- Whether you’re a producer seller or a processor buyer, it’s important to know your pricing options.

- Volatile seasons make timing critical for setting prices.

- Extraordinary market moves call for calm decision making.

Price Instability in Wheat

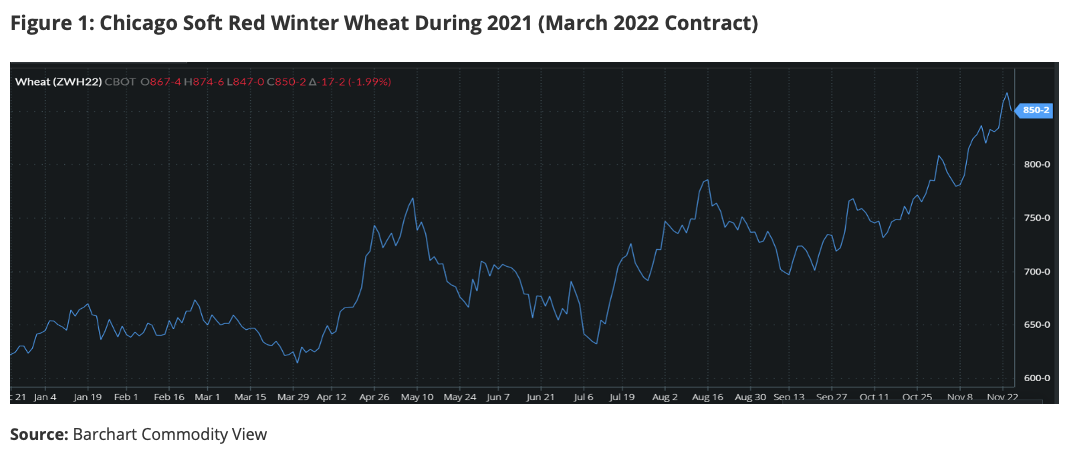

Global wheat prices have had an extraordinary year, reaching record highs in various regions, as we saw in our last article.

Making the best pricing decisions and knowing the next move in these unpredictable markets is virtually impossible.

Avoiding the Emotional Pitfalls in Erratic Periods

Whatever your position in the supply chain, buyer or seller, people are all too often guilty of three emotional pitfalls…

Hope

Uncertainty can lead to a lack of conviction and thus a potential to act, or not, in hope that the price will move favourably.

This is a dangerous position to find yourself as, if the market moves against you, there’s a distinct possibility that you’ll be driven to our next emotional pitfall.

Fear

When things do not go to plan, a state of fear can be like a deer in headlights. Either people freeze and do nothing or get out of a position and run. Both can be brutal to the bottom-line numbers of your profit and loss.

Greed

When the market helps you out, know when to get out! Greed can be an incredibly frustrating pitfall to have to look back on, with the inevitable question: Why did I not bank the profit?

Decisions Based on Facts in the Here and Now are Best

Look at the information available to you at any given time and have the conviction to make firm decisions at that moment, given all the information at your disposal.

Don’t be afraid to change your view. Facts and figures change – so must you.

A change of view, with solid conviction and action, considering the market influences will frequently turn out to be the best course of action in the long run.

How to Price in Turbulent Times

If we cannot realistically value wheat and struggle to have any idea where the top or bottom of the market is, what are the best ways of firming up our prices?

Fixed best price on the day, co-operative pool pricing or options. All three have their place in the market, but the best decision on price is dependent upon your individual situation.

Fixed Price

Whether a buyer or a seller, if it sees you a profit then it’s never wrong to take the plunge.

A clear margin for your business must be a good place to start.

Fix a percentage of your crop or requirements and there’s always room to leave more for another day, safe in the knowledge that some wheat is priced to see a profit.

Cooperative Pool Pricing

More of a farmer’s selling tool, this ‘grain pool’ system, where the marketing of your wheat is placed in the hands of grain trading companies, enables the less market orientated farmer to see approximately average prices.

This cooperative marketing is where small volumes are sold at regular intervals to ultimately achieve an average final price, thereby avoiding the big peaks and troughs.

Allowing the grain traders to market your wheat this way is a sure way to take out the stress of marketing and avoid the above-mentioned emotional pitfalls.

Options

Traded in a variety of guises buying puts or calls, physical minimum or maximum price contracts are otherwise simpler than people are led to believe.

There are costs involved, but these contracts allow a buyer to know that the price will never be more but may be less. Conversely, a seller can rest assured that a price will not go down but may go up.

These contracts may be of less use where the costs completely erode margin. However, if there’s margin in the guaranteed price, there’s little downside and the prices only get better.

Concluding Thoughts

- Volatile times are difficult to trade if you can only sell your crop or buy your requirement once.

- Try to think outside of the box and make clear decisions, based on the facts presented to you today.

- Hindsight is a wonderful thing, but a luxury we don’t have until it’s too late.

- Never let emotions (hope, fear, or greed) drive your decisions.

- Be calculated and use the right type of contract for you and your business.

- Remember, it always looks cheap halfway down, and the opposite applies on the way up!

- We’re in turbulent times and tops and bottoms are said to be for fools – take heed and remember that profit is sanity.

Other Insights That May Be of Interest

Wheat Highs, Exporters, Importers, and a Changing Market