Insight Focus

- Hamas attack on Israel stirs further geopolitical concern.

- China scouring the globe for wheat as Argentina & Australia struggle.

- Wheat prices hit new lows.

Introduction

The world of wheat is dealing with multiple price drivers.

The eruption of another conflict, between Gaza’s Hamas and Israel, fuels fear of escalating both the horrific human suffering while adding to the increasingly strained geopolitical landscape.

As Argentina and Australia jointly suffer a lack of rain as harvests approach, China has been searching the globe for wheat imports following their heavily rain impacted harvest.

The latest October monthly USDA WASDE (United Staes Department of Agriculture World Agricultural Supply and Demand Estimates) report continues to peg world wheat end stocks tighter.

Despite these many fundamental issues wheat prices have hit milestone new lows again.

Assessing where these lead market prices is interesting.

The recent market

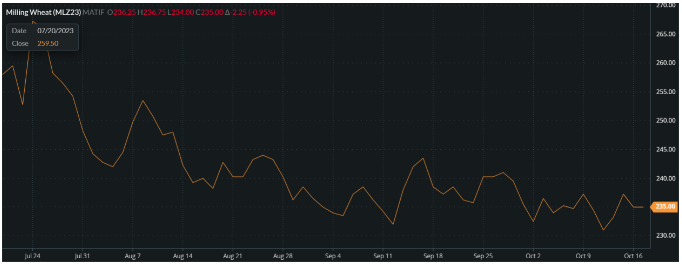

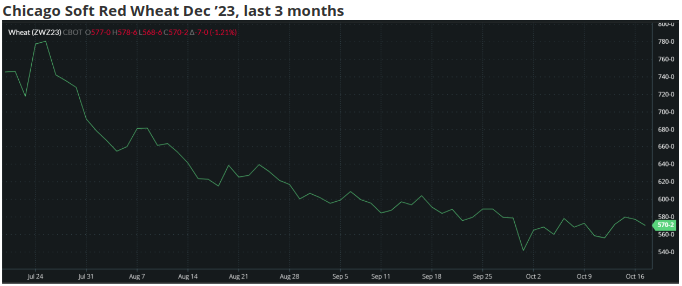

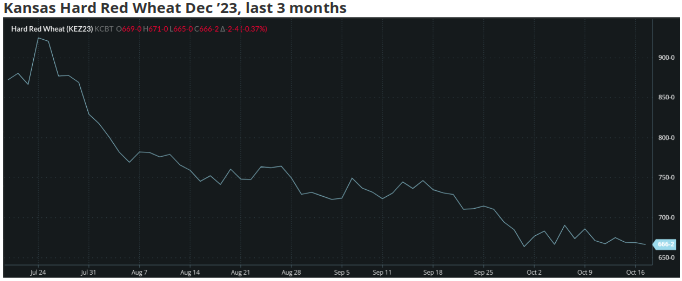

The generally bearish trend continues as seen in the charts below, with wheat markets hitting new three-year lows in recent days.

Assessing these market prices in isolation could generate a lacklustre feeling that the global markets are uninspired and trundling along lows.

However, stories circulating the daily reports paint a somewhat more interesting picture, which have the potential to light a spark to values.

Paris Milling Wheat Dec ’23, last 3 months

Source: Barchart Commodityview

Hamas – Israel conflict

The attack on Israel by Hamas nearly two weeks ago has not had the market panic reaction that Russia’s war in Ukraine ignited in February 2022.

Nonetheless, as Israel’s response gathers pace, the wider issue for wheat is the impact on global politics.

As Russia’s isolation from the West continues, Putin seeks greater friendships and allies in China, North Korea and Iran, among others.

The United States has readied a number of US troops for non-combat roles to support Israel, if necessary; while Iran’s foreign minister has warned of a possible ‘pre-emptive action’ against Israel.

The potential for further East-West political strain will not be comforting to markets.

Importer and Exporter Struggles.

China has been actively buying up wheat during the course of 2023. It has leapt to the top of the importer league, surpassing the longstanding buyer, Egypt.

China’s circa 135mmt (million metric tonnes) harvest has been heavily rain impacted, with up to 40mmt of wheat downgraded from human milling quality to livestock feed.

Reports suggest that China’s wheat purchases have ballooned to nearly 10mmt thus far in 2023, with over half from Australia, while talks continue to source from others, including France, the US and Canada.

Egypt has also been actively pursuing wheat purchases, reportedly holding direct talks with Russia to source over 1mmt in coming months.

This follows India’s recent comments that they are potentially looking to buy 9-10mmt from Russia in an effort to boost reserves.

With importers on the look out to buy, supply issues face the two largest Southern Hemisphere wheat exporters, Australia and Argentina.

Their harvest combines will be rolling in the coming weeks, with crops having faced uncomfortably dry growing seasons, leading to dwindling production forecasts.

Compounding supply concerns was last week’s October USDA WASDE report, forecasting 2023/24 World wheat carry out stocks at 258.13mmt, down from 258.61mmt in September. This represents the lowest figure since 2015/16.

It is worth noting that, despite the above buying spree, China’s own wheat stocks are projected to be 132.92mmt at the end of 2023/24, over 50% of the entire global number!

Conclusions

- World wheat stocks are estimated at their lowest in years.

- China, India and Egypt are exploring wheat purchasing options to ensure their own food security.

- Argentina and Australia are facing smaller than anticipated wheat crops over the coming few months.

- Another conflict has the potential to further disrupt political tensions across the World.

- Wheat prices have nonetheless hit new lows, with little appetite for the market ‘Bulls’ to emerge.

- Interesting weeks lie ahead. The market lows may continue, but awaken the ‘Bull’ and price carnage could follow!