Insight Focus

- Consumers have taken advantage of this weaker environment.

- Speculators are again net sellers of raw sugar.

New York No.11 (Raw Sugar)

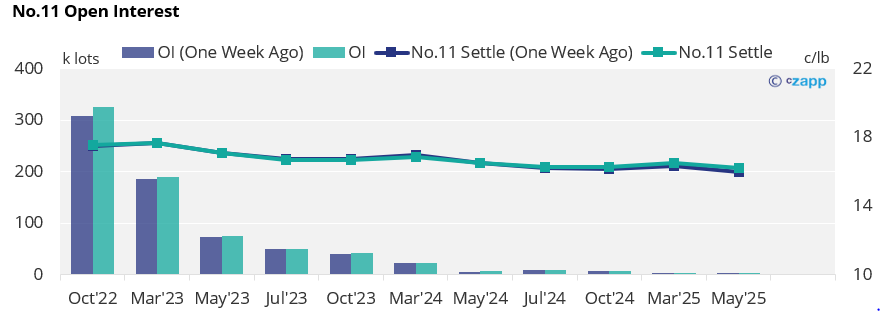

- No.11 prices have traded broadly sideways last week, moving around 17.5c/lb with minor buying preventing prices falling further.

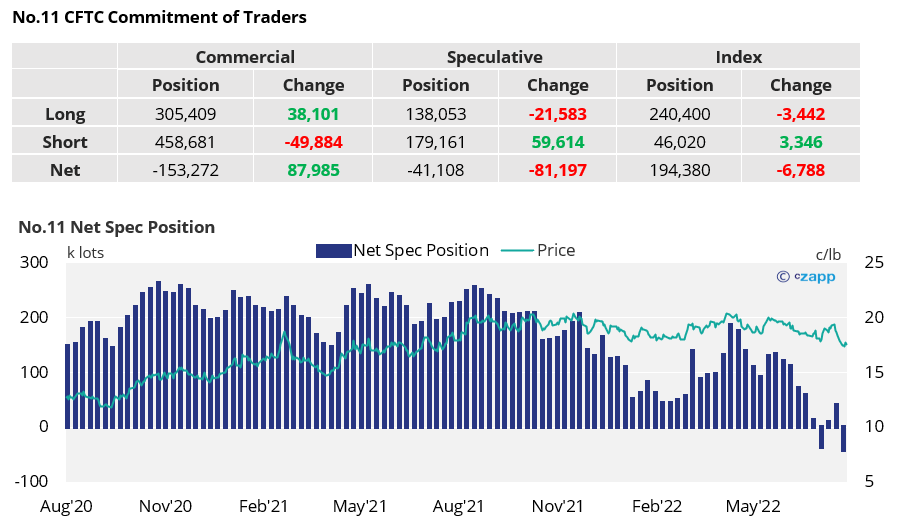

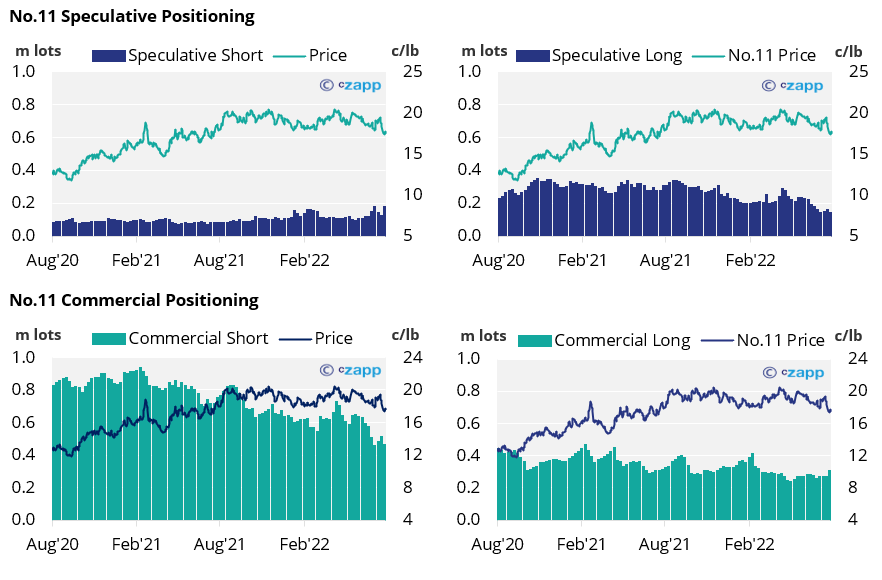

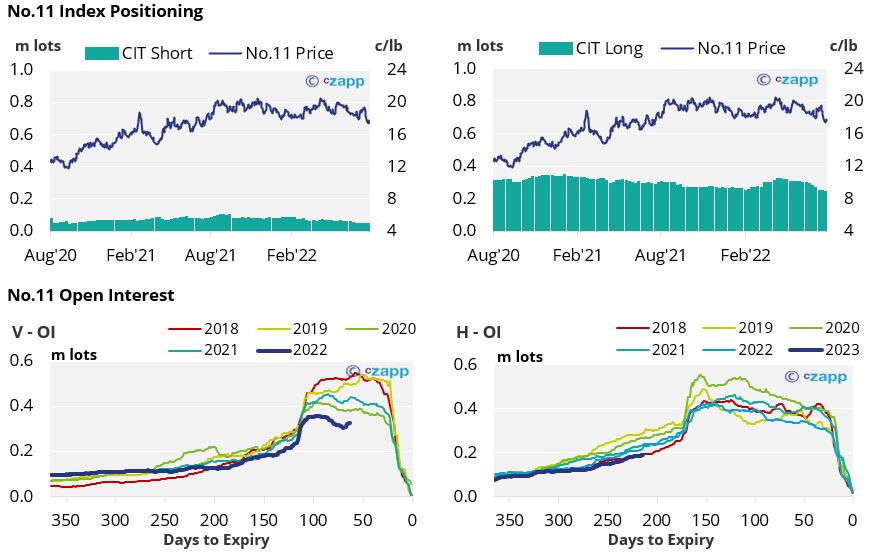

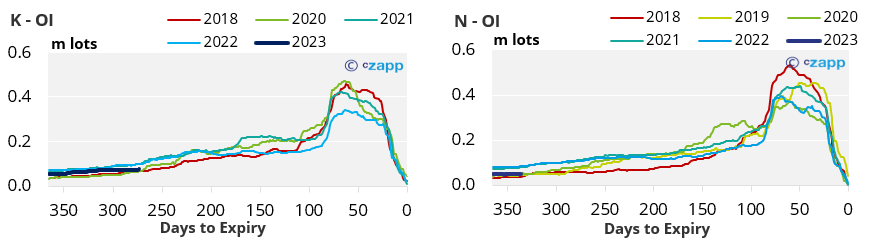

- As of the latest COT report from the 27th of July, speculators have again added a significant