Insight Focus

- India faces a sucrose shortfall in 2024.

- Global sugar production isn’t growing.

- Sugar prices may need to be higher for longer.

Hi everyone, I’m Stephen Geldart from CZ and I’m here with a sugar market update for September 2023.

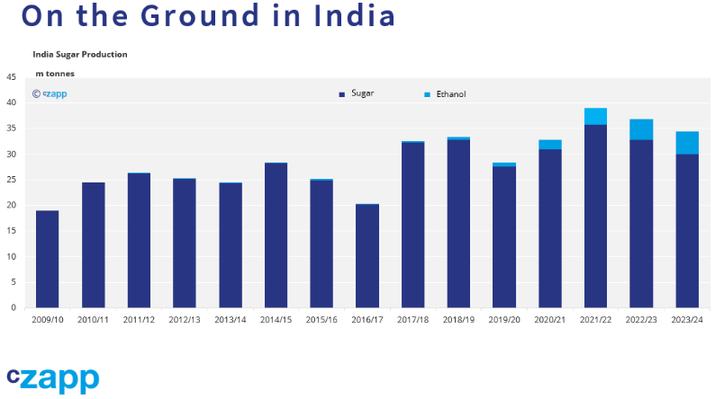

I’ve just come back from India, where the entire sugar market is buzzing. India is one of the world’s largest sugar producers, it’s the largest sugar consumer, and it also uses sugar cane to make ethanol for road fuel.

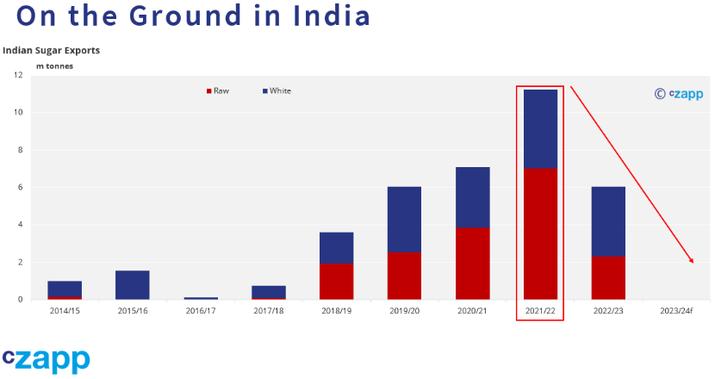

The problem is that this year’s cane hasn’t matured well. The lack of rainfall during this year’s monsoon has set it back, especially in the south west of the country. This means, as I discussed in my august video, sugar exports are unlikely in 2024.

This is a big shift. 2 years ago India shipped 11m tonnes of sugar to the world market. Even worse, the ground has been so dry in India that farmers haven’t planted as much cane for the year after. The cane crop could be even lower in 2025.

