Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

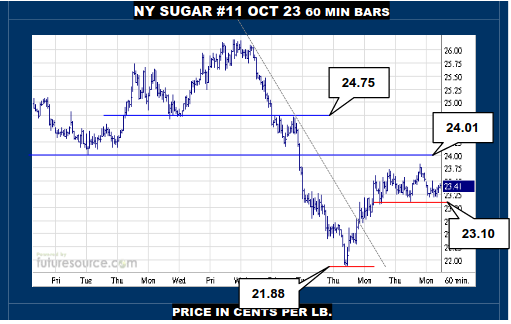

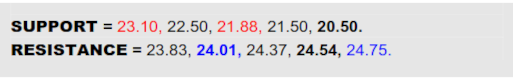

The post-Jly era is proving a bit of a conundrum as Oct NY has rebounded a Cent or so but has shown troubling wheelspin in the 23’s in recent days as it sits in the shadow of the ex-uptrend (23.82) and of course the Q2 double top (24.01). This only qualifies the bounce as corrective for the time being and it will take a punch through 24.01 and the swiftly incoming mid band (24.21) to suggest really regaining a footing where the 26’s could be in play once more. Mind 23.10 meantime as tipping over there could readily spark another round of spec long evacuations.

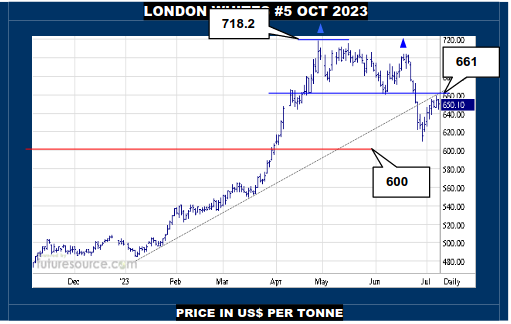

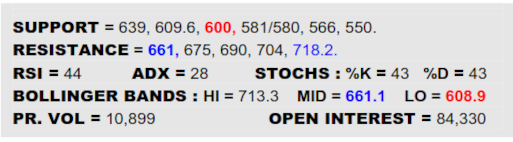

LONDON WHITES #5 OCTOBER 2023

Some intraday jitters but London held stable Monday by and large as meanwhile both the ex-uptrend and the mid band have converged at the 661 double top border just overhead. If the market could duly deliver a pronounced lunge across there and at least see Raws starting to chew away at the 24’s, there would then be a growing sense of shaking off NY’s Jly delivery lull and going back on the offensive. A bit of a knife-edge in the meantime though and ousting from the 640’s as NY fell from the 23’s would instead warn of a sharp new dive to attack 600.

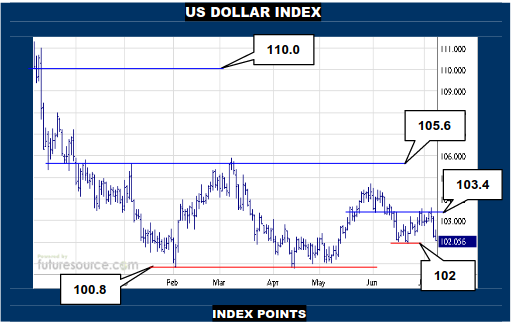

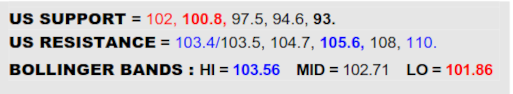

US DOLLAR INDEX

Failing to make a definitive hole in the 103.4 resistance over the preceding week or so, the Dollar slumped through its mid band Friday and now has its back against the ropes in the low 102’s. Although the downside momentum of ’22 has plainly lifted in ’23, this latest stumble still means a string of descending highs continues and the Dollar would have to pivot off 102 and make a clean getaway across the mid 103’s to finally shake off that sequence and make a louder claim to tipping the balance more towards the creation of a larger base. Meanwhile, loss of 102 would start Q3 in weary fashion, exposing 100.8 with risk of far deeper fallout towards the 93’s beneath there.

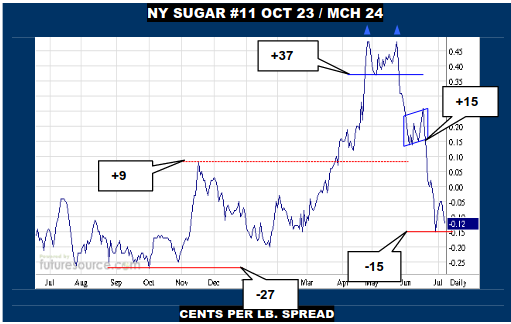

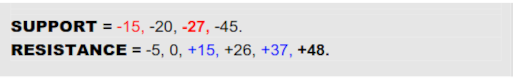

NY SUGAR #11 OCT 23 / MCH 24 SWITCH

VALUE : -12

Oct/Mch got a breath of air last week after a prior dive to -15 overreached the -8 early Jun bear flag projection. Alas, consistent with Oct flat price thus far being unable to trouble the heftier resistance above 24₵, the switch hasn’t made any useful headway, remaining in negative values and thus a far cry from the +14/+15 underside of that preceding flag. So while a jab over 24₵ and over level-money might start to stir the waters again, meantime it feels more about just trying to stay propped up and breaking 23.10 and -15 would suggest failing in that quest and err for another bear flag instead here to warn of attacking -27 with the threat of a further flag measurement to -45 if it gave way.

NY SUGAR #11 OCT 23 INTRADAY SNAPSHOT

While clearly thus far sustaining last weeks’ near term downtrend escape and stabbing beyond the 38.2% Fib retracement (23.53) a couple of times, the intraday chart still emphasizes the markets’ obvious reluctance to really take a swing at the Q2 double top itself north of 24.01. That is already leading to immediate action starting to assume a toppier guise and attention is hence increasingly diverting back towards 23.10 as a tripwire to fall from this rather brief corrective perch and resume the preceding fallout, which could then lure the next wave of slower reacting spec longs to jump ship and thereby exceed the prior 21.88 trough. Must otherwise hold 23.10 to keep 24.01 within strike range.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.