Insight Focus

- Weather is causing concerns in major growing areas worldwide.

- Crop production forecasts are creating much uncertainty.

- Russia sees no prospect for renewal of the Black Sea grain corridor.

Introduction

Weather is always a factor driving wheat markets at this time of year, as we await the Northern Hemisphere wheat harvests.

This year is seeing some unpredictable forecasts for global production, spurring some interesting market reactions.

The Black Sea grain corridor, as always, is never far from the daily headlines as Russia protestations continue to disrupt prospects.

The markets

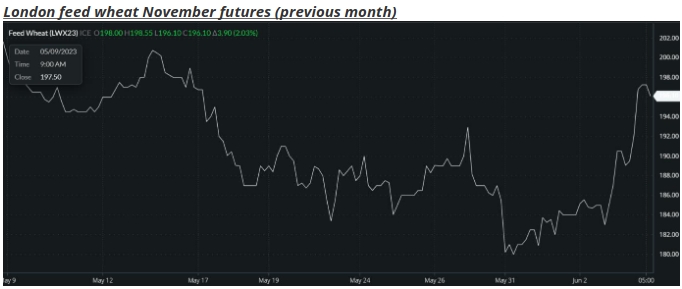

The below charts show the volatile movements over the last month.

Securing a 60-day extension to the grain corridor eased tensions on prices.

Nonetheless, these tensions have returned and are exacerbated by weather reports from around the world, prompting a recent rally in values.

Source Barchart commodityview

The Black Sea grain corridor

Participation in the agreement by the Russian Federation appears to be as fragile as ever. Despite the 60-day renewal last month, Russia continues to protest against the agreement’s ability to allow unhindered exports of Russian agricultural products.

The United Nations have been attempting to save the deal with a ‘mutually beneficial’ deal for both Ukraine and Russia.

Ukraine and Turkey have agreed to the new proposal, however, there has been no positive response from Russia.

Indeed, Russian officials have suggested that there is ‘no prospect’ for a continuation of the agreement past the current deadline in mid-July.

Weather and world wheat production

There are stories across the continents reporting weather threatening the global wheat crop for harvest 2023.

The US sees a continuation of the dry weather plaguing crops.

Although much of Europe’s wheat crop is looking good in advance of the upcoming harvest, there remains weather concerns in Russia and other parts of Northern Europe where dry weather has the potential to reduce yields.

In China, excess rain has recently hampered crops. Although the production reduction is not considered too significant at present; the prospects for large areas of wheat being downgraded post-harvest from milling quality for human consumption, down to livestock feed use is causing concern.

On a more positive note, India, with increased plantings is seeing reports for a potential record wheat harvest in 2023 of 112mmt. Significantly higher than the USDA estimate of 104mmt from the 2022 harvest.

Encouraging reports from Argentina, where rains are aiding the young plants, are giving hope for a return to a more usual level of production, in the region of 19-20mmt. This following the drought decimated crop of 12.5mmt in 2022.

Conclusions

Volatility for the markets will continue with disruptions from the Black Sea as the huge volumes exported from this area are needed to feed the large importers in North Africa.

The breaking of extreme weather records has been a regular feature over the last year or more. Headlines suggesting that these could create a 20mmt or more reduction to the 2023 production figures, could create a further tightening of the already dwindling world wheat stocks.

There seems little certainty surrounding wheat prices currently.

Assessing the ongoing impacts from Russia’s war in Ukraine, coupled with predicting the increasing extremes in global weather predictions will no doubt keep all market participants on edge for the months ahead.