Insight Focus

In May, China signed new phytosanitary agreements. These allow it to import Brazilian food products previously absent from its market, such as distillers dried grains (DDG), a corn ethanol by-product. The Brazilian government is also working to sign similar protocols with other countries to diversify agribusiness exports.

A few weeks ago, during a meeting in Beijing, Presidents Xi Jinping and Luiz Inácio da Silva (Lula) announced the authorisation of distillers dried grains (DDG) exports to China—a byproduct of corn ethanol considered an important component of animal feed.

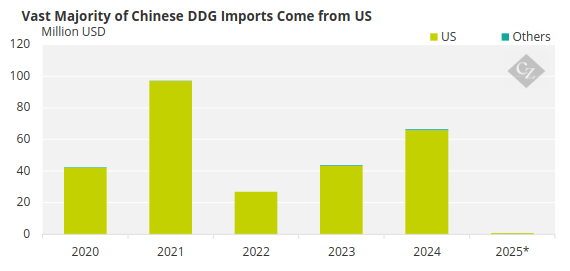

Currently, between 99% and 100% of all Chinese DDG imports come from the US. From 2020 to 2024, these imports were valued at over USD 276 million.

Source: GACC

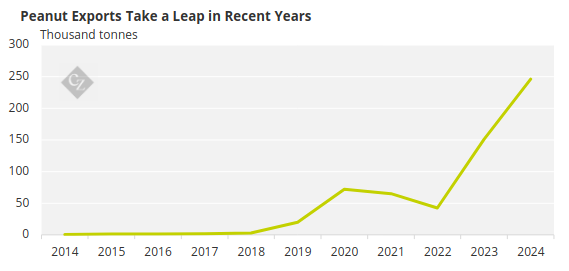

The green light to begin shipments should lead Brazil to compete for a significant share of this market, particularly in light of current trade tensions between the US and China. In 2024, China imported more than 250,000 tonnes of DDG, according to the Chinese government.

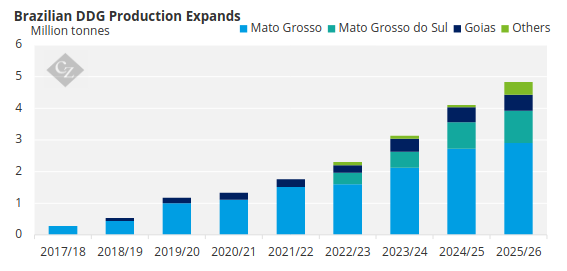

At the same time, production in Brazil has been growing, stimulated by domestic and foreign demand. In the 2024 harvest, it reached 4.1 million tonnes (36% higher than in the previous period) and in the current cycle it should reach 5 million tonnes, according to the National Union of Corn Ethanol (Unem). By 2035, this volume should double.

Source: UNEM

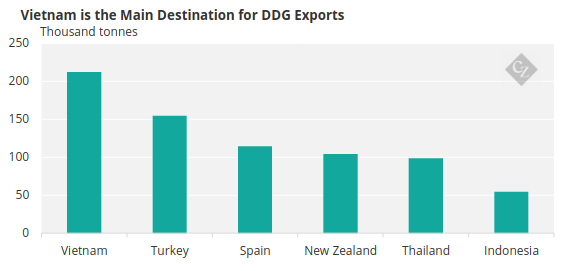

Brazil currently exports DDG to countries such as Vietnam and Turkey. In 2024, about 792,000 tonnes were exported, 32% more than the previous year.

Source: Comex

With 10 new corn ethanol plants ready to go into operation in the coming years —through investments based on expanding demand—and the license to export to China, new leaps in market growth are expected.

New Agreements

China also authorised the start of imports of certain meat products including duck, turkey and chicken giblets, as well as peanut meal.

This achievement was only possible through the formalisation of phytosanitary agreements, which ensure compliance with quality and health standards.

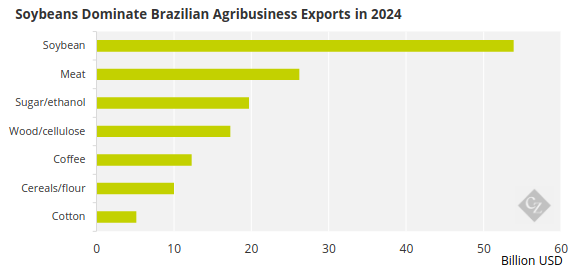

These agreements are essential to enable the trade of products. The Brazilian government’s intention is to diversify food shipments, which are currently concentrated on a few products.