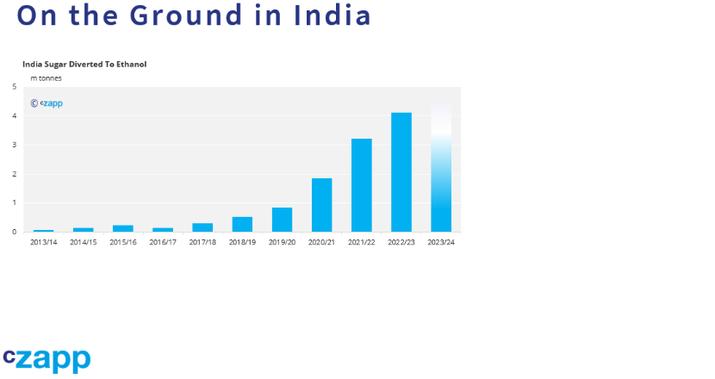

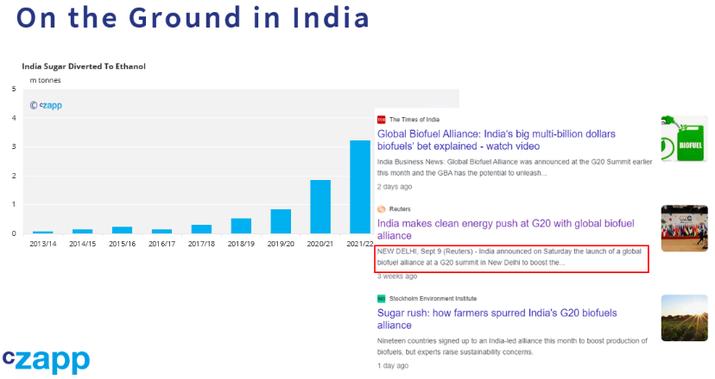

So there’s open talk now of India reducing its ethanol blend. This is kinda embarrassing.

India has just helped launch the Global Biofuels Alliance with President Biden and Lula at g20 and has committed to blending 20% ethanol with gasoline by 2025. But the Indian government can’t control the weather and so probably won’t be able to reach 15% in 2024/25…which brings into question whether its 2025 target is achievable, especially given the monsoon has also hit grains crops.

Cutting the blend frees up more sucrose for sugar production, so the government will probably get away without needing to import sugar. But the possibility of sugar imports into India is at least being recognized, and perhaps even priced into the futures market.

The problem is that the global sugar futures market may well be pricing in Indian imports at 26c. But the Indian dome18181818stic market remains below 40 rupees per kilo, which is quite some way below world sugar prices.

This means that the government would either need to let sugar prices rise, which it’s unlikely to do with a general election due in May 2024. Or if it decides it needs sugar imports, it’ll have to subsidise them. Sugar bull markets tend to end when the last stressed buyer has capitulated. Does the Indian government realise it might be a buyer?

If India seems like a bit of a mess, that feeling extends to the sugar market as a whole. The same themes I’ve been talking about for months are still driving prices.

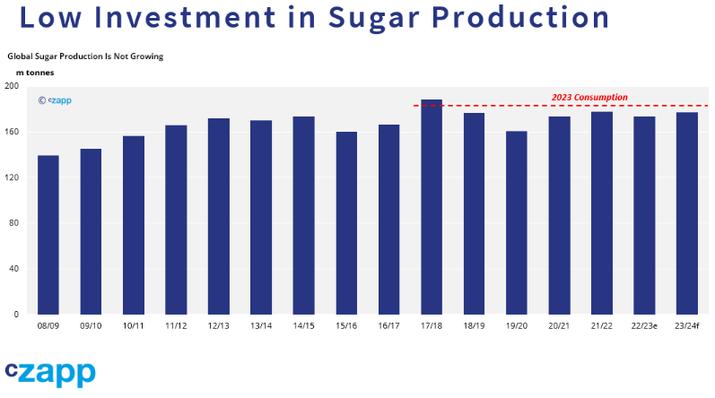

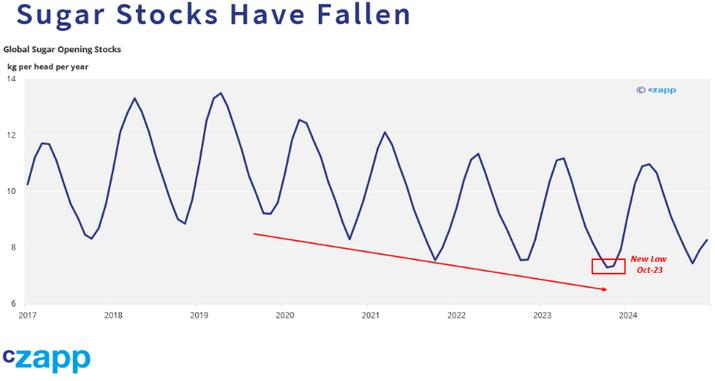

We had a decade of low investment in sugar production around the world, production has flatlined and we now don’t make enough sugar to feed everyone. Sugar consumption has finally reached 180m tonnes this year, and global production has only exceeded this level once, in 2017/18. So we need higher sugar prices to encourage more investment in sugar production so that we make enough to keep pace with future consumption growth.

