Insight Focus

Increased yield and area should allow Brazil to produce 300,000 tonnes of cocoa this year. By 2030, Brazil aims for 400,000 tonnes, driven by new market entrants and investments in seedlings, irrigation and proper management.

Brazil Aims to Be a Leading Cocoa Producer

Brazil appears closer to achieving its goal of playing a central role in global cocoa production, repeating an achievement made with other commodities such as soybeans, corn and cotton.

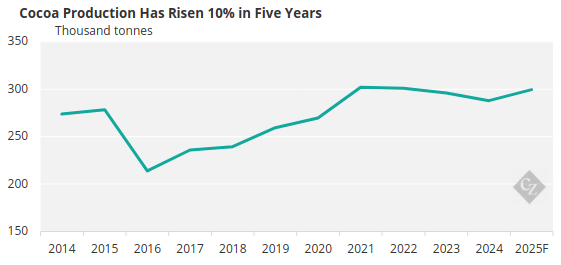

This year, the country is expected to harvest 300,000 tonnes of cocoa, a volume 4% higher than in 2024 and 10% higher than that obtained in 2020, according to the Brazilian Institute of Geography and Statistics (IBGE).

Source: IBGE

The goal is to produce 400,000 tonnes of cocoa by 2030. “There should be no difficulty in achieving this, as Brazil has no shortage of land, water or qualified farmers,” said Michel Arrion, executive director of the International Cocoa Organization, during the organization’s global event in São Paulo in April.

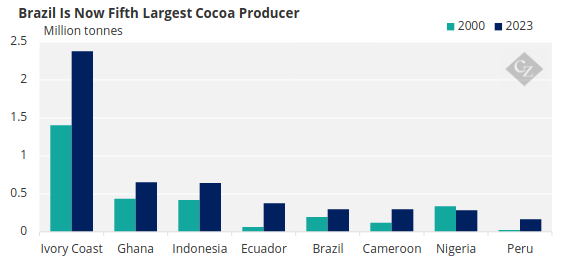

Producing cocoa in large quantities is nothing new for Brazil. In the first few decades of the 20th century, the country accounted for 25% of the world’s cocoa supply. Today, it ranks fifth among the largest producers and is expected to climb in the rankings in the coming years.

Source: FAO

In addition to the gradual recovery of crops in Bahia, which were damaged in the 1980s by pests such as witches’ broom and fluctuations in the international price of cocoa, a fundamental factor has been contributing to the renewal of the market.

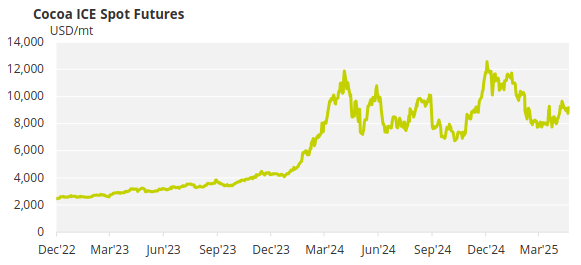

The rise in the price of cocoa, which went from around USD 2,900/tonne in April 2023 to USD 8,400/tonne in April of this year, and the structural challenges of cultivation in Africa (the world’s leading producer) have incentivised a new producer profile in Brazil.

Shifts in the Profile of the Brazilian Farmer

Now, large agribusiness groups are showing interest in the crop. A good example is Schmidt Agrícola, known for producing soybeans and cotton on 35,000 hectares (ha) of farmland in western Bahia. Six years ago, the company launched a 400-ha pilot project to grow cocoa in the region, with good results. The plan is to expand the area to 10,000 ha in the coming years.

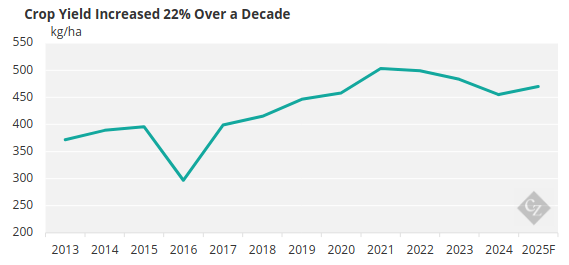

Investments of around BRL 200,000 (approximately USD 35,200) per hectare—in seedlings adapted to cerrado conditions, irrigation and soil correction—have yielded productivity of up to 3,000 kg/ha, six times the national average. Brazil’s cocoa yield, incidentally, has been on the rise.

Source: IBGE

The difference between this production model and traditional cocoa plantations, generally owned by small farmers, is significant.

