Insight Focus

- Volatility continues as weather, war and politics play their part.

- Hot and wet months add to yield and quality debates.

- India adds to market uncertainty.

Introduction

As the market rollercoaster continues, we assess the important stories and what they might mean for global wheat prices over the coming weeks.

The Ukraine war and Black Sea exports are, as usual, headline news stories, as Ukraine looks to have its own way of increasing the pressure on Russia.

July was the hottest on record. That is not always good news for a Northern hemisphere crop needing grain fill.

Rain in August could certainly dampen quality prospects in parts, while giving a welcome boost elsewhere.

India reports interesting news with potential tax changes.

Markets

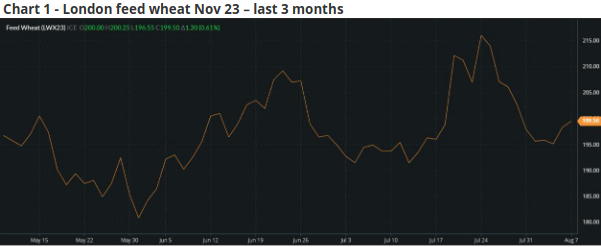

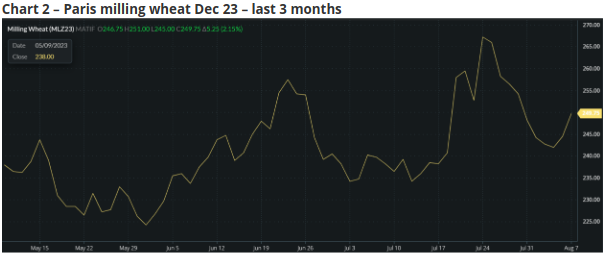

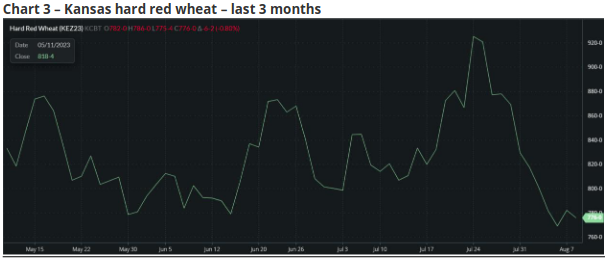

As seems to be the norm, the last couple of weeks have seen a continuation of the volatility in wheat values across the world.

Source Barchart commodityview

The Rally and Collapse from 17th July to 4th August

A strong rally in the wheat market followed Russia’s announcement, on 17th July, that they are not

prepared to continue their participation in the Black Sea Grain Corridor.

Nonetheless, after a week of firming prices, values have seen a mini collapse due partly to better weather in the US, as well as Russia’s comments that they can more than make up for any lost wheat exports from Ukraine resulting from the demise of the Black Sea Grain Corridor.

Considering the Next Moves

The next few weeks may well see the market face some potentially critical developments taking centre stage.

The Black Sea

With no grain corridor, one could be forgiven for thinking that Russia, the largest wheat exporter in the world, would simply make up for any losses endured by Ukraine. Reports of Russia’s missile attacks on the Ukrainian Black Sea ports and export terminals on the Danube have added concern.

Russia and Ukraine have both stated that all shipping, military or civilian, heading to the other’s ports will now be considered a fair military target, assumed to be carrying supplies for the war effort.

With Russia blockading and bombing Ukrainian ports, exports via land routes through neighbouring countries will have to suffice for now.

However, over the last week, reports of Ukraine’s successful attack on the Russian naval vessel, the Olenegorsky Gornyak landing ship, off the coast of Novorossiysk is a strong indication that Ukraine is retaliating for Russia’s attacks and withdrawal from the grain corridor agreement.

This was followed by a drone attack on a Russian oil tanker in the Kerch Strait, connecting the Black Sea with the Sea of Azov.

These Ukrainian attacks clearly have the ability to disrupt Russian exports, if only by creating concern among ship owners and insurers. A continuation of successful attacks will, if nothing else, add notable premiums to shipping rates.

The Weather

The weather has been mixed across the globe in recent weeks. With July the hottest on record and the beginning of August seeing some heavy rains in Europe, quantity and quality of the Northern Hemisphere harvest, which is in mid-flow, is far from certain.

China and India, the two largest producers of wheat in the world have both seen wet periods, having a potentially significant impact on not just the quantity but also the quality of their wheat crops for 2023.

India Wheat Tax

The Indian government has announced that they are considering removing their wheat import tax. This is due to the excessive rains affecting grain fill, potentially reducing production by up to 10mmt, from 112mmt down to 102mmt.

There are also concerns that these rains will have damaged the crop’s milling quality.

The removal of the current 40% import tax, would pave the way for up to 9mmt of wheat imports, most likely Russian.

Global Politics

Last weekend saw Saudi Arabia host a meeting of delegates from more than 40 countries in Jeddah. The aim, to consider proposals for a peaceful settlement to the war in Ukraine.

There were representatives from Saudi Arabia, Ukraine, European countries, China, India, the US and more; but importantly Russia was not invited.

China’s Foreign ministry statement on Monday said that the talks on finding a peaceful resolution to the Ukraine crisis had helped to ‘consolidate international consensus’.

Conclusions

As weather has plagued crops across the globe at important growth stages, there are undoubtedly justified concerns over both quantity and quality of wheat crops, which will remain talking points for many weeks to come.

The potential for higher imports by huge consumers such as India and the recently crowned largest wheat importer China, suggests more price volatility ahead.

The termination of the Black Sea grain corridor may not play to Russia’s advantage, as perhaps they may have hoped. With attacks on Russian shipping already evident, the shockwaves for the North African, Chinese and now possibly Indian importers, are worth following.

Political will to find solutions to the Ukraine crisis could play a big part in where the market heads from here. Greater pressure may be applied to Russia and its President Putin by China, India, the Saudi Arabians and/or the Africans in the coming weeks.

The market drivers have radically diverse consequences:

- The weather will always play its part.

- Ukraine may land a severe blow to Putin if Russian Black Sea shipping is seriously reduced.

- Can the wheat-needs of Russia’s ‘friendly countries’, China, India and African nations, drive them to pressure Putin to resume participation in the Black Sea grain agreement?

- Major global political will could be the only real solution the Ukraine crisis, either on a humanitarian war level or more simply on a wheat supply and trade level.

It is hard to assess which will be the major driving force for wheat markets in the near term, but while news reports swing from supporting the ‘bulls’ to the ‘bears’ we can expect some fireworks and volatility ahead.