Insight Focus

- European PET peak season demand fails to take off, market sentiment increasingly bearish.

- PET prices fall sharply as some producers price aggressively to shift volume, losses mount.

- Veolia close rPET production due to weak rPET market demand, sustainability on hold.

Demand and Market Overview

Current PET resin demand across Europe is weak and far below typical seasonal levels. Whilst certain producers reported a slight uptick in April, coming into May peak season has faltered.

Volatile macroeconomics and a wet and cold start to the summer, right across Europe, has weakened resin demand with converters continuing to destock.

Most converters carry minimal stocks, buying hand-to-mouth. Those buyers that had been looking to restock ahead of summer demand have been scared to the sidelines by the recent fall in domestic prices.

A price drop in May gives a very bearish sentiment, and with potential further deterioration in prices expected in the coming months, buyers are waiting-out for further confirmation on price direction.

Even if summer demand does pick up, most larger brands are well covered with only minimal additional spot requirements expected.

Despite tepid demand there has been no real change in operating rates, or number of lines running over the last few months.

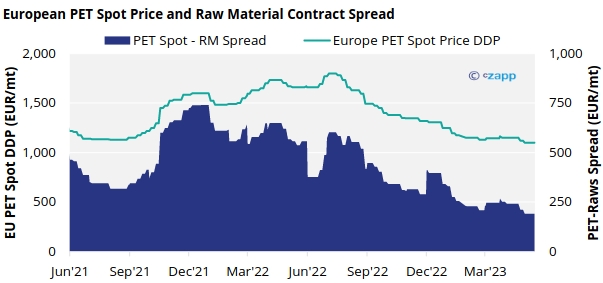

PET resin producers continue to face poor margins, and for those facing losses the big question is, how long can they continue to burn cash if fundamentals refuse to change?

European PET Spot Prices Consolidate Ahead of Potential Rise

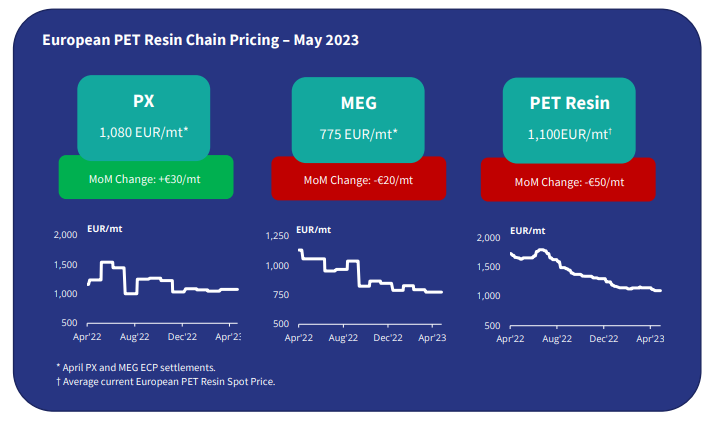

The current market price range is assessed at EUR 1080 to EUR 1120/tonne, with an average price of EUR 1100/tonne, down EUR 50/tonne versus mid-April. As always, depending on volume and location, prices varied, with prices as low as EUR 1060/tonne within the Benelux area.

Most producers with manageable stock levels initially attempted to keep prices around EUR 1110-1130/tonne levels in early May. However, aggressive spot pricing out of the Benelux region continues to drag the market downwards, a situation that may worsen if buyers delay restocking in coming weeks.

Prices within other Northern European markets have followed suit in tumbling over the last week, with some spot prices in Poland heard at EUR 1075/1085/tonne.

There is now an air of desperation amongst certain producers who are not only pricing aggressively against imports but also ratcheting up intra-regional spot competition.

Current May European Contract Prices (ECP) for MEG and PX remained unsettled at time of writing. April settlements saw the PX ECP increase EUR 30/tonne to EUR 1080/tonne, whilst the MEG ECP dropped EUR 20/tonne to EUR 775/tonne.

Current market sentiment is that May settlements may not fully reflect the recent declines in European PET resin prices further eroding producer margins.

As a result, European PET margins are expected to come under increased pressure in May, although with warmer weather on the horizon buyers are likely to be brought back to the table in June to replenish stocks, potentially helping certain producers to stem losses.