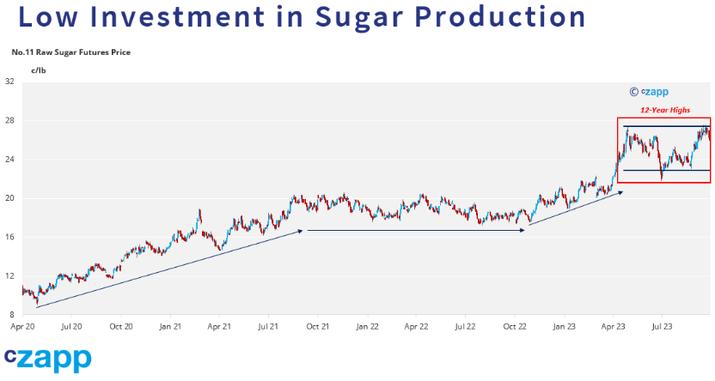

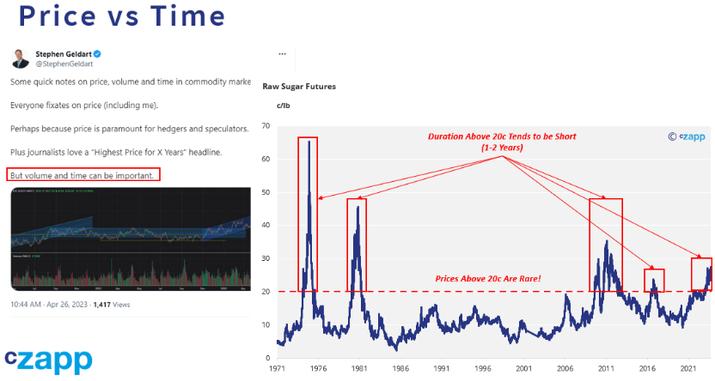

Well, we’ve had the higher prices. Sugar prices have been rising for more than 3 years now. Raw sugar has been above 20c all year; 20c is a rare price, a high price. Yet look around the world and we’re not seeing any real increase in cane or beet plantings.

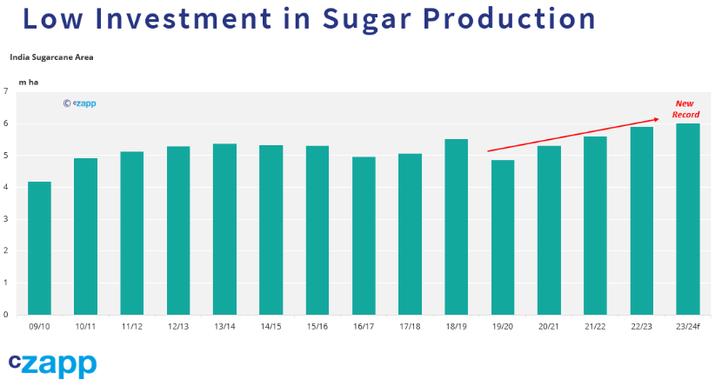

In India the cane acreage is expanding, but it’s been planted on increasingly marginal land which leaves the crop vulnerable to poor weather, as we’ve seen this year. The cane is also increasingly being diverted to make ethanol not sugar.

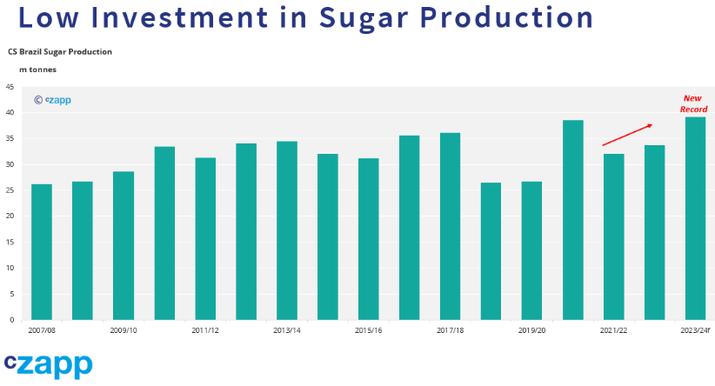

Brazil is the world’s largest cane region and its output is also growing. But so are the soy and corn crops and it’s becoming clear that the infrastructure to get the crops from inland to the ports is inadequate. It’s not clear if Brazil can get enough sugar out to the world market in 2024, or if it’ll remain stranded inland when it’s needed. Elsewhere, there’s little growth.