volume of new short positions whilst lifting existing long ones. As such the net spec position has fallen negative for the second time in the last few weeks.

- These weaker prices encouraged stronger consumer buying, with more than 38k lots of commercial long positions being added over the same timeframe.

- Raw sugar producers allowed almost 50k lots of short positions to roll off, leaving them much less well hedged than earlier in the year.

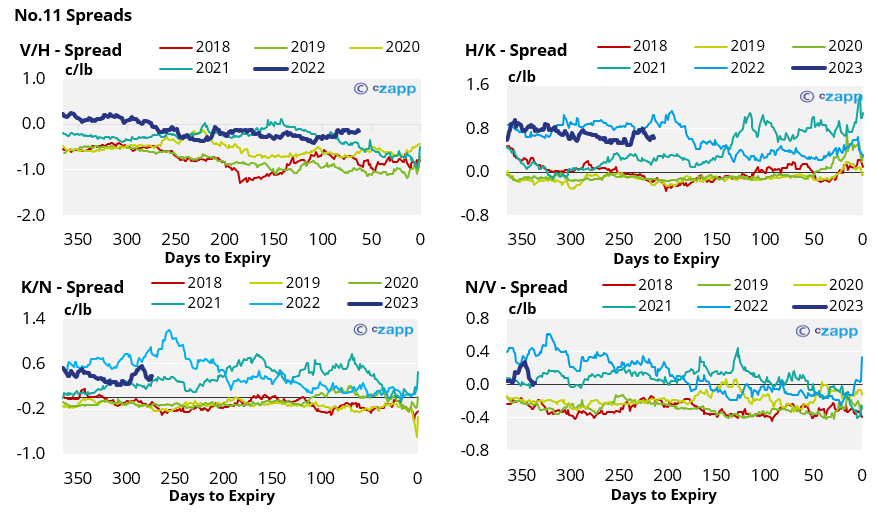

- The No.11 forward curve is still in carry into Mar’23, falling into backwardation for the rest of 2023.