With Asian PET resin export margins squeezed, and European PET prices to correlate closely to import parity for the duration of 2023, European producers are expected to face an extended period of low margins, as discussed previously.

Is it cheaper to import?

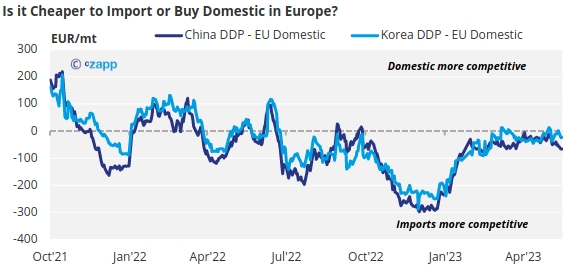

Chinese PET export prices have weakened significantly over the last month, with current prices averaging USD 930/tonne, represent a decline of around USD 110/tonne since peaking mid-April.

Indicative import prices typically range USD 1040-1090/tonne CFR customs cleared NWE, equating to EUR 1035-1045/tonne DDP, based on current Asian export prices. In Italy and other Southern European markets, imports were slightly higher at EUR 1020/1030/tonne CIF.

The downturn in Asian export prices has out stripped the fall in European domestic prices, meaning that the delta between average Chinese import and domestic European prices has begun to widen again, to EUR 65/tonne on a delivered, duty paid basis.

Korean and other origins have also improved in competitiveness, averaging around EUR 25/tonne the below European average. This comes despite some European producers attempting to beat import parity by slashing domestic prices.

The delivered spread between Chinese and other origins has also increased to EUR 40/tonne, within typical range.

If European raw material costs are not brought down in coming months, it will be difficult to foresee import parity being reestablished on an average price basis. Meaning imports from all origins are expected to become more competitive in H2’23.

Is 2023 now a lost year for rPET?

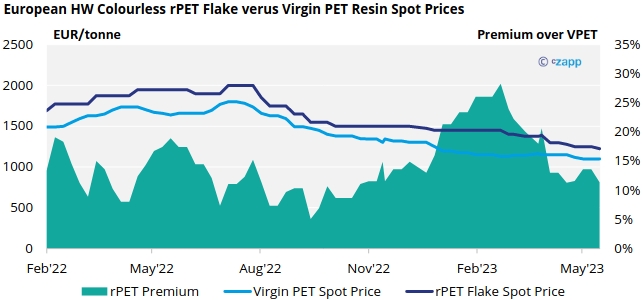

Sustainability is on pause. Not the official message of most multi-national brands but nevertheless Europe demand for rPET has slowed to but a trickle. High prices and record premiums over virgin resin seen in recent years have strangled the market.

Buyers, even amongst some of the major brands, have reversed course switching back to virgin resin.

Virgin prices have fallen around EUR 750/tonne since July 2022, and recycled prices have at times been reluctant to respond quick enough to changes within the virgin market, both domestic and import.

Even now, colourless hot washed rPET flake is trading between EUR 1200-1300/tonne, with a 11% average premium over virgin prices.

Some thermoformers are beginning to pick up some more recycled material, but largely blending in cheaper mixed coloured flake, which is now below virgin levels, demand for colourless flake is weak with ample availability.

Uncertain market conditions, and challenging financials for some converters, has led to cost cutting and without a current regulatory obligation in most of Europe, rPET and sustainability has been sacrificed.

As a sign of the times, last week, Veolia PET Germany announced plans to shut down its recycling facility for post-consumer PET bottles in north-eastern Germany on 31 December 2023 in response to the long-lasting slump in the market.

According to Veolia, “The company said it had not succeeded in securing long-term sales of recycled PET in collaboration with the beverage industry and/or grocery retailers. In this volatile environment, the sustained, economically viable operation of a PET recycling plant is not possible for Veolia”.

Following a flurry of new rPET capacity in recent years, particularly food-grade, some now believe that Veolia’s announcement may just the start, with others are likely to follow suit leading to consolidation with the market ahead of any potential recovery in demand ahead of 2025 EU targets.

Recovery in rPET demand and price is unlikely over the next 6-9 months, given the backwardated forward curve for virgin resin, and the fact we are already part way through the peak summer season.

rPET prices are expected to correlate closely with virgin material through the remainder of 2023.