Insight Focus

- Wheat prices are near contract lows as supply is plentiful.

- Buyers are reluctant to act, and funds are short.

- The 2024 new crop could present a very different scenario.

With the Northern Hemisphere harvest still three to four months away, remaining stocks of the old crop still in store need to be traded.

As the new crop harvest approaches, stores will need emptying so the focus will turn to the outlook for the 2024/25 marketing year from June onwards.

As global stocks dwindle and weather disruption persists, there is far from certainty over whether the price trends of 2023/24 will continue.

Wheat Rally Subsides

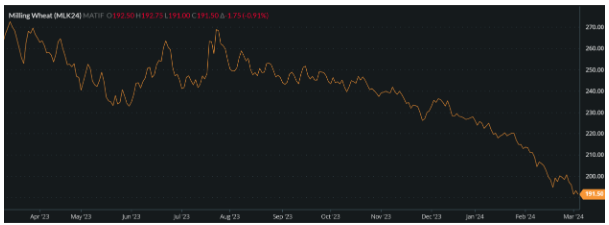

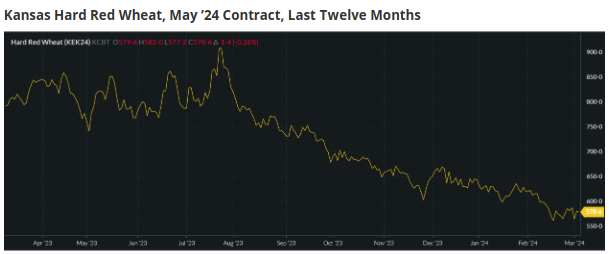

The charts below show the steady trending decline in wheat prices over the last 12 months. As the disruption caused to the world wheat trade by Russia’s February 2022 invasion of Ukraine has to a degree subsided, values have fallen away.

Buyers all over the world have been in the comfortable position of buying what they need, when they need it. With ample willing sellers, it has been an easy year to purchase.

Paris Milling Wheat, May ’24 Contract, Last Twelve Months

Source: Barchart Commodityview

Old Crop Dominated by Bears

A relaxed attitude from buyers has stifled any meaningful rallies, with one exception evident in the charts above — when Russia withdrew from the Black Sea Grain Corridor Agreement on July 17, 2023.

As the calendar turned from 2023 to 2024, it has generally been a quiet trading environment as sellers rue the higher prices that they could have obtained in previous months. Coupled with no apparent panic from buyers, the market has struggled to see much uplift.

The funds have been content to continue their short positions. They have ridden the decline in values, adding profit to their positions on an almost week-by-week basis.

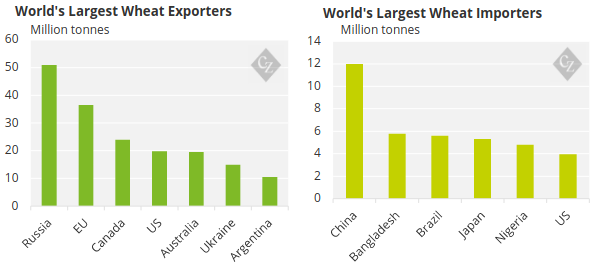

Meanwhile, Russia appears to continue its dominance by undercutting prices to ensure its competitiveness.

With lacklustre interest from buyers, prices remain uninspiring. The long-hold farmer sellers with wheat still in store will gradually release it onto the market over the coming months, making room for the upcoming 2024 new crop harvest.

New Crop Could Inject Life into Market

The 2024 new crop harvest may yet present an entirely different story as weather issues have plagued wheat plants across the globe. Due to heavy rain, there has been reductions in plantings for areas of Europe, while dryness has lessened yields in other parts, such as South America.

Production for many of the leading exporters is likely to be down in 2024.

The ultimate harvest numbers from Russia (the world’s largest exporter) and China (the worlds recently crowned largest importer) will be eagerly awaited.

As combines roll, the big question may well be whether the year-on-year end world stocks continue their decline.

Concluding Thoughts

Markets have been trending downwards throughout the old crop year. Buyers have been relaxed purchasers, alleviating any panic buying rallies. Sellers know that they should have sold more wheat earlier, while values were higher.

The funds have ridden the waves with short positions and look to be coming away with good profits.

We will have to wait and see what the new crop harvest of 2024 delivers. However, it would seem improbable that prices will decline substantially from here, given farmer profits at these values are struggling.

Any headlines questioning supply could prompt funds to buy in their shorts, while buyers may believe the bottom has been reached, spurring more physical purchases for the months ahead.

The wheat market is never simple, but it is worth remembering that it could be said that ’a market is never more bullish than when it is at its most bearish’.

Are prices reaching the bottom? Only time will tell.