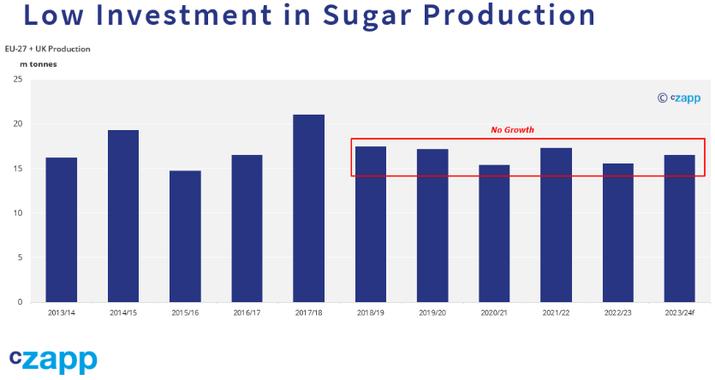

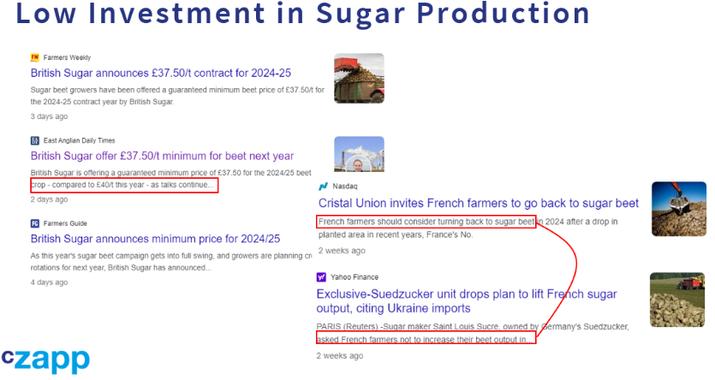

In Europe, the signals are mixed. The British beet processor is proposing a beet price cut this season versus last season.

Farmers aren’t happy.

One major French processor has asked its farmers to plant more beet as sugar prices are high. But another French processor has told its growers NOT to plant more beet, as it’s worried that Ukrainian sugar flows will prompt prices to fall.

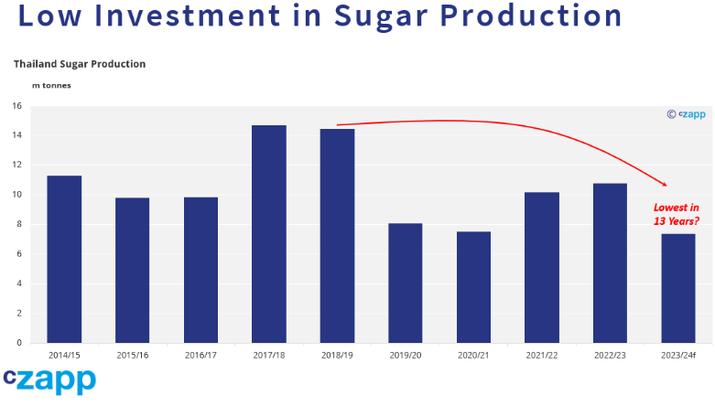

In Thailand we are expecting the worst cane crop in 2 decades thanks to poor weather leading to poor cane development, and also because cassava pays farmers more than cane, so cane acreage is falling.

Sugar output has almost halved in 5 years with no sign that this trend will reverse any time soon. Farmers need higher cane prices to change their mind, which means they need their sugar to be hedged at the high-20c level.

