Insight Focus

- The last operating sugar mill in Texas is closing.

- The Rio Grande Valley Sugar Growers Mill produced around 44,000 tonnes per year.

- The closing of the mill could lead to a potential TRQ increase.

The last operating sugar mill in Texas, The Rio Grande Valley Sugar Growers Mill, is closing after fifty years of operation. The closing of this mill will take away around 500 direct jobs and around USD 100 million from the Texan economy. More than 100 local Texan farmers sold their cane to the mill.

The mill is closing because intense droughts have slashed yields in the region to historical lows, making production economically non-viable.

Texan officials claim that Mexico’s failure to comply with the 1944 Water Treaty has also affected yields. Under the treaty, Mexico is expected to deliver water to the state of Texas in amounts set every five years.

The Rio Grande Mill released the following statement, “For over 30 years, farmers in South Texas have been battling with Mexico’s failure to comply with the provisions of the 1944 Water Treaty between the US and Mexico that governs water sharing between the two nations on the Colorado River and the Lower Rio Grande.”

Rio Grande Mill Closing Impact

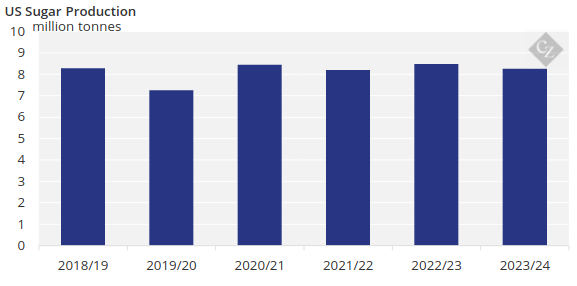

Sugar production in Texas has been decreasing for the past three years. Production from The Rio Grande Mill (the state’s only remaining mill) went from 124,000 tonnes in 2021/22 to 76,000 tonnes in 2022/23 and finally 44,000 tonnes in 2023-24.

The Rio Grande Mill closing should have a minimal effect on the US sugar market since it only accounted for 0.5% of the 8 million tonnes the U.S. produces.

Potential TRQ Increase

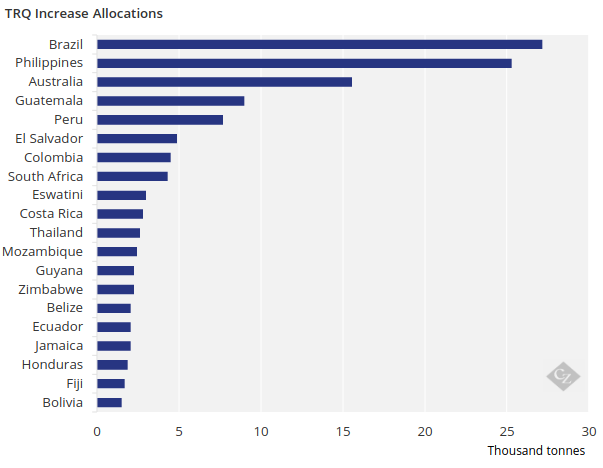

In March, the US announced a TRQ increase of around 125,000 tonnes for 2024. A damaged US beet crop and an underperforming Mexican crop caused the US to increase TRQ allocations.

It would be little surprise if the US announces another TRQ increase in late 2024 or early 2025 to compensate for the lost production of around 40,000 tonnes. The US usually allocates TRQ increases to countries that consistently complete their TRQ quotas, such as Brazil, Australia, and Guatemala.