This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The sugar market remains firm ahead of the International Sugar Colloquium next week.

- Processors are still worried about the impact of shrinkage due to warm weather.

- Mexican production issues are still causing concern.

Market Firm Ahead of Colloquium

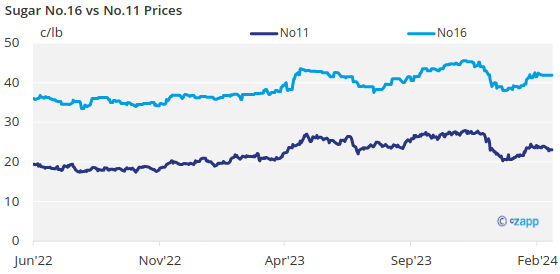

Bulk refined sugar prices were unchanged with a firm tone in the week ended February 16. Spot and forward trading continued, with activity for 2024-25 slowing ahead of the International Sweetener Colloquium slated for Feb. 25-29 in Aventura, Florida, where sideline meetings between buyers and sellers are expected to be active.

Some beet processors reported active sales for next year mostly to small- and medium-size users on a regional basis in late January and early February as those buyers wanted to get ahead of whatever may develop at the Colloquium when larger buyers may set the tone.

That activity continued but at a slower pace in the past week, although some processors were anticipating pricing requests. Last year sales “exploded” in March after the Colloquium. While that level of activity may not occur this year, a significant increase is expected.

One processor indicated sales for next year were further along in the first week of February than they were at the end of February last year, and at higher prices this year.

Trading for 2024 continued at a slow pace. Beet processors had sugar available as slicing campaigns ran strong.

Pricing indications were steady with a firm tone for 2024-25 and were unchanged for 2024. Beet sugar for 2024-25 was offered at 53¢/lb to 55¢/lb FOB Midwest. While some was offered at 56¢/lb, there was also some below the range if in volume or for competitive reasons. For 2024, offers were mostly at 55¢/lb to 58¢/lb FOB Midwest.

Bulk refined cane sugar for 2025 was offered at 60¢/lb FOB Northeast and West Coast and in the range of 56¢/lb to 58¢/lb FOB Southeast and Gulf. For 2024, it was offered at 62¢/lb FOB Northeast and West Coast and at 58¢/lb to 60¢/lb FOB Southeast and Gulf.

Shrinkage Creates Supply Concerns

The condition of outdoor sugar beet piles was top of mind for beet processors. Unseasonably warm weather in December and fluctuating temperatures (mostly warm) so far in 2024 were expected to increase shrinkage in beet piles, with the situation becoming critical for one processor who may withdraw from the 2024 market in the next few days. The need for another processor to run well into the spring to slice the large 2023 crop added to concerns.

The USDA in its February 8 WASDE report lowered its forecast of 2023-24 beet sugar production by 79,297 tons (71,937 tonnes) based on updated beet sugar processors’ estimates of beet pile shrinkage. Some in the trade think another 50,000 to 100,000 tons (45,359 to 90,718 tonnes) could be trimmed from the production number if concerns about losses in outdoor piles come to fruition. The current beet sugar forecast of 5.3 million tons (4.8 million tonnes) is a record high.

Source: USDA

Mexico Remains Top of Mind

Other sugar supply concerns that emerged from the WASDE report included imports from Mexico. There have been record-high imports of high-tier sugar, which the government appears to be using to make up for lower imports from Mexico. Users would prefer a tariff-rate quota increase, but that can only be done after April 1 unless an emergency is declared.

The USDA forecast 2023-24 US imports of sugar from Mexico at 799,000 tons (724,741 tonnes), down 13% from January after dropping Mexico’s sugar production forecast to more than a decade low. Exports from Mexico can be achieved only if that country continues the controversial practice of importing high-tier sugar for domestic use while exporting its own production to the US.

Note: Values converted from short tons to metric tonnes

Source: USDA

Corn sweetener markets were quiet. The USDA in its WASDE report lowered its forecast of corn used to make glucose/dextrose in 2023-24 from January based on “pace to date.”