Insight Focus

India’s mango market has been volatile, driving buyers to consider other origins. Latin America offers stable supply and consistent quality. New US tariffs add uncertainty, threatening this shift.

After a year of volatility in India’s mango market, largely driven by freight rates and high stocks, global buyers have increasingly turned to consider the more stable origins of Latin America. Countries like Colombia, Mexico and Peru may offer different mango varieties, but their consistent quality and reliable harvests are making them serious contenders—even in markets traditionally dominated by Indian supply.

Now, as promising 2025 crops begin to arrive, newly imposed US tariffs are adding further pressure to the global mango market, threatening to disrupt this fragile shift and creating fresh uncertainty for exporters and buyers alike.

Where Stability Rules, Tariffs Disrupt

Alphonso and Totapuri are well-known Indian mango varieties, valued for their rich, sweet flavour and creamy texture, making them the top choice for many processors. Alphonso is prized for its complex, honeyed flavour profile, while Totapuri offers a distinctive balance of sweetness and acidity, making both ideal for pulp, juice and processed applications.

These specific varieties are not grown in South America due to regional and climatic differences. Instead, Mexico primarily exports Tommy Atkins—a firm, mildly sweet mango suited to the fresh fruit market and concentrate—while Colombia grows both Tommy Atkins and Kent, with the Magdalena River variety commonly used for purée.

Though the varieties differ, South American origins offer stable crops and consistent quality. This reliability has become a key factor for global buyers, prompting some to consider sourcing from the region despite the need to adjust specifications.

As of April, the outlook for South American mango crops looks normal, with good volumes expected across the region considering a higher production compared to last year, where Mexico had slight downward. With no stock from last year and high demand from multiple destinations, product is being allocated and delivered promptly.

Pricing is very consistent between countries, however, a major concern this year is the new US tariff imposed on imports from certain countries, which has created uncertainty in trade. With Mexico covering around 50% of North American demand and Colombia another 35%, exporters looked to accelerate shipments and finalise contracts quickly.

Although greater clarity around the tariff situation was expected by now, uncertainty remains. In contrast to Mexico, Colombia and other countries were hit by the new tariffs. Some processors are absorbing this cost while others are struggling to keep competitive. Now processors just have to wait and stay alert, expecting Mexico eventually can’t cover the demand and buyers redirect their attention to Colombian market.

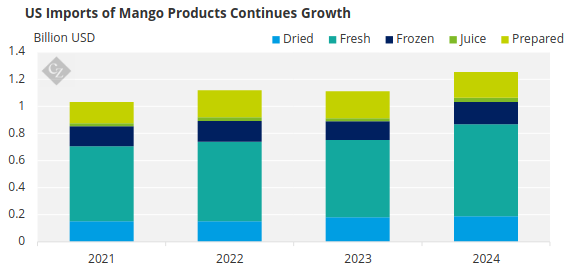

Source: USDA

Continued Volatility in the Indian Mango Market

While South American suppliers offer more stable production, the Indian mango market continues to experience volatility. Despite a short crop in 2024, there was good volume available due to surplus stock from the 2023 harvest held by both buyers and some processors in India.

Mango Market, India

As in any market, high supply and low demand impacted prices. This effect was further exacerbated by the offering of 2023 product as part of the 2024 crop or blended with freshly harvested 2024 product. The use of different raw material varieties in these blends added to the confusion, making it difficult for processors and buyers to establish a reliable market benchmark.

With uncertainty in India, buyers may increasingly seek alternatives from more stable regions, further shifting demand toward South America.

Will the 2024 Situation Repeat Itself?

As the mango harvest season begins, with Alphonso Mango harvesting during May and Totapuri following in June/early July, processors have begun to share indicative pricing for this year. These prices are similar to last year’s, but there is caution due to the ongoing downward trend in demand.

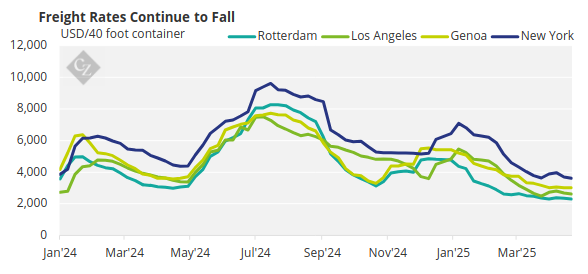

Additionally, Indian processors still hold around 40% of Alphonso mango purée and 60% of Totapuri from last year’s stock. This surplus could put downward pressure on prices, further exacerbated by the ongoing decline in global freight prices due to the recent US tariffs, which could, in turn, influence overall pricing trends.

Source: Drewry

Although this year’s pricing may appear attractive, the persistent volatility in India’s mango market is prompting buyers to remain flexible with their specifications and consider sourcing from other regions.

This shift is driven by the need for more predictable supply chains and price stability.