Opinions Focus

- Northern Hemisphere wheat harvests are in their latter stages.

- War, weather, COVID and the global economy have thrown estimates into disarray.

- The challenge is deciphering what is relevant and what is not.

Introduction

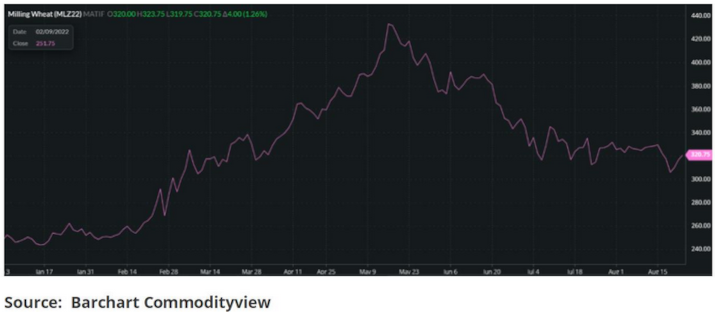

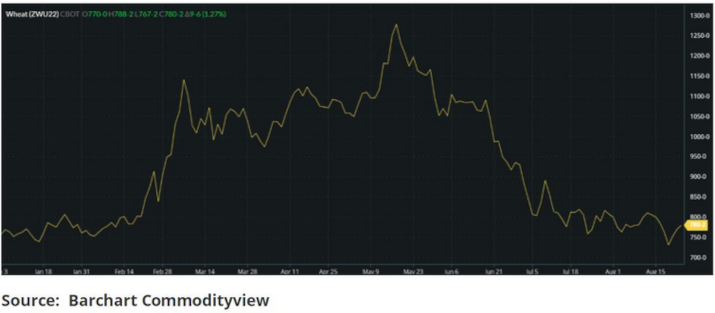

Thus far 2022 has certainly been an interesting year as we have followed the ups and downs of the wheat market.

Since prices tumbled in mid-May, I have heard constant comments from various parts of the food supply chain saying the market will go back up. Yet to date, it has continued its downward trend.

Relevant news headlines are abundant, be it Russia’s war in Ukraine, heatwaves, droughts, COVID restrictions or the financial struggles facing the general population with economic turmoil aplenty.

Assessing what is relevant to our own business interests can be a daunting task.

The Wheat Markets

Since the beginning of the calendar year wheat markets have, across the world, started firmly as stocks looked to be dwindling year on year.

In February the markets soared, when Russia invaded Ukraine, prompting what is becoming a prolonged and draw out war, with a far-reaching impact on the markets.

As history has shown time and again, rallies will always be overdone, as in May 2022, when prices climbed to exorbitant levels. Whatever the supply issues suggest, ultimately demand erosion will come into play once prices reach values buyers are either unwilling to, or simply cannot afford to pay.

Values have begun to stabilise a little over the last couple of months, but nonetheless remain volatile.

The current challenge facing market participants and businesses, is interpreting the plethora of news, covering a huge variety of topics. These include war, politics, weather, heatwaves, drought, inflation, economic uncertainty; the list goes on.

Paris Milling Wheat December 2022 contract, dates January 2022 to present

Chicago Soft Red Wheat December 2022 contract, dates January 2022 to present

News and Information to Baffle the Best

Reading specific wheat or general global news, drawing conclusions and price impact reactions to it can currently be a mind-boggling exercise.

Wheat supply and demand

As harvests reap several 100m tonnes of wheat across the Northern Hemisphere we are inundated with reports and estimates assessing supply for the coming months.

The August USDA WASDE Reported

- World wheat stocks for the end of 2022/23 remain the lowest in six years, relatively unchanged month on month at 267.34m tonnes, compared with 267.52m in July.

- Production was raised to 779.60m tonnes from 771.64m in July.

- Global consumption is larger at 788.60m tonnes than the July estimate of 784.22m.

Russia’s war in Ukraine

News reports are relatively positive towards the continuation of wheat exports through the Black Sea from Ukraine, following the agreement brokered by the UN and Turkey.

Whether the official Ukrainian wheat export prediction of 10m tonnes (18.8m in 2021/22) from a 20m tonne harvest materialises will be revealed in the fullness of time.

Weather

Heatwaves, drought, flooding, La Niña predictions into early 2023 and general climate change news are all adding to the woes and complications facing any business associated with the wheat markets and its pricing.

Global Economics

High food, fuel and energy prices are impacting huge swathes of the population world-wide, driving inflation and fears of recession.

COVID

A pandemic seemingly waning in some countries, remains A cause for lockdowns and business stoppages in others.

Political Concerns

Russia’s invasion of Ukraine has stirred increased global political divisions. Issues such as China and the US, with sabre-rattling over Taiwan, the future and its impact is anything but easy to predict.

Conclusions

There may be more stability in wheat values as 2022 draws towards its close.

Fundamental news which has, and continues to drive prices is as diverse and perplexing as we have seen for many years.

Ultimately economists state that prices are driven by supply and demand.

Supply on a global year-on-year level, appears relatively stable, despite the weather and political issues working against this tide.

Demand is ever-present as populations need feeding.

For now, supply will suffice to meet the needs, if not always the wants, of people around the world.

Markets can rise and fall, but as 2022 has yet again proven; if prices rise too high, the upside will be short-lived.

Sellers, take profits when prices are too good to be true……they probably are.

Buyers, fear not the rallies, wheat has always found its affordable level to feed the poorer nations.

If not today, then tomorrow.