- China bought 320k tonnes of US wheat in July, despite the ongoing tensions surrounding their Trade Agreement.

- Egypt, the world’s largest wheat importer, also bought 699k tonnes of wheat.

- Argentina is still suffering from dry weather, which will likely scupper any thoughts of their record 21-22m tonne crop.

The Wheat Markets Last Month

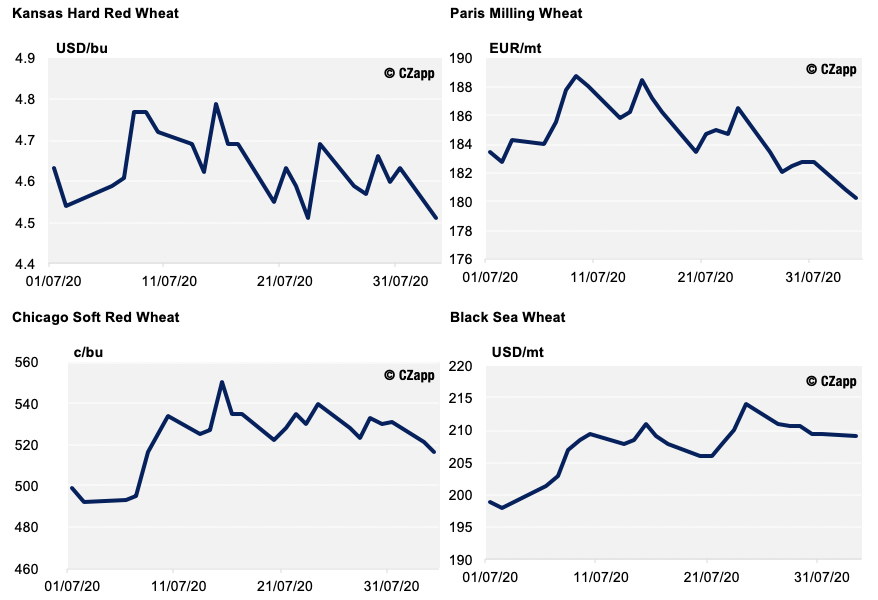

- Since our last update, the global wheat markets have had their ups and downs but remained broadly rangebound.

- The harvests continue in the Northern hemisphere with mixed reports, but the markets are neither flying nor crashing.

- The economic outlook in the United States has impacted the US dollar detrimentally, but this weakening has allowed wheat markets to be more resilient.

China Imports US Wheat, Despite Ongoing Trade Dispute

- China bought 130k tonnes of Hard Red Wheat and 190k tonnes of Soft Red Wheat on 10th July in an attempt to uphold the ‘Phase One Trade Agreement’ with the US.

- Days later, President Trump stated that he had no immediate intention of speaking with the Chinese about a ‘Phase Two’ deal. He swiftly followed this with the order for China to close their Houston consulate.

- China, in reply, demanded the closing of the US Consulate in Chengdu.

- Where does this leave future agricultural purchases by China? Despite purchases of corn and soybeans since, any escalation in diplomatic tensions could have serious implications.

The Other Importers Have Been Active Too

- Egypt, the world’s largest wheat importer, bought 699k tonnes of wheat in July.

- July also saw tenders from Japan, Jordan, Tunisia, Ethiopia, Taiwan, the Philippines, South Korea, Thailand, and others, with varying purchases made.

- Brazil bought at least 120k tonnes of Russian wheat, which is an interesting purchase given its proximity to the two major exporters, Argentina and the US. This reiterates the competitiveness of Black Sea wheat on the market.

- Pakistan has also been buying Black Sea wheat recently, with at least 300k tonnes purchased for shipment in August-September.

The Harvests Roll on with Little Trouble

The USA

- US winter wheat is 85% harvested, but below the five-year average of 88%.

- The US spring wheat crop is 5% harvested, up from 2% last year, but below the five-year average of 10%.

Russia

- The Russian harvest moves into central parts with better yields than were first seen in the Southern regions.

Europe

- The EU’s harvest continues at a brisk pace with hot weather.

- France’s Soft Wheat Crop should total 29.22m tonnes (Agritel), making it one of its smallest crops in the last 25 years, down 26% year-on-year.

- At the start of July, the National Farm Ministry thought the crop would total 31.3m tonnes.

Argentina

- It’s not all good news.

- Argentina continues to suffer from dry weather conditions. This is reducing its planted area and will likely scupper any thoughts of a record 21-22m tonnes crop in 2020.

The Coming Weeks Will Start to Shape Prices

- The markets have been lacking any real direction, despite strong importer activity and crop progress in the Northern Hemisphere.

- However, the coming weeks will start to shape prices for this marketing year.

- The futures will look at wheat quality and quantity for direction and spread values between each other.

- The world has ample supply, but prices will be driven by who has what and that will determine the direction of trade flows.