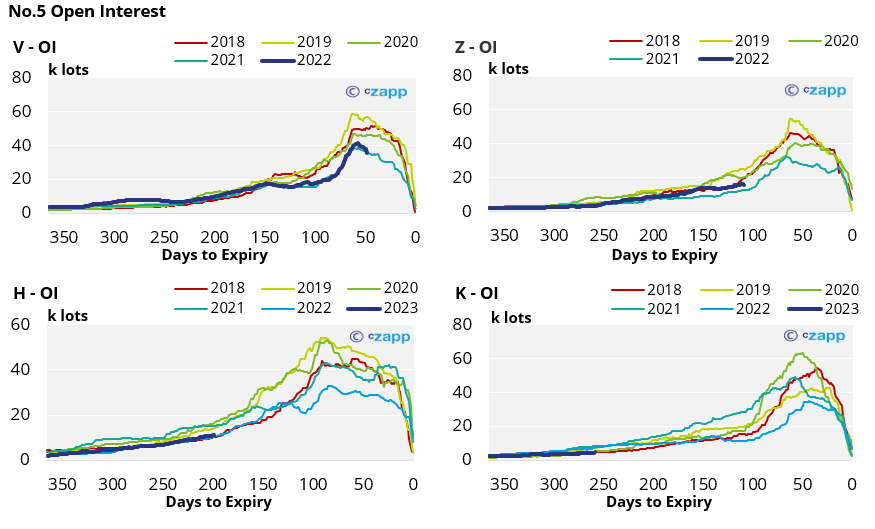

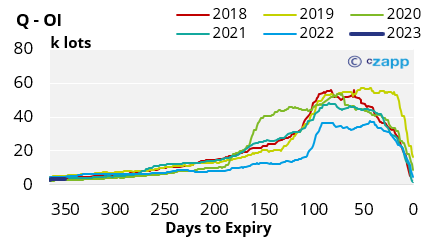

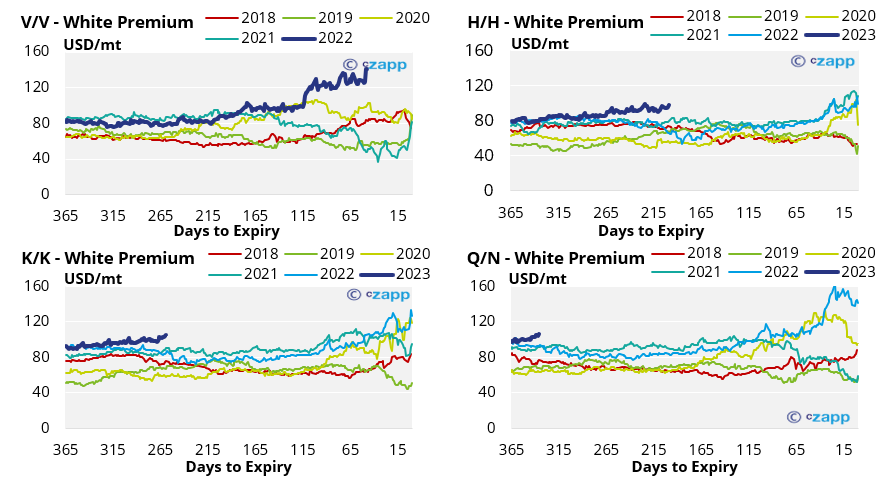

London No.5 (White Sugar)

