Insight Focus

- 2023 a year of war, weather and changing trade flows with an overall down trend.

- 2024 will likely test both buyers and sellers as uncertainty continues.

- Here’s an assessment of what the year ahead will hold for wheat.

Introduction

The beginning of a new year, as we head into 2024, sees a calmer market sentiment than the volatility of both 2022 and the ups and downs of 2023.

Looking back at the world’s wheat markets over the last year there were a few unexpected price drivers that created some volatility and give food for thought for the future.

This current relative stability in the market has the potential to be disrupted by a number of factors worthy of vigilance.

The global wheat markets in 2023

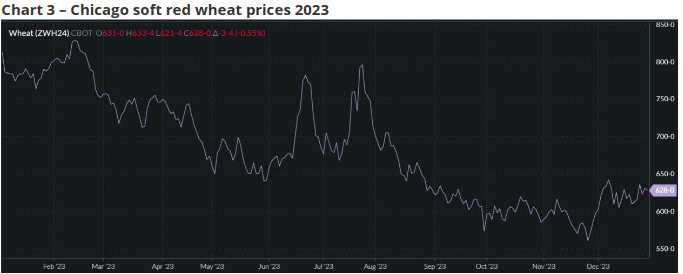

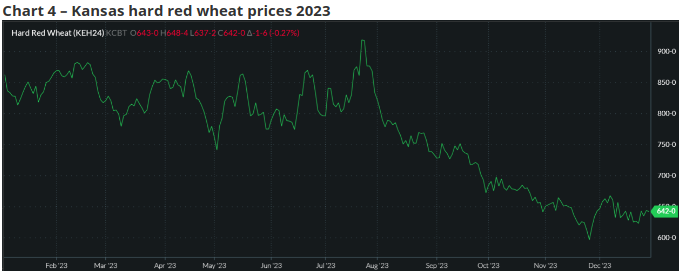

The charts below show the down trend experienced over 2023, with a few rallies to keep the ‘bears’ on their toes.

Early on in the year, bank collapses stoked fears over an economic crash.

Black Sea exports, feeding the world’s poorest and largest wheat importers in Africa, were a regular feature as Russia’s war continued to rage in Ukraine.

Towards the end of 2023, despite weather disruption to many of the biggest exporters’ wheat crops, prices stabilised somewhat. This will have been a welcome relief to many given the enormously difficult volatility in prices encountered since Russia’s invasion of Ukraine in February 2022.

Source: Barchart Commodityview

Source: Barchart Commodityview

Source: Barchart Commodityview

Source: Barchart Commodityview

Chart 5 – Movement of wheat prices, by percentage over 2023, in London, Paris, Chicago and Kansas.

Source: Barchart Commodityview

Chart 5 above demonstrates the volatility of the global wheat markets as prices dropped overall by around 20% over the calendar year.

Thoughts on 2023

The major price headline of 2022 was the disruption to commodity and financial markets as a result of Russia’s invasion of Ukraine.

Although values had tumbled from the highs seen in early to mid-2022, we entered 2023 with wheat costs to buyers still at depressingly inflated levels.

Economic concerns

The protraction of Russia’s war in Ukraine had inevitably caused concern for the world’s economic analysts.

The impact of the Western democracies sanctions on Russia prevailed, complicating and changing trade flows.

The cost of everyday items, from food to energy, heaped financial pressure onto populations across every continent.

In March 2023, these concerns took an alarming turn.

Silicon Valley and Signature Banks were shut down by the regulators in the United States.

This was swiftly followed by a, virtually overnight, rescue of Switzerland’s second biggest lender, Credit Suisse, by its rival UBS.

The shock of these bank collapses, sparked concerns that a global financial crash for banks, similar to the devastation of the 2008 world economic crisis, was potentially imminent.

Fortunately, this anxiety subdued, but watchful analysts have muted fears throughout 2023 for many of the globe’s biggest nations’ economies.

Black Sea exports

As we headed into 2023 there was an acceptance that Russia’s war in Ukraine was unlikely to end during the year. Sadly, along with unimaginable human suffering that has proved to be the case.

With Russia, the largest wheat exporter in the World, and Ukraine an important exporter, both looking to export increasing volumes, the Black Sea and the impact of the war on the smooth running of supply chains has, at times been the main focus of markets.

Most notably, during the summer months of June and July, the expiry of the Black Sea grain corridor agreement between Ukraine and Russia, brokered by Turkey and the United Nations was the major news for wheat markets.

Finally, on 17th July, Russia withdrew from the agreement, which had been anticipated and had led to the rally in values during this time.

Fortunately, the extraordinary resilience and determination of the Ukrainians prevails. Exports have continued, despite Russia’s barrage of attacks on all avenues for export, notably Ukraine’s ports and river routes via the Danube into neighbouring countries.

Concerns subdued as these exports persisted, albeit more slowly at times.

Weather

The weather is never far from any wheat market analyst’s thoughts.

We have seen all manner of record-breaking weather extremes throughout 2023.

China suffered extreme amounts of rain at harvest, reducing both production and importantly the quality of milling wheat suitable for human consumption. This has shot China to the top of World importer rankings, surpassing Egypt to the top spot.

Argentina and Australia have suffered weather issues too.

Argentina’s optimism, has not returned production to the circa 20+mmt hoped for, although the 15mmt estimate is an improvement on the dismal 12.5mmt in 2022.

Australia, having reaped a huge 2022 crop nearing 40mmt, 2023 estimates suggest a crop nearer 25mmt.

European weather in 2023, looks to have significantly hindered the 2024 crop as the North and West have barely had a let up in the rain over the autumn winter wheat planting season. This has led to reductions in sown area of 10%+ in some areas.

Looking to 2024 and the year ahead.

According to the USDA (United States Department of Agriculture) world wheat end stocks are forecast to drop from 269.85mmt to 258.20mmt this year. These are the lowest end stocks in nearly ten years.

There is a need for good production numbers when harvests start in the Northern Hemisphere during the summer months of 2024. With rain persisting as it is, there is no certainty either. It could paint a troubling picture if end stocks take another hit for 2025.

China, the world’s largest producer, consumer and end stock holder, will play an influential part as 2024 progresses. Any further increase in import forecasts for 2024/25 could spark concerns, as this marketing year’s 12.5mmt is already significant.

With economic woes another area of unease for China, there will be interest in whether this impacts imports or the wider world economic picture.

Exports from Russia and Ukraine through the Black Sea will no doubt be in the headlines as they either help or hinder the feeding of the major importers in Africa.

A hope that conflict in both Ukraine and Gaza eases, should help relative stability that many hope for in wheat prices, but again this is merely hopeful rather than probable.

Conclusions.

Wheat prices are at their lowest in over two years, with the first trading day of the 2024 showing another fall in values.

Wheat farmer’s costs remain unusually high, while poor weather will only make matters worse. A drop in prices from these lows will be unwelcome and hard hitting for many growers.

The shorts (those who have sales without purchases), of which there are many in the wheat markets, are vulnerable to any big crop scares. A major rally, where the ‘bulls’ take control, will force many shorts out, possibly pushing markets up further.

The ‘bears’ in control at the moment, will be hoping for good crop forecasts with helpful weather. It is difficult to see them forcing the market prices down very far from here.

2024 will be another year full of uncertainty in terms of weather, economies, conflict and wheat demand.

Nonetheless, it would seem fair to say that the upside in prices most certainly has greater potential than the downside as we move further into 2024.

HAPPY NEW YEAR 2024!