Insight Focus

There has been speculation that Brazil could be one of the big winners in the tariff war. As a major competitor with the US for agricultural exports, counter tariffs could open up new markets to the South American giant. Still, given that the US is a major market for Brazil, the measures could add inflationary pressure for some producers.

Some Products to Suffer from Tariff Increase

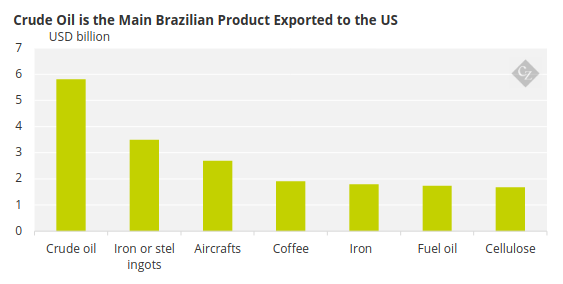

The oil sector in Brazil breathed a sigh of relief as crude — the main export to the US – was exempted from Trump’s tariff hike.

Source: Comex

For other agriproducts that are widely exported by Brazil, such as pulp and beef, China is the main destination, which eases pressure in the face of Trump’s new tariff regime. In fact, it could even give Brazil a competitive advantage – particularly when it comes to soybeans.

But for other large swathes of Brazilian agribusiness, the feeling is very different.

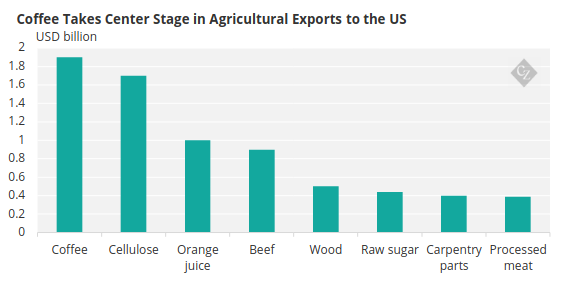

Agribusiness products – among a total of 70% of Brazil’s US exports — will pay an additional 10% tariff. Products such as orange juice and coffee, with huge exposure to the US, risk being some of the most impacted.

Source: Comex and Ministry of Agriculture.

Previously, raw coffee beans were not subject to import tariffs in the US, while orange juice was taxed at USD 415.86/tonne of concentrated juice.

Orange Juice on the Hot Seat

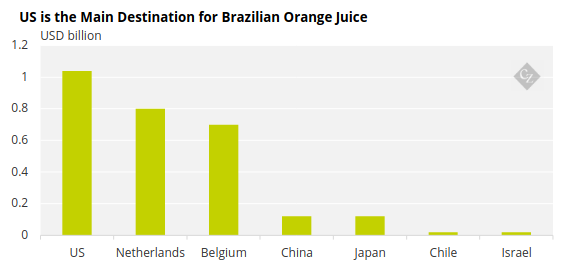

Source: Comex.

Import taxes on orange juice are now set to rise sharply, added to the current rate of USD 415.86/tonne. Last year, the flat tax per tonne alone cost about USD 85.9 million, according to CitrusBR, the orange juice exporters’ association.

Considering the price of exports to the US last year, paying the 10% tax would result in an additional expense of around USD 100 million per year. According to CitrusBR, the additional costs should be spread across the entire production and export chain, which could have an inflationary effect in Brazil.

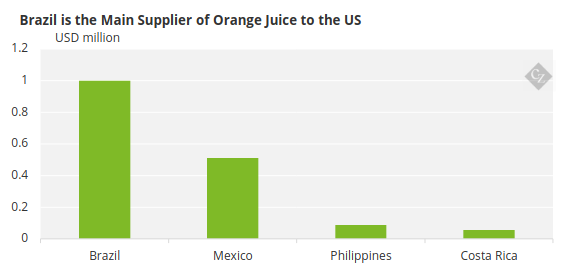

The market is also concerned about fiercer competition with Mexico, since the country escaped Trump’s tariff hike and is privy to a favourable trade deal in the form of the USMCA agreement. Brazil is the main supplier of orange juice to the US market, followed by Mexico.

Source: USDA

Exporters are also discussing a possible redirection of foreign sales, with a potential reduction in shipments to the US and a search for new markets, although the representatives within the sector have maintained a conciliatory tone.

“Brazilian companies will continue to supply the US market with high-quality orange juice,” CitrusBR said in a statement, adding that “the sector regrets that the measure was adopted without considering the long-term relationship with American companies.”

