242 words / 1 minute reading time

- Global PET demand remains sluggish due to COVID-19 lockdowns hitting soft drink consumption.

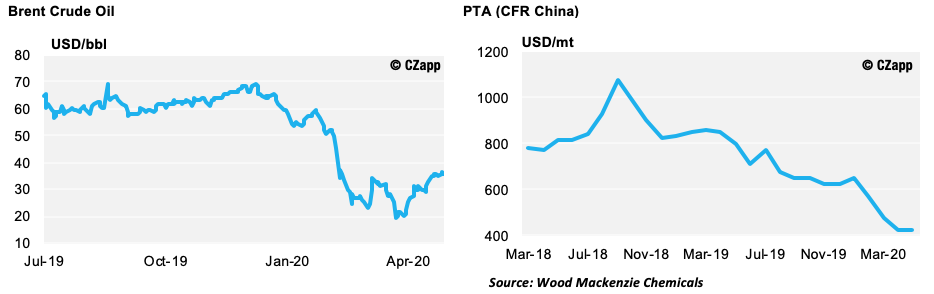

- However, PET feedstock prices remain weak thanks to low crude oil values.

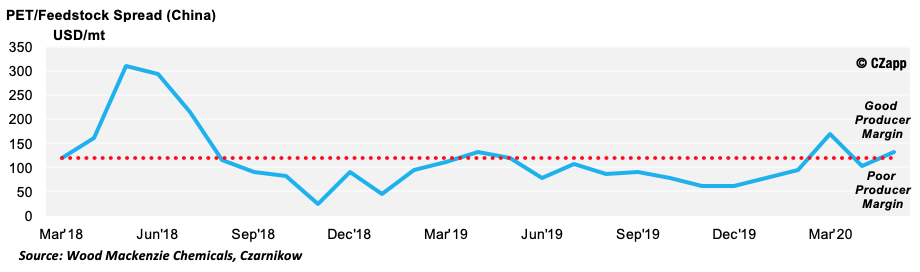

- PET production margins in China, therefore, remain just about acceptable.

PET and Feedstock Market Activity

Brent Crude Oil has recovered from the lows in May, trading up from around $20/bbl to $35/bbl in the month. This follows production cuts among major oil producers and increases in gasoline demand in countries which have been more successful in tackling the coronavirus pandemic. This all suggests the panic around coronavirus is gradually subsiding, which could be helpful for PET feedstock markets too.

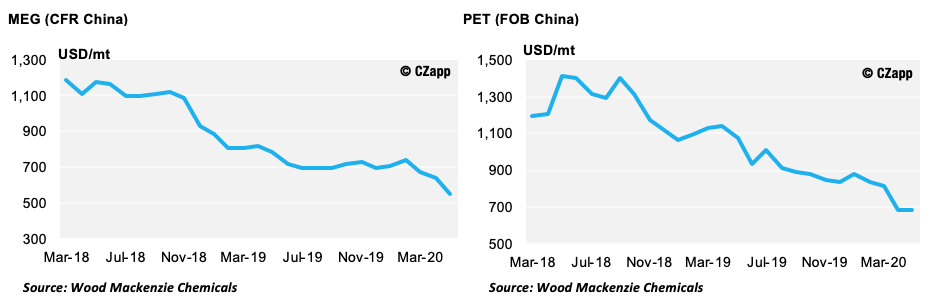

PX prices and Asian MEG prices have stabilised in the past month, but at low levels, reflecting the drop in crude oil in March/April and also reduced PET demand around the world. Carbonated soft drink consumption in the USA and EU has been lower than expected thanks to the lack of sporting events, concerts, festivals, etc, and this means PET demand is also lower.

Chinese PET producers are slowly increasing their output rates as coronavirus is brought under control. This, combined with low global demand for PET means PET export prices are falling, though by not as much as feedstock prices. This has helped keep PET margins at acceptable levels.

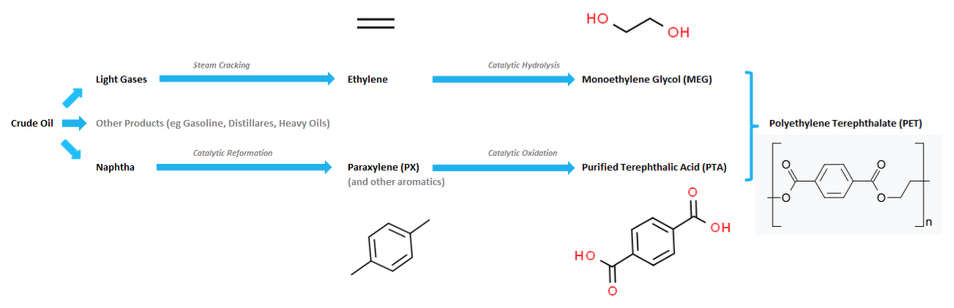

PET Production Process