Insight Focus

- World ending stocks forecast at their lowest in years.

- Wheat prices slide along contract lows.

- Ukraine’s grain corridor making small gains.

Introduction

Recent headline wheat news gives encouragement to both the ‘bulls’ and the ‘bears’. However, the coming months could signal a problem for 2024.

A surprise from the most recent monthly United States Department of Agriculture’s World Agricultural Supply and Demand Estimates (USDA WASDE) report, published last week on 12 September, shows a reduction in projected world stocks ending 2023-2024.

Wheat Prices

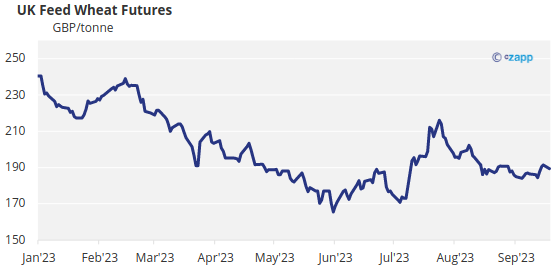

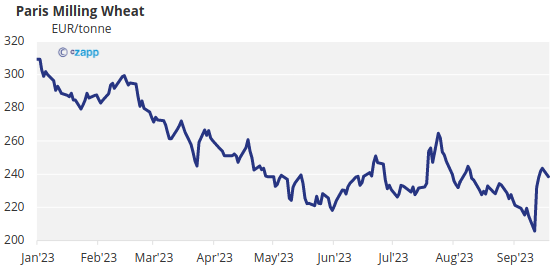

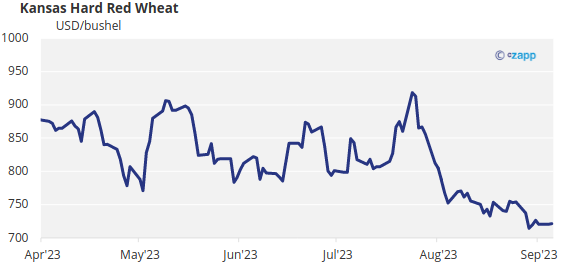

Global wheat prices have seen a steady trend downwards, favouring the bears, since the dizzy heights in May 2022.

The recent price troughs, hitting new contract lows, could be cause for concern.

Chart Source: © Czapp

World Stocks

The USDA WASDE report in September pegged world ending stocks for 2023/24 at 258.61mmt (million metric tonnes), a reduction of 7mmt from their August figure of 265.61mmt.

We have mentioned in previous editions that stocks are dwindling on the world stage and this new estimate, if realised, will put global end stocks at their lowest levels since 2015-2016.

To put this in context, end stocks 2020-2021 were 284.09mmt, a nearly 10% drop in 3 years.

It must also be noted that China is expected to hold 132.92mmt of the 2023-2024 end stocks, a huge 51% of the global total, while the major exporters figure is a mere 34.7mmt in comparison.

Prices & Acres

Looking back a year with the high, and rising, values for wheat during September and October 2022, it is no surprise that large acres were planted in many countries. Inevitably, as wheat farmers saw prices that would enable good profit margins, greater areas were sown throughout the northern hemisphere in the autumn.

Move forward to our current situation and we can see that significantly lower values seen on the charts above, will not encourage similarly large numbers of acres around the world.

Farmers that grow wheat on marginal land, or where other potentially more profitable crops can be planted, may feel that with the current market prices, land will not be sown with wheat.

Ukraine

As wheat producers read the news headlines, they will note that Ukraine appears to continue making small gains in their offensive against the Russian military.

In the last few days, we have seen reports of ships heading to Ukrainian ports to load grains for shipment through a new Black Sea grain corridor, without the endorsement of Russia.

This could prove a major success in exporting wheat from Ukraine, while applying bearish pressure to markets.

Conclusions

Dwindling world stocks have been a concern for a while, but have not prevented the market steadily dropping over the duration of 2023.

Northern hemisphere farmers are likely less enthusiastic, with the prevailing wheat prices, to plant larger acres than in 2022 over the coming months to replenish these stocks, when they eventually harvest the 2024 crop.

Ukrainian progress in exporting wheat and making headway militarily, may give the market bears help in the short term, maintaining a lid on prices while the bulk of the 2024 crop is sown.

All of these factors have potential to shock the market once we find ourselves in early 2024. Reports may show lower stocks than comfortable, while the double whammy of reduced planted acres and subsequent 2024 crop size.

Put all of these factors together and we could be heading for some price fireworks by the time the new year arrives.