Opinion Focus

- Brazil should become the world’s leading corn supplier for the 1st time in history.

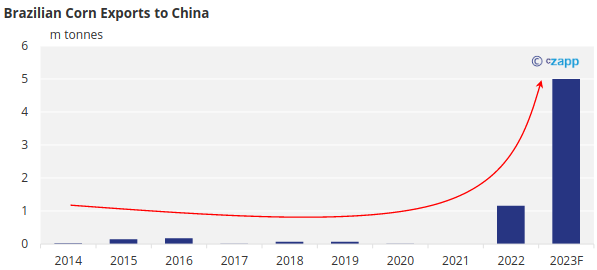

- Expectation is to export 5 million tonnes of corn this year to China, a record volume.

- Chinese retaliatory tariffs and logistical issues make US corn less competitive.

At the beginning of the year, a shipment with 68 thousand tonnes of Brazilian corn docked for the first time in the port of Guangzhou, one of the largest cities in China, attracting the attention of the market and the local media. For the Chinese, it was cause for celebration. With the war in Ukraine, the second largest supplier of the cereal to China, and the United States (the champion) in the midst of trade disputes with Beijing, Brazil is a strong candidate to conquer an important share of this market.

Source: Comexstat and Czapp

We expect 5 million tonnes of corn leave the port of Santos bound for China this year. For Brazil, it is quite a change – for the better. Over the past ten years, shipments to Chinese ports totalled just 1.7 million tonnes. In the month of January, however, they reached 980 thousand tonnes. Other ships are ready to sail to Chinese ports.

This story began to change in mid-2022, when representatives of the Chinese and Brazilian governments reached an understanding about phytosanitary parameters that blocked corn exports to China. Subsequently, Chinese customs approved more than 130 corn exporting companies with branches in Brazil, including facilities of Archer-Daniels-Midland Co, Bunge Ltd, Cargill, Louis Dreyfus Company and COFCO International.

Today, more than 400 companies are authorized to export Brazilian corn to China. In January and February of this year alone, more than 90 companies received the green light to ship the cereal to Chinese ports.

We think the move is a strategy by the Chinese government to diversify food import sources and ensure food security.

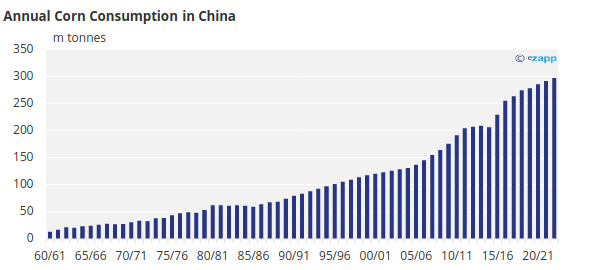

The world’s largest corn consumer, China faces the challenge of sourcing large volumes of the cereal around the world. To give you an idea, in 2022 corn consumption reached 291 million tonnes in the country, 2.1% more than in the previous cycle. This year, it should reach 297 million tonnes.

Source: USDA

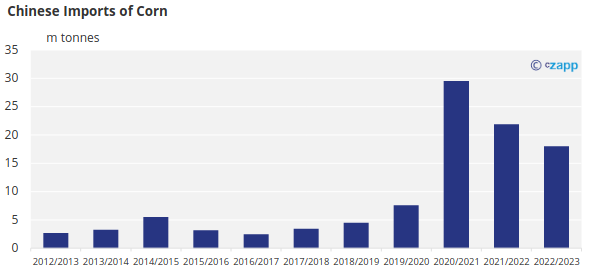

In 2022, China imported 21.8 million tonnes of cereal, with 5 million departing from Ukrainian ports. The United States provided the remainder, according to the USDA.

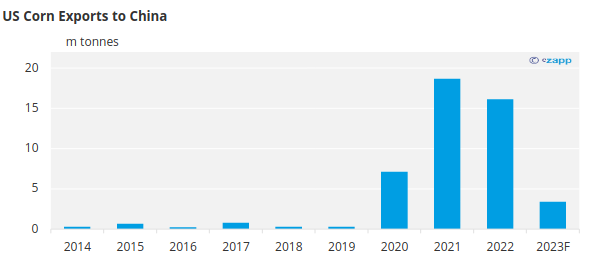

In a new sign of the times, China bought just 3.7 million US corn for 2022/2023 delivery, 70% less than the same period of the previous cycle.

Chinese corn imports hit their record in 2021, reaching 29.5 million tonnes, up 288% compared to 2020. This volume was a result of strong demand to feed the livestock industry. The country needed to rebuild its herds when facing a wave of African swine fever that, since 2018, has decimated about 60% of its herd.

Despite the drop of 7.6 million tonnes in imports in 2022, the volume remains 188% higher than in 2020. According to the USDA, this reduction can be explained by lower imports from Ukraine due to the war, as well as the high corn prices in the United States.

