Insight Focus

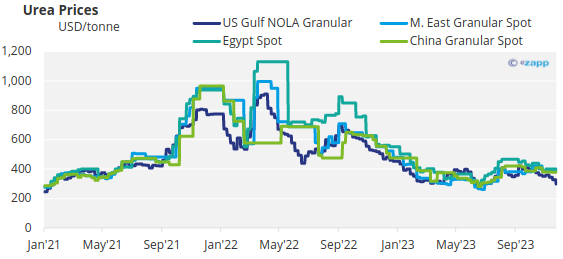

- The international urea market saw drastic price reductions this week across the board.

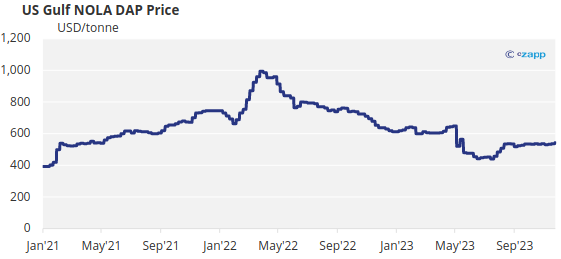

- Processed phosphate availability remains tight with the absence of China.

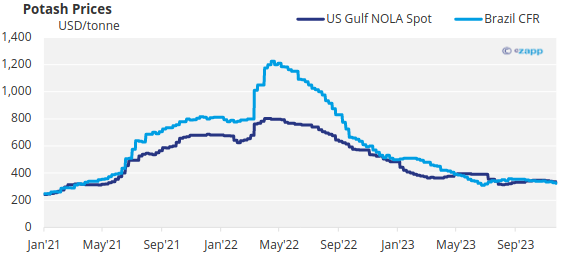

- The potash market is very quiet this week with Brazil being out of season and affected by bad weather and logistics issues.

The China Agriculture Means of Production Association (CAMPA) and the National Development and Reform Commission (NDRC) met with 15 Chinese fertilizer trading companies on November 24th to decide on an export policy.

In the gathering, an export quota for close to 1 million tonnes for the period through to early 2025 was agreed among the participants. These volumes apply for traders with product already in ports ready for export. A separate export quota is expected to apply for producers ex-factory and that volume is expected to be between 3-4 million tonnes.

The total export from China is expected then to be in line with historical annual exports of around 5 million tonnes before export control took place in 2022, which reduced exports to 2.8 million tonnes.

Further Urea Price Declines Expected

Black Friday week spooked the international urea market with price indices across the board seeing substantial declines week on week. Reported declines in the Black Sea saw FOB prices drop more than USD 30/tonne, Chinese FOB values dropped close to USD 20/tonne, Arab Gulf values fell close to USD 50/tonne and CFR values in Brazil dropped more than USD 40/tonne. Since the beginning of the month, prices in Egypt have dropped more than 10% whilst NOLA/US and Brazil prices saw declines between 15-20%.

Demand in most major markets is low and producers need to find a home for production as well as trying to stimulate demand by reducing prices. Rumour had it that an offer of USD 305/tonne FOB Arab Gulf did not attract interest.

Tenders in Pakistan, Bangladesh and Ethiopia have yet to result in business. The outlook for another urea import tender in India appears slim for the remainder of 2023, with a delay into January 2024 the most likely outcome. Market participants expect that prices may still decline further although at some point, the lid will come off in a major market and we could see a price rally.

The big question is what is happening in China – or rather what will happen. Export restrictions have been tightened this week with domestic producers being told to continue producing and sell at lower prices. Current daily urea production in China is at a reported 176,000 tonnes per day this week. Total exports of urea from China this year through October is at 3.4 million tonnes, up 1.47 million tonnes year on year but below the 4.76 million tonnes exported in the same period of 2021.

South Korea imported 594,000 tonnes through October, down 23% year on year. New Zealand imports through October were at 292,000 tonnes, down 13% year on year versus 462,000 tonnes in the first 10 months of 2021. Exports from Indonesia through September came in at 838,000 tonnes versus 1.46 million tonnes for the same period in the previous year.

Processed Phosphate

The processed phosphate industry is facing tight supply on the back of China’s absence from the market. The Chinese government has again tightened export restrictions and according to insiders there is around 400,000 tonnes of DAP/MAP sitting at ports in China with export clearance but not allowed to be exported.

Exports of Chinese DAP through October was 4.05 million tonnes, up 30% year on year. MAP exports were at 1.7 million tonnes, up 5% year on year.

Indian buyers are looking for much reduced import prices on DAP now that the government has slashed subsidies for the Rabi season starting on October 1st by 31%. However, offshore producers are not budging and maintaining prices at the current level of around USD 595/tonne CFR.

Tightness of processed phosphates has seen MAP prices in Brazil increase this week with an assessed CFR price of between USD 560-565/tonne. It should be noted that Brazil is currently out of season.

The outlook for processed phosphate prices should remain firm with prices expected to increase given China’s absence from the market.

Potash

The potash market this week saw very little activity since Brazil is out of season. But the South American country is also afflicted with unseasonably hot weather and logistics issues due to lack of trucks for domestic transport. Granular MOP prices were this week assessed at USD 330-335/tonne CFR with expectations of further declines in the weeks ahead.

Southeast Asian standard MOP prices remained unchanged from last week’s range of USD 300-330/tonne CFR. Indonesian imports of MOP through September were 1.5 million tonnes, down 32.9% from 2.3 million tonnes for the first nine months of 2022.

Russia was the largest supplier of MOP to Indonesia at 595,000 tonnes. Imports of MOP in India through October was 2.44 million tonnes, up 26% year on year.

According to the International Fertilizer Association, global MOP production will increase 5% year on year to 65 million tonnes. The outlook for potash prices is bearish with ample supply.

Ammonia

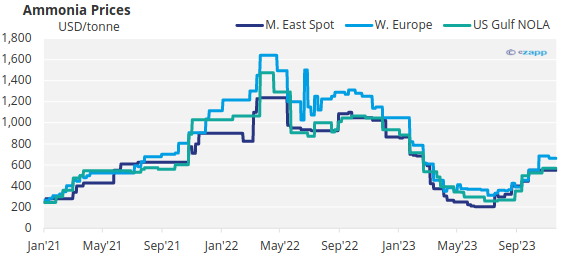

The ammonia industry is expected to face greater pressure on prices with increased supplies amid a seasonal lull in industrial demand in Northwest Europe and Northeast Asia.

The market is anticipating the Tampa December settlement price between MOSAIC and YARA to be announced shortly with the latest price of USD 625/tonne CFR Tampa expected to fall.