Insight Focus

- Pecege Consultoria e Projetos event shows cane costs fell 15% in Centre-South Brazil.

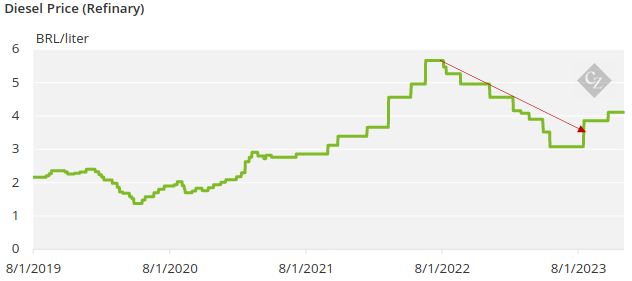

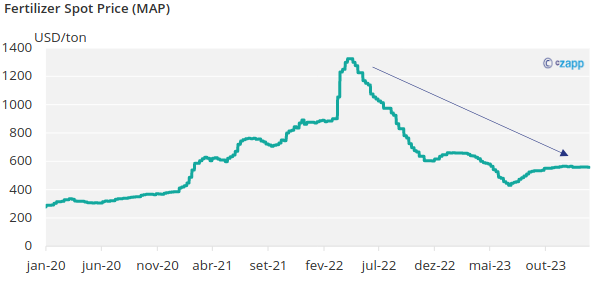

- Falling fertilizer and diesel prices helped contribute to this.

- Results from the 2023/2024 season should not be repeated in the 2024/2025 harvest.

After two consecutive harvests with increased costs, sugar cane producers in Centre-South Brazil were finally able to breathe in the 2023/2024 season.

“The drop in costs was a factor that contributed greatly to the special season we had in 2023/2024”, said Haroldo Torres, managing partner of Pecege Consultoria e Projetos, during the “Expedição Custos Cana” (Sugarcane Costs Journey) event. The event, which featured lectures and debates, was held in Piracicaba, in the interior of São Paulo, at the end of February.

Cane producers spent around 15% less than in the 2022/2023 harvest, according to data presented by Pecege during the event, which brought together around 400 rural producers and companies.

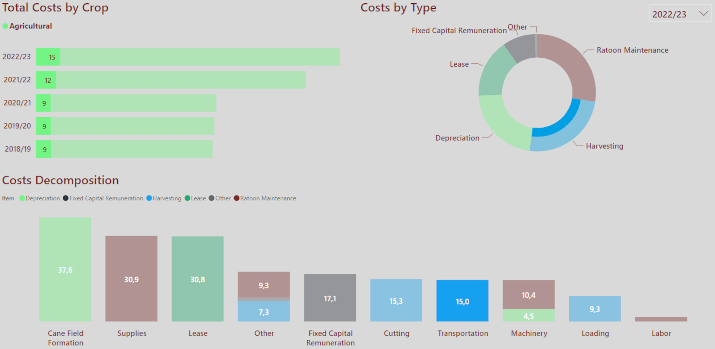

The production cost of cane was around BRL13,057 per hectare. Of these, BRL 3,577.44 was used to cultivate ratoon sugarcane and BRL 3,476.54 was used for harvesting, transshipment, and transport (CTT).

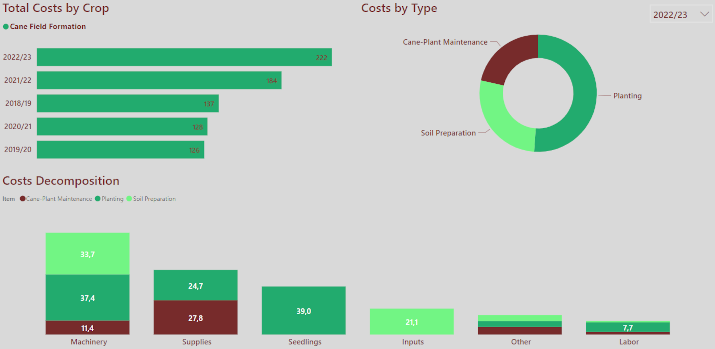

Spending on sugarcane planting registered a small drop, going from BRL16,742 per hectare, on average, to around BRL 16,297.

Furthermore, the reduction in the price of inputs and diesel was important for the cost composition of sugarcane processing, which fell 10.5% compared to the previous cycle.

In addition to the drop in the price of diesel, the normalization of maintenance costs for machine parts and tires contributed to the drop in cutting costs, as well as the increase in productivity, which helped to dilute costs.

The combination of all these elements led to a 17.3% reduction in operating costs in the 2023/2024 harvest, according to a Pecege survey.

A similar pattern was observed in sugarcane transport. In the 2023/2024 harvest, producers spent an average of BRL 12.77 per ton to transport production, while in the previous season an average value of BRL 15.02 per ton was recorded.

The fall in fertilizer prices was another important point. While in the 2022/2023 harvest, spending on this type of input represented 14.6% of all agricultural costs, in the 2023/2024 season this value fell to 11.7%.

Expectations for the 2024/2025 harvest

The price of inputs, which negatively affected previous harvests mainly due to the pandemic and the invasion of Ukraine by Russia, should remain stable. Furthermore, there should be less pressure on land leasing because of less competition with grain cultivation.

Regarding labor, another point raised during the event, a salary increase in line with inflation is expected. “With an expectation of lower productivity, however, the excellent results of 2023/2024 should not be repeated”, analyzed Torres during the event.