“Smallholders generally have difficulty obtaining credit and technical assistance, which ends up impacting productivity. They need support to obtain better results,” says Ricardo Gomes, a cocoa producer in Bahia and manager of territorial development at the Arapyaú Institute, which focuses on promoting sustainability in the countryside.

Ricardo Gomes. Photo: Ana Lee Sales/Instituto Arapyaú

The big players, on the other hand, are already entering the cocoa market with adequate capital and are ready to begin large-scale cultivation. “There are already 100,000 ha in states like Bahia and Mato Grosso being prepared for cocoa planting,” says Cristiano Villela, scientific director of the Cocoa Innovation Center in Bahia.

This has brought Brazil closer to its goal of increasing production by around 30% by 2030, as predicted by the Ministry of Agriculture and the private sector. Large chocolate manufacturers, such as Barry Callebaut, have even expressed interest in investing in areas of more than 5,000 ha in Bahia.

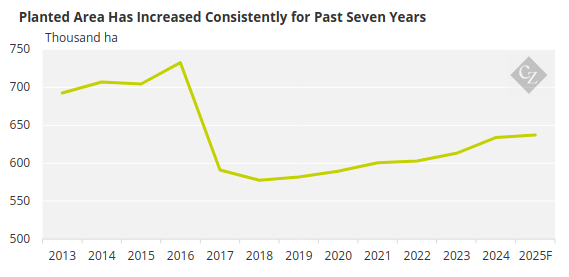

Currently, cocoa is cultivated on approximately 640,000 ha, primarily in Bahia and Pará, according to the IBGE, with a steady increase in area since 2018.

Source: IBGE

Brazil’s Path to Becoming a Cocoa Exporter

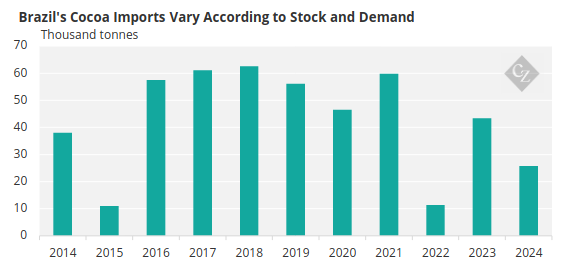

The goal is to start exporting the commodity instead of importing it. Currently, the country must rely on imports to meet domestic demand, which fluctuates based on cocoa stocks, domestic production and market demand. In 2024, 25,6000 tonnes of cocoa were imported, according to Comex.

This year, with lower stocks, the volume of imports is expected to be much higher—between January and March alone, imports totalled 28,9000 tonnes, 91.8% more than in the same period last year. Over the past five years, foreign purchases have averaged around 37,000 tonnes/year.

Source: Comex

This reality is expected to change with the expansion of cultivation and the achievement of higher productivity levels, as seen in western Bahia.

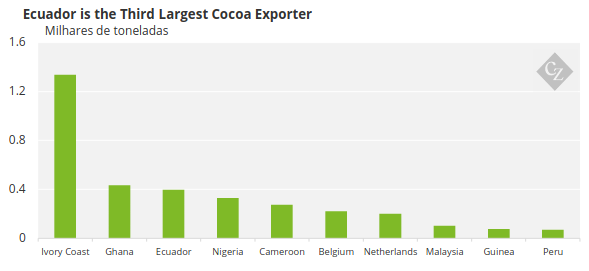

Even with cultivation on an area of 660,000 ha, only slightly larger than the current area, production would jump to around 430,000 tonnes per year, assuming a productivity of 650 kilos/ha. This production level is similar to that of Latin American countries like Ecuador—the third-largest exporter in the world.

As a result, Brazil would be able to export around 90,000 tonnes/year, positioning it alongside countries like Malaysia and Guinea.

Source: FAO

Small Farmers Need Attention

With new players entering the market, one of the biggest challenges will be to maintain—and even stimulate—the production of family farmers in southern Bahia, a traditional stronghold of cocoa cultivation.

The National Program for Strengthening Family Farming offers financing of up to BRL 250,000 (approximately USD 44,100) at an interest rate of 3% per year (much lower than the base interest rate of 14.5%) to producers who adopt agroecological systems, as is common in southern Bahia. However, to access this credit, it is necessary to present provide a detailed technical analysis of the project, which not all farmers are able to do.

Additionally, in 2023, the government of Bahia launched a special credit line for small farmers, with an interest rate of 6.5% per year. However, there is still a need to expand specialised technical assistance and create more mechanisms for accessing credit. With these improvements, the entire cocoa supply chain could reach new levels of development.