Insight Focus

- China’s ban on the export of fertilisers has created support for processed phosphate but urea is still wobbling.

- Potash markets are quiet with further price declines expected in Brazil.

- Ammonia markets are dormant with buyers expecting price declines amid increased supplies.

China Export Ban Lifts Phosphate

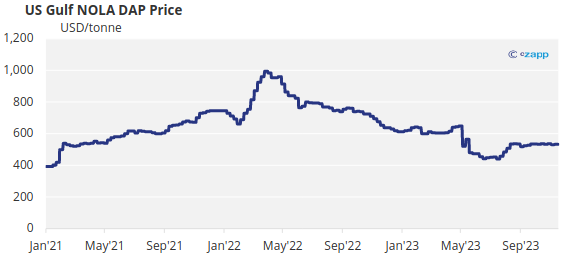

There is uncertainty in the global processed phosphate market on the back of tight supplies and China’s absence from the market. Tight phosphate supplies are leading to higher prices after strict export restrictions brought exports to a halt. Even already-cleared cargoes still at the factory gates are now said to be prevented from export.

DAP prices in China for export are said to be around USD 580-585/tonne FOB but this appears to be a nominal price since no new exports are taking place. It is now expected that China’s exports could be restricted well into 2024.

With China out of the market, the responsibility of supplying the world with processed phosphate is now on the shoulders of OCP Morocco and Ma’aden Phosphate Company of Saudi Arabia. Both companies are commanding higher prices for both DAP and MAP.

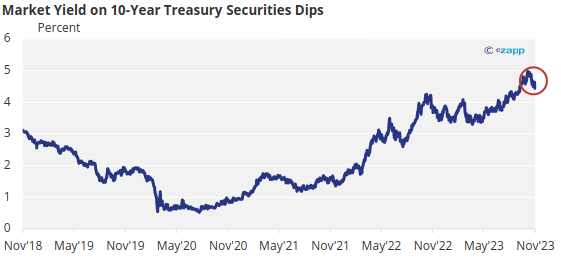

Major import markets of Brazil and Australia are feeling the squeeze both in terms of low availability and higher prices. The only respite is that the USD currency is falling on the back of falling inflation data in the US. This could lead to lower interest rates with the 10-year US Treasury rates falling sharply this week.

Source: St Louis Fed

Indian buyers were hoping to achieve lower import prices on DAP after the 31% reduction in the subsidy rate set by the Indian government. However, the assessed DAP CFR price in India is still at USD 595/tonne CFR versus the breakeven import price of around the USD 500/tonne. This means imports of DAP to India have more or less come to a complete halt.

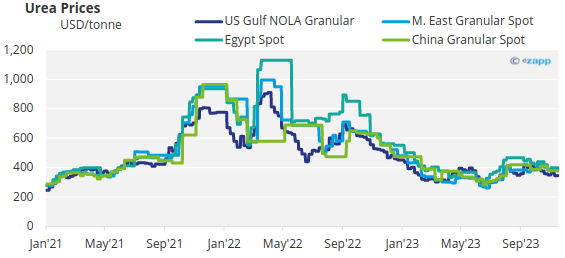

Urea Prices in Freefall

The outlook for the urea price on the other hand is bearish with persistent lack of demand from the major markets of Brazil, the US and Europe. Supplies are readily available and fully open for December onwards among