Source: USDA

“It is possible that the combination of higher US corn prices and additional tariffs of 10% for the export of American production to China, in force since 2019, have made the purchase of cereal produced in the United States more complex for Chinese firms”, assesses economist Sandro Steinbach, director of the Center for Agricultural Policy and Trade Studies at the University of North Dakota, in the United States. Logistical issues in the United States during the pandemic also aggravated this scenario.

At the same time, imports from Ukraine remain an open question, as for now there are no signs of an end to the conflict with Russia.

In this context, will Brazilian corn surpass American corn in exports to China?

According to the USDA, Brazil should lead, for the first time, world shipments of corn. The country should export 50 million tonnes of corn this year, with 27.6% of world sales, compared to 23.5% in the previous cycle.

The United States, in turn, should export 48.9 million tonnes of corn, 22.1% less than in 2022. Of this total, about 3.4 million tons should go to China.

If the geopolitical scenario does not change anytime soon, with the continuation of the war in Ukraine and the trade dispute between the United States and China, Brazil should increase corn shipments to China. Already this year, if all goes well, Brazilian corn exports should surpass American ones.

Source: FAS, USDA

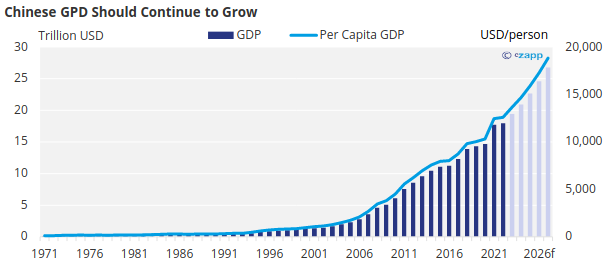

The growth of the Chinese economy and the expansion of the middle class are among the main drivers of this dynamic. The increase in purchasing power has boosted the demand for meat – and corn is an essential component of animal feed. Between 2009 and 2013 alone, the demand for corn increased 39 times.

Source: USDA

Today, imports account for only 2%, on average, of total corn consumption in the country. Even so, it is a lot of corn – and this demand should increase, opening opportunities for Brazil.

Source: World Bank

One of the clues to this trend comes from Chinese multinationals in the food sector. Chinese market analysts have been paying special attention to COFCO International, a state-owned agricultural commodities company that has been investing heavily in Brazil.

With offices, mills and soybean crushing factories and silos in ten Brazilian states, the company should spend at least USD 1 billion over the next few years on works to improve the STS11 terminal, at the port of Santos, which won in an auction held in last year.

In recent years, COFCO has invested more than USD 2.3 billion in Brazil. Today, the company is already the largest exporter of Brazilian soybeans to China.

Source: CONAB

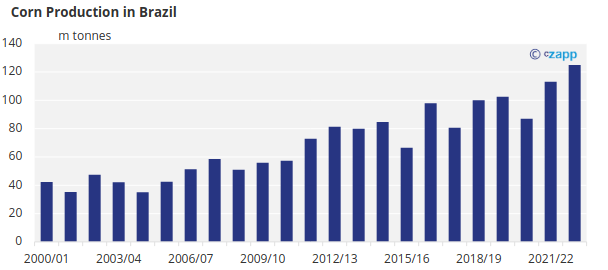

The super harvest forecast for this year is another positive factor in this scenario. Brazil is expected to produce 125 million tonnes of corn, 10.4% more than in 2022, a record.

This increase in production is mainly linked to the recovery in productivity. In previous harvests, corn planting was affected by prolonged droughts. According to the Companhia Nacional de Abastecimento (CONAB), the productivity of the current harvest should be around 7% higher than that of the previous cycle, reaching 5.6 tonnes per hectare.

Challenges

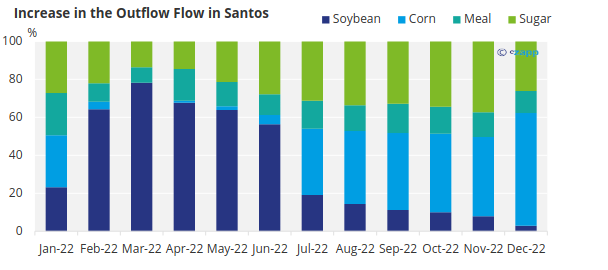

But not everything is perfect. If the forecasts of a record harvest of grains (and the second largest of sugar) are confirmed, with 152.7 million tonnes of soy, 125 million of corn and 36 million of sugar, the logistical bottlenecks should come on the radar. The main challenge will be the competition for space in the loading of trains and in the ports.

Source: Williams and Czapp

The port of Santos, the largest in Latin America, has a shipment limitation of 8 million tonnes of solid agricultural bulk per month. One of the questions asked by the market is whether there will be more delays in the length of stay for ships and congestion on the highways.

There is yet another challenge. The boom in agricultural production has also been pushing up the price of rural real estate. The valuation of the land destined to the cultivation of grains reached 45% last year. In the last three years, rural land had an increase of 127.4%. This year, a certain accommodation of the market is expected, with lower price increases. Even so, investments in agricultural areas may represent a higher cost for the rural producer.