Insight Focus

- Latin American freight rates to the US have increased by 257%

- Decrease in profitability in Asian routes could lead to more containers in LATAM.

- More high-tier tariff sugar could be entering the US.

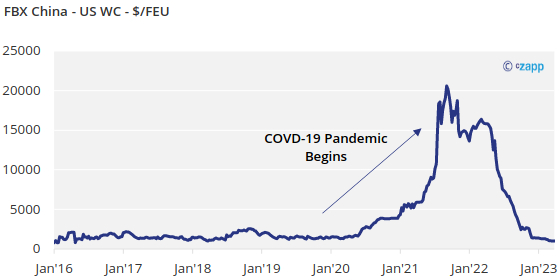

Container freight rates in Latin America have increased sharply following the COVID-19 crisis. This is because of a lack of available containers.

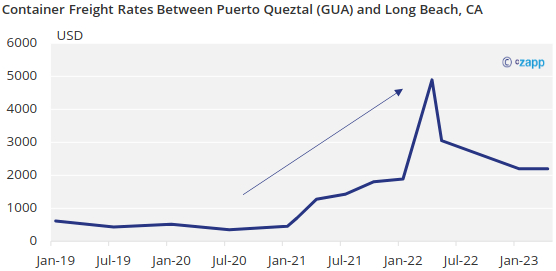

The container freight rate between Puerto Quetzal and Long Beach, CA, on January 2020 was around 500 USD. This route reached an astonishing rate of 4,890 USD in April 2022; today, it is about 2,200 USD. The change in price marks a 257% increase since 2020.

Why have Latin America container freights increased?

Low container availability has been because during the peak of the world’s supply chain problems in 2021, shipping lines cut smaller routes to concentrate container availability on major routes (Asia to north-west Europe, Asia to west coast and east coast USA) instead. Now that container rates have fallen dramatically around the world, shipping lines have been blanking sailings, meaning that container availability in Central America still hasn’t recovered.

At times this has meant people have agreed to pay 4x the rate they had pre-pandemic, yet only received 20% of the agreed container allocation.

Will Latin American container freights decrease?

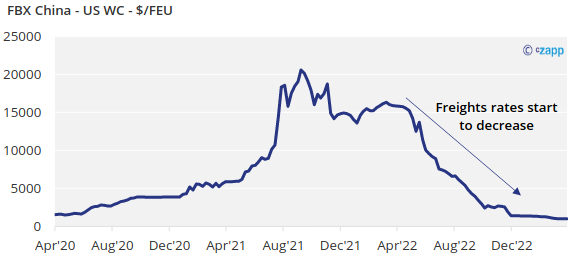

Following April 2022, freight rates between China and the USA have fallen. The fears of a potential recession and high-interest rates have reduced consumer demand.

Since the shipping lines between China and the West Coast United States are less profitable, container ship owners will look at alternative routes, such as Latin America. If shipping lines and container accessibility shift towards Latin America (where sugar is primarily traded), container freight rates could decrease in this region due to higher availability.

What does this mean for sugar?

Currently, the No.5 sugar is trading at a ten-year high. The lower container freight costs will help alleviate or offset the high costs of buying sugar, which could stimulate further trade. A lower container freight could also mean an increase in high-tier tariff sugar entering the United States in 2023.