Insight Focus

- European heatwave brings about staggeringly early harvests.

- Deal signed by Turkey, UN, Ukraine, Russia on shipping Ukrainian grain.

- Global economics will inevitably affect wheat trade.

Introduction

Global wheat markets, like many others, have since February been focussed on developments in Russia’s invasion of Ukraine.

The impact on wheat has been significant in many ways. Prices surging to record highs in May as Ukrainian exports were all but stopped and Russia’s actions panicked buyers usually reliant on Black Sea wheat exports.

The world’s economic woes, some optimism on Black Sea exports combined with attention turning to the 2022 wheat harvests have sent the markets tumbling since mid-May.

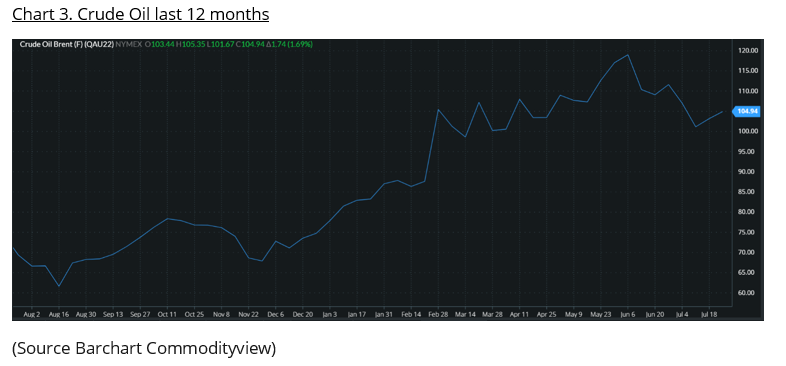

The global economic cost of the war has driven up prices for people’s everyday essentials across the World, especially food and fuel.

Unrelated to the war, extreme weather has added to the 2022 uncertainty in the wheat markets. Heatwaves continue to make production estimates harder than normal, while global wheat stocks continue to fall.

Heatwaves and Harvests

With combines rolling across the Northern Hemisphere harvests are in full swing.

A European heatwave has made production estimates difficult to assess, with its impact varying according to area.

The heat has rapidly ripened crops in France, where recent reports are that the wheat harvest is 84% complete, up from a mere 12% last year.

An early harvest can often lead to smaller, lower bushel weight grains. This will likely reduce yields, increase protein level and reduce the flour extraction rate for millers.

Dryness has not just been reserved for Europe, as the drought-delayed planting of the Argentinian wheat crop finally nears completion. At this initial stage, dryness can have a detrimental impact on the plant’s ability to germinate and begin its growth cycles. Furthermore, planted area forecasts have been reduced to 6.1m from 6.6m hectares, which will inevitably mean lower final output figures.

Ukraine is indicating a production figure of around 20m tonnes compared with 33m in 2021.

Russia, the world’s largest wheat exporter, is predicting a bumper wheat crop as high as 90m tonnes, compared with 75m in 2021.

The final numbers for the 2022 crop will be debated for a few months yet.

Ukrainian exports

As the war continues to rage across Ukraine it is hard to see how meaningful exports will flow.

Nonetheless, Turkey has successfully facilitated negotiations involving the UN, Ukraine and Russia to allow the shipment of food exports from Odesa, Cher omorsk and Yuzhny.

The agreement has been thrown into doubt as missile attacks have been reported in Odesa leading many to question whether any exports will materialise in the coming weeks.

Global Economics

There have been many headlines on the increase in the cost of living around the world as food and fuel prices have risen in 2022.

Inflation, recession and currency fluctuations have all sparked concern about affordability and how populations will afford the basics needed everyday living.

Conclusions

Heatwaves continue to generate concern over the year-on-year fall in production reducing world wheat stocks.

Any potential agreement to ship more wheat from Ukraine’s Black Sea ports will be welcome news to the poorer importing nations of North Africa.

The needs of many are suffering as prices for basics remain unaffordable, despite the recent fall in prices.

Wheat is a necessity for many.

People cannot buy what they cannot afford.

The poorer nations are the world’s largest wheat importers.

A continuation of the lower price trend of recent weeks looks hard to reverse as long as wheat prices remain too high for too many of those most in need.