Insight Focus

- We are in a period of turmoil between the old crop and the new.

- Weather is pulling the market in contradictory directions in different regions.

- This creates uncertainty for buyers and sellers.

Markets Contend with Volatility

Buyers and sellers are constantly facing the dilemma of what to do next and when. But as burdensome old crop wheat supplies continue to pressure values, many participants are looking to the new crop for some direction for their longer-term needs.

Contrasting drivers in different parts of the world have, at times, been making markets unfathomable from one moment to the next, as markets rise and fall in the space of an hour or two.

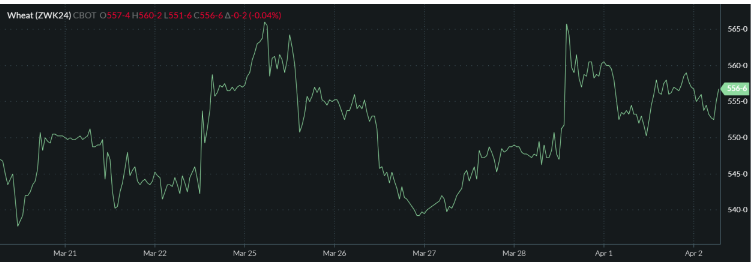

The charts below show the ups and downs endured by prices over the last couple of weeks.

Chicago Soft Red Wheat May ’24 Contract

Kansas Hard Red Wheat May ’24 Contract

Paris Milling Wheat May ’24 Contract

Source: Barchart Commodityview

For anyone needing to buy or sell, this constant volatility makes pulling the trigger on decisions a perilous task.

Stocks Remain High

We have seen a general downward trend in prices over many months as old crop wheat sellers are there whenever the buyers appear.

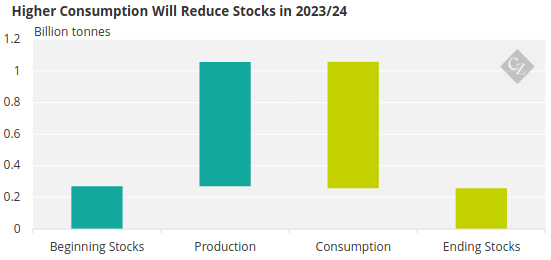

According to the most recent USDA WASDE report released in March, world demand has outstripped production in 2023/24 reducing stocks over the year from 271.10 million tonnes to 258.83 million tonnes.

Source: USDA

Despite this reduction in stocks over the year, prices continue to feel pressure due to what appear to be burdensome supplies available.

Looking to the new crop, the Northern hemisphere crops are growing rapidly towards harvest, while the Southern exporters in Argentina and Australia are approaching their planting season. During this critical period, the market is seeing some contrasting weather fortunes.

Northern Hemisphere

Adding to price pressure is the state of the US winter wheat crop. Last week, it was rated at 56% good to excellent, up from 28% good to excellent at the same time a year ago.

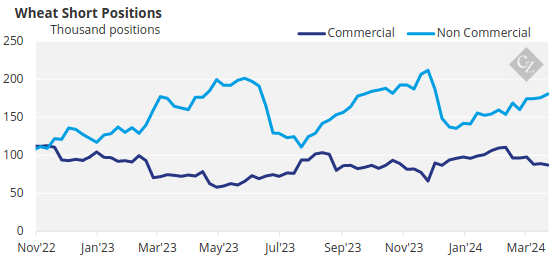

On the US wheat futures markets, funds continue to hold large short positions, seeing any rally as a selling opportunity and maintaining a firm level of price resistance.

Meanwhile in Europe, the West and Northern parts of the continent have experienced incredibly consistent rain for many months. This disrupted the winter wheat planting season, reducing acres, while many crops that were sown have experienced largescale flooding.

The French wheat crop is reported to be 66% good to excellent, down from 94% year on year.

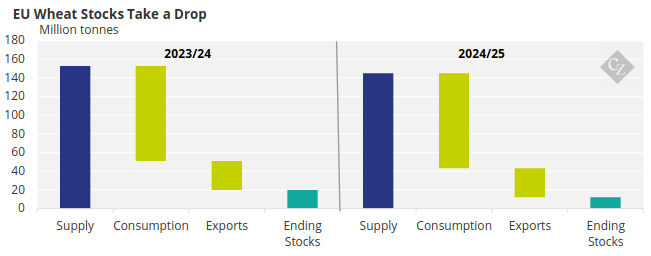

In recent days, the European Commission has forecast 2024/25 wheat output at 120.8 million tonnes, down from 125.6 million tonnes the previous season. With exports unchanged, at 31 million tonnes, stocks are looking to drop next year from 19.9 million tonnes to 12.1 million tonnes.

Source: European Commission

Southern Hemisphere

Both Argentina and Australia have experienced dryness, so rain will be important for the planting season on the horizon if good production numbers are to be reached at the end of 2024.

Conclusions

- As funds remain stubbornly short, it is difficult to see much of a price hike in the near-term, until their resolve is broken.

- On the global physical market, sellers appear whenever a major importer steps up to buy. As long as this continues, old crop values will struggle to lift, even if we are reaching, or have reached a floor.

- New crop production needs to be impressive if the dwindling stock scenario is to be arrested. This is by no means a given, considering the weather and potential problems across the globe.

- Buyers continue to hold the stronger hand for now, but there is a definitive argument for this current state of balance to change, which may yet allow sellers better opportunities ahead.