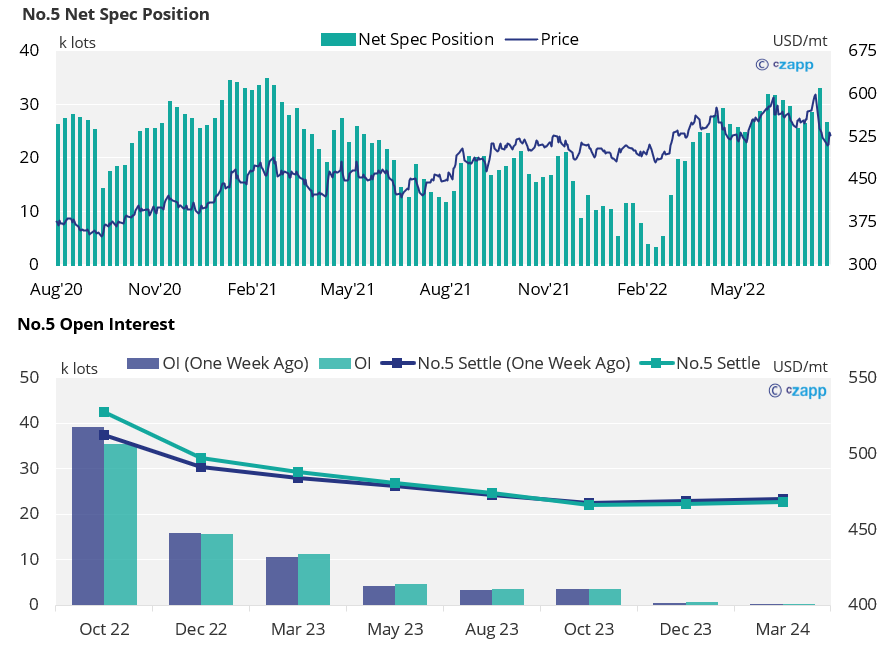

- After weakening throughout the second half of July, No.5 prices recovered to above 525USD/mt by end of trading last week.

- This recovery won’t yet be reflected in the CFTC COT report, which as of the 27th of July showed the net spec position fall by over 6k lots whilst prices were in decline.

- With most of the recovery last week seen in the Oct’22 contract, the white sugar futures curve has become steeper across 2022 and into 2023.

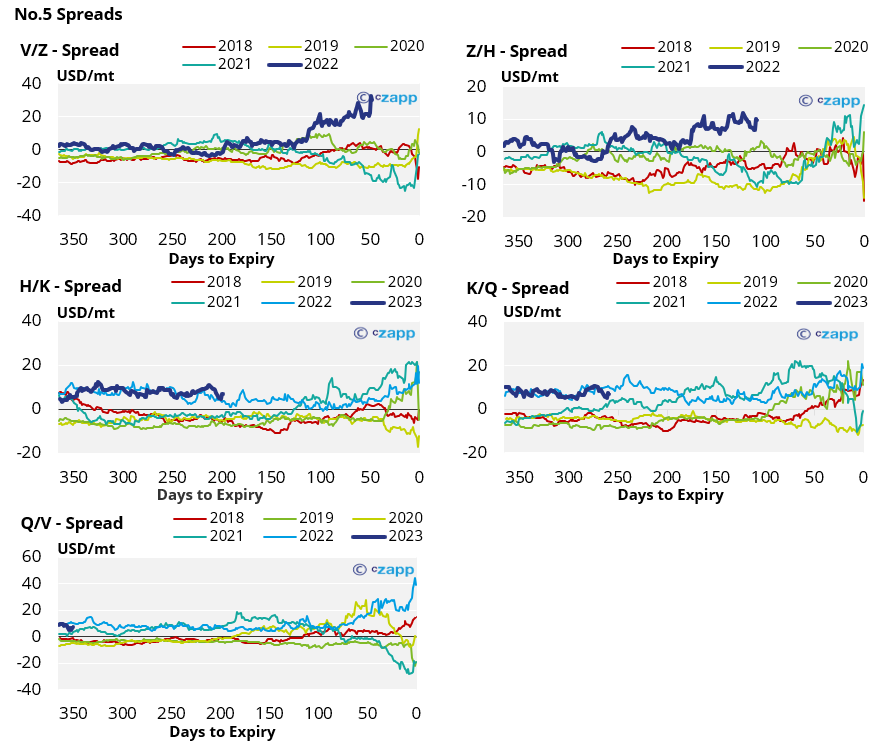

White Premium (Arbitrage)

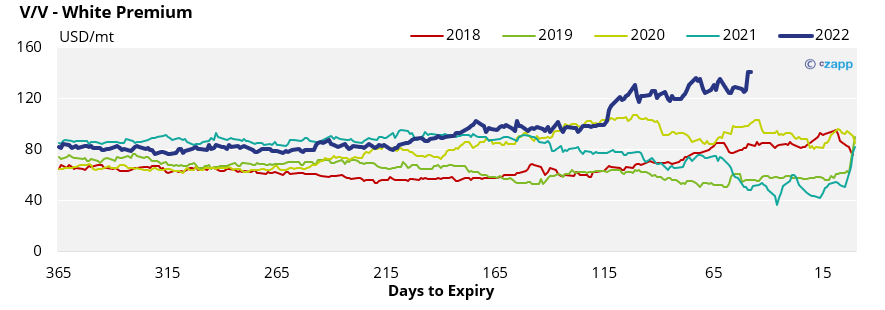

- Weakness in the No.11 has allowed the white premium to rally above 140USD/mt over the last week

- At this level we should see re-export refiners operating profitably and maximising their throughput.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix

Other Insights That May Be of Interest…

News Review: Walmart Warns on Food, Fuel Cost Impact

Ask the Analyst: Will Tankage Availability Become an Issue for Brazilian Ethanol?