Source: Comex

In recent years, Brazil has signed phytosanitary agreements for the commercialisation of various foods with several countries, including India, South Korea, Saudi Arabia and Turkey. “These negotiations are essential for increasing Brazilian agribusiness exports,” said Marcel Moreira, Deputy Secretary of Commerce and International Relations at the Ministry of Agriculture, in an exclusive interview with Cz App.

Marcel Moreira, Deputy Secretary of the Ministry of Agriculture. Publicity photo.

The Brazilian government has just signed an agreement that allows the export of DDG to China. Are there other agreements of this nature being negotiated?

We are always seeking phytosanitary agreements, which allow the export of certain foods to the countries with which we have concluded these negotiations. It is important to remember that since 2023, markets have been opened for more than 360 Brazilian agribusiness products in more than 60 countries through the signing of phytosanitary protocols. Around 100 products are of plant origin, such as fruits, seeds, vegetable oils and nuts.

This is largely the result of the work of the 40 Brazilian agricultural attachés spread around the world, in Brazilian diplomatic representations.

Source: Comex

What needs to be done to obtain authorisation to export food to a country that does not yet import the product from Brazil?

This authorisation involves an analysis of phytosanitary risks and compliance with a series of quality and health requirements. Countries follow a very similar system, but there may be specific requirements for certain products. Once the steps of receiving the requirements and meeting the specifications are completed, we can conclude the negotiation.

We are doing this with fruits, vegetables and a series of other products. A good example is corn DDG, which we will begin exporting to China. We have also obtained authorization to export sesame to South Korea.

Last year, we signed a phytosanitary agreement with China for the commercialization of sesame, and in 2020, we finalised the same type of agreement with India. These agreements contribute to the increase of exports.

Source: Comex

Is there a possibility that Brazil will begin exporting corn ethanol to China?

This issue depends on an assessment of market demand. We are seeking to expand the market for our sugarcane and corn ethanol. This also depends on vehicle adaptation in the countries in question as they’d need to be enabled to use ethanol.

We have been working with some countries, such as India and Japan, to promote the idea of using a higher percentage of ethanol in the blend. We need to create a broader external market for ethanol.

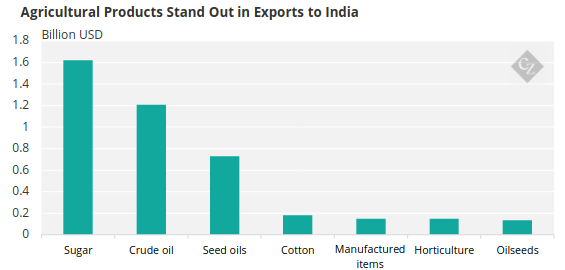

What other opportunities are being explored? Is there potential to further expand trade relations with India, for example?

Yes. India is a very interesting country for us due to its economic growth and the expansion of the middle class. There is also a prospect of increasing protein consumption. Per capita consumption of chicken, for example, is still low. There is room for exports of more chicken and foods used in animal feed. However, there are still some obstacles, such as high import tariffs on certain products.

In any case, we have been working closely with the Indian authorities. We export several agribusiness products to India, and there is room to increase our commercial relationship.

Source: Comex

Overall, which Brazilian agribusiness products have been most successful in reaching new markets?

In addition to signing agreements for the export of DDG to China, we also obtained authorisation to export grapes and sorghum to the Chinese market.

It is also worth mentioning that we identified new opportunities for the export of fruits such as apples, melons and avocados. We cannot, however, discuss the negotiations that are ongoing.

The Ministry of Agriculture has also been identifying opportunities for ‘pulse foods,’ correct?

Yes, these are very interesting foods. These leguminous seeds, such as beans, chickpeas and peas, have high nutritional value and their consumption is on the rise. In India, for example, there is a great demand for some types of beans, which Brazil does not yet produce.

We can invest in the production of these types of beans to meet the needs of the international market, which may make sense for other foods as well. We are working to map opportunities of this nature.