Insight Focus

- Biomass is increasingly a source of revenue for cane mills.

- Cane biomass can also be exported for power generation elsewhere.

- Higher energy prices could make this an attractive option in the 2020s.

Biomass: Back to the Past?

In 2022 Russia invaded Ukraine, European natural gas prices went ballistic and German Google Searches for “Brennholz” (firewood) hit record levels.

Source: Refinitiv Eikon

This led to a certain amount of schadenfreude* among non-European analysts who’d long warned of the danger of becoming overly dependent on cheap Russian energy and Germany’s plan to switch off all its nuclear power stations. After all, our primitive ancestors relied on firewood for energy for millennia. That one of the richest countries in the world might need to revert to this was ridiculous.

(*schadenfreude ≈ pleasure derived by someone from another person’s misfortune)

This isn’t a good basis to start talking about how biomass might be part of the modern energy revolution. But it is – let’s take a closer look at how.

Green Energy from Sugar Cane

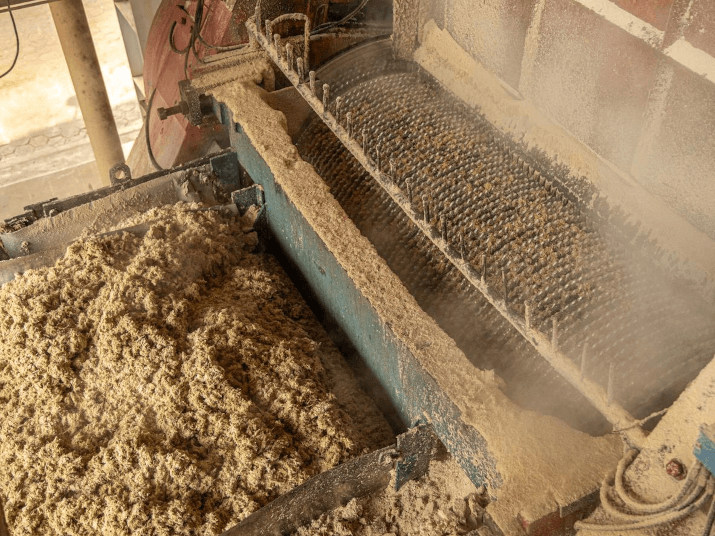

Sugar cane is a type of grass which is harvested and crushed for its sucrose content. This sucrose can then be crystallised to make sugar or fermented to make ethanol. But the cane juice isn’t the only valuable part of the plant. The cane plant has leaves which are removed when it is mechanically harvested and are often left in the field as trash/straw. The stalk itself is fibrous and this fibre is leftover at the mill after the cane has been crushed. This biomass is known as bagasse.

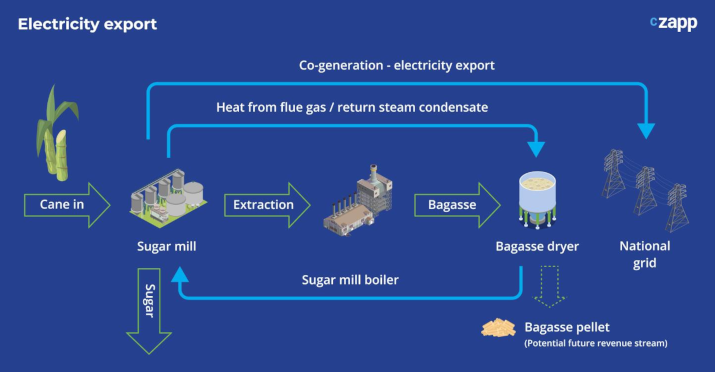

Both can be burned in boilers to create energy. Cane mills around the world have done this for more than a century to provide power while crystallising sugar. But mills today have further options available to them. Those with low pressure boilers can invest in high pressure boilers. These are more efficient and so require less biomass fuel to achieve the same energy output for cane processing. This means that the mill can either sell excess power to the grid or can sell surplus biomass to nearby mills if they are able to use it.

However, no-one wants to pay to transport water so mills can also invest in biomass dryers to further increase the energy content of the biomass per tonne, increasing its value. Indeed, even mills that don’t intend to sell surplus bagasse can benefit from dryers as it increases the efficiency of the fuel in their boilers.

If no local mills or other energy consumers wish to buy surplus biomass it can then be pelletised for export. This involves compacting the biomass into hard, high energy intensity pellets which can be moved to the port, loaded onto drybulk vessels and shipped to overseas buyers. It’s therefore possible for cane fibres grown far inland to be cost-effectively moved to power generators on different continents to generate green electricity. In an era of high energy prices, cane mills can finally capture significant value not just from the sucrose in the cane plant, but also from the fibre of the cane plant.

Is the Capital Expenditure Worthwhile?

Whether mills choose to export surplus electricity to the grid depends on the local electricity market. Cz has extensive experience in advising customers on how to maximize their returns from local electricity markets. We have also advised on excess biomass availability in different countries around the world. If you would like help exploring your options for using biomass locally, please contact us.

Exporting biomass overseas for power generation is a different story. In general, this becomes more advantageous the higher that world energy prices become. One indicator to watch is the European TTF natural gas price. Natural gas prices used to be regionalized. Gas could only be moved long-distance by pipeline. Today liquified natural gas means that there is a more effective world market price. The EU TTF price no longer just reflects supply from North Sea gas fields, nor supply from Russian pipelines. In the past winter it’s shown the price of LNG cargoes arriving from the US or from Qatar. Europe competes with China, Japan, Korea, Pakistan, Egypt, and many others for these cargoes.

Source: Refinitiv Eikon

For years the EU TTF price has been low, between 10-30 Euros per megawatt hour. There were plentiful natural gas supplies from the North Sea and Russia. Politicians assumed natural gas was natural gas – the same molecule at the same price whether it came from the North Sea, Russia or Qatar. It could all be delivered cheaply on a just-in-time basis. Indeed, the UK shut 70% of its gas storage in 2017. The government thought it was too expensive to operate.

Source: Refinitiv Eikon

Then global demand for energy increased as we learned to live with COVID. Prices increased. In 2022 Russia invaded Ukraine, gas flows to Europe stopped and prices went through the roof, peaking at 10 times the 2010s range. At this time German google searches for “firewood” also peaked. But since this time, natural gas prices have fallen by more than 90% top to bottom.

The risks remain, though. Competition for world market LNG cargoes is intense. This month Pakistan has unsuccessfully tendered for LNG. European storage is refilling ahead of the 2023/24 winter. EU TTF in June has rallied 70% from 23 Euros per megawatt hour to around 40 Euros. Given the lack of viable Russian gas supply and competition for LNG cargoes, its possible that EU TTF prices remain higher than the 2010s levels during the 2020s.

In addition to the higher European/world LNG prices, Europe is also attempting to rapidly decarbonise. In 2022 the European Commission’s ‘Fit for 55’ plans to reduce the EU’s greenhouse gas emissions by 55% by 2030 became law. This includes the introduction of a carbon border adjustment mechanism, a proposal to extend the EU Emissions Trading Scheme, and additional support for clean transport and renewables, including biomass.

This all means that cane biomass has much greater revenue potential in the 2020s than ever before.

Cz can help you use biomass more effectively, using the broad expertise of our global team. We finance new investments at mills, including:

- boiler upgrades,

- industrial “green steam” (derived from sustainable byproducts such as bagasse)

- new cogeneration plants,

- biomass dryers,

- pellet plants.

We buy and ship and sell biomass globally. We optimize biomass supply chains. We undertake consulting scoping and feasibility studies to explore biomass options in your region. Please contact us if you’d like to maximise value from biomass in the years to come.