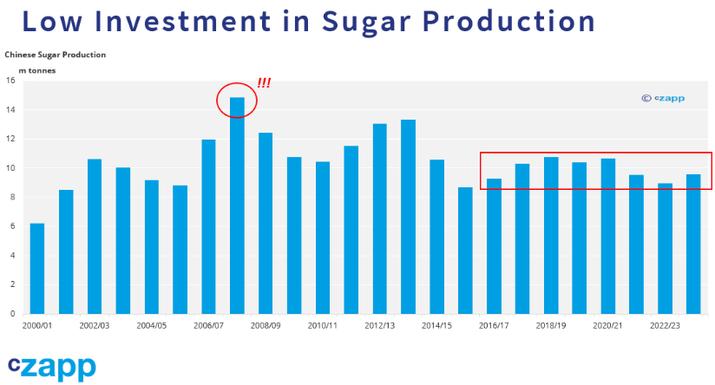

In China, sugar production has been stuck at 9-11m tonnes for years. It once reached 15m tonnes, a level which would virtually eliminate China’s sugar deficit and need to import. But to get back to this level sugar would need to offer better returns; fruits pay more in cane regions and all of the government’s initiatives on food security focus on grains, not sugar.

If we’re not seeing some of the world’s largest sugar producers increase output with prices at decade-highs, what more can we do?

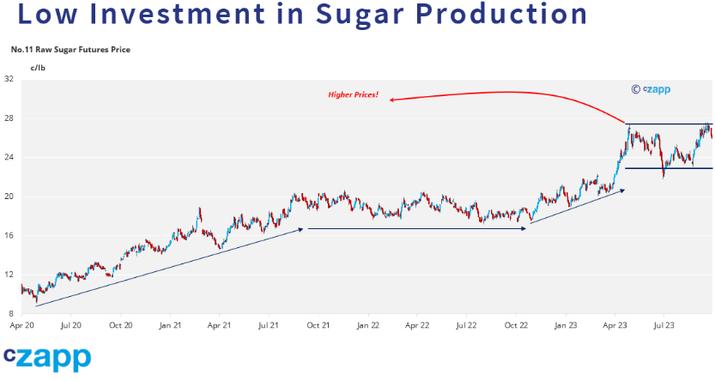

Well, you may have heard me say before that price isn’t the only way you solve problems in markets. We all fixate on price because that’s what anyone who needs to hedge is seeking: a good price. But the market isn’t just made up of hedgers. Time cane also be important.

A consumer can ride out a temporary price spike by running down stocks, for example. But persistent high prices are harder to dodge, which is why governments around the world are scrambling to control inflation.

Incidentally, this is why you should look more at the amount of time interest rates remain high, rather than just look at the headline rate itself. In many markets, duration can be as important as price. So, what does this mean for sugar?

Well, there’s no doubt sugar stocks have been drawn down globally.

A few months ago I said that there was no sign yet that sugar consumption was being hit by higher prices; especially seeing as the price of all foods was higher in most places. In the face of a general rise in food costs, people tend to cut back on expensive luxuries like meat and may even eat more carbohydrates like sugar. BUT we are perhaps seeing the first signs of change.

Nestle recently said that consumers were buying less food: either by buying cheaper, or wasting less. They are, of course, a major sugar buyer. There are also hints that European sugar consumption growth may be a little less robust than we’d thought previously. This is definitely something to watch as closely as we can.

Regardless, for sugar if we think about price and duration together it looks like sugar prices will need to be higher for longer.

We will probably trade between 23c and 27c for quite a while. But this is still a commodity bull market, and commodity bull markets can show astonishing volatility. Be aware of this as you manage your price risk this year and next.

Today, sugar is extremely dependent on Brazil for supply, and reliance on a single supplier is rarely a good idea. At some point in 2024 I believe sugar prices may break to fresh highs once more.

That’s it for now, thanks for watching. I hope you’ve found it useful. See you next time.