Coffee Market Alert

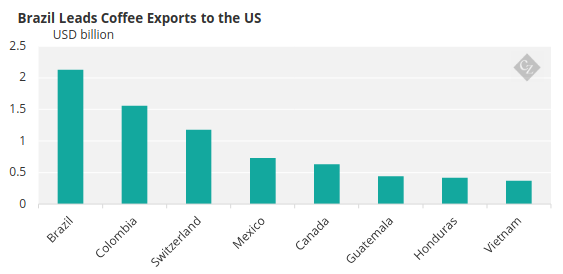

The coffee production and export chain has also been put on alert. Although Brazil’s main competitors in supplying coffee to the US have also been taxed, such as Colombia (10%), Brazilian coffee growers have expressed concern about the effects of the new tariffs.

Source: USDA

In a scenario of unfavourable weather conditions and crop failures, this is a delicate time for an increase in costs. The new US tariffs could cause Brazilian exporters to spend more than USD 200 million, considering sales to the US last year.

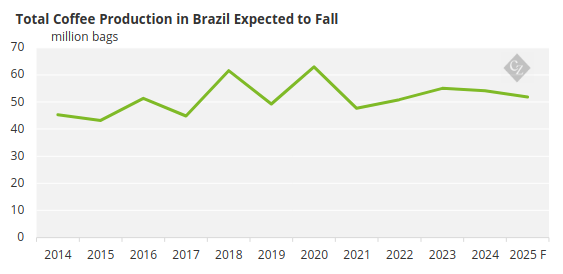

At least part of the costs must be passed on further up the production chain, which may impact on profitability. In addition, the 2025/2026 harvest has been revised downwards due to climate problems, such as heatwaves and low humidity.

The state of São Paulo, where Arabica coffee is grown and accounts for 70% of the Brazilian harvest of the bean, is being most affected, which should push down production estimates for this year.

Source: CONAB

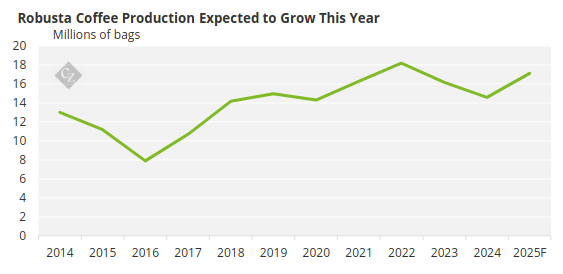

In Espírito Santo state, however, where Robusta coffee is mainly planted, production is set to increase, with investments in management and efficient use of irrigation systems.

Source: Conab

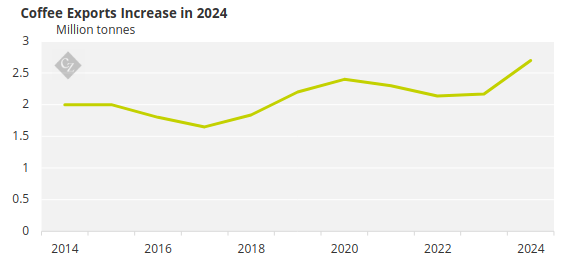

Overall, however, production challenges have reduced supply, which is also reflected in exports. Despite the jump in foreign sales in 2024, driven mainly by shipments to the US, which increased by around 40% compared to 2023, this year should not see such a significant result.

Source: Comex

Government Adopts Diplomatic Route

Meanwhile, the government has adopted a diplomatic tone regarding the US government’s decisions. The hope is that tariffs can be re-discussed. Behind the scenes, associations of producers, exporters and authorities have been meeting to discuss negotiation strategies with the US administration.

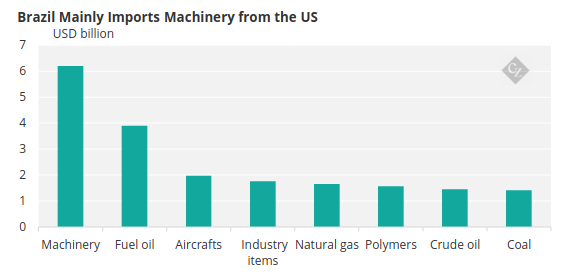

One of the main arguments is that the US has a surplus in trade with Brazil, although it is not large. Last year, Brazil exported USD 40.3 billion in goods to US consumers, while importing USD 40.6 billion, according to Comex. Imports are mainly higher value-added products, such as machinery.

Source: Comex

It is still too early to make any predictions about the progress of the negotiations and the decisions of the US government. Brazilian Vice President Geraldo Alckmin has said that Brazil has been in talks with representatives of the US government about the tariff issue. For now, uncertainties remain.