates on price, but markets don’t just resolve problems through higher or lower prices. They also resolve problems through duration. Hedgers often look only at price because they only need one shot to hit their targets. But for many people, including end-consumers, the amount of time that the market spends at a higher price can be equally important. Few people need to chase a momentary price spike higher; they can choose to run down stocks. But a sustained high price hits all buyers.

The biggest question of all is whether India has realised that it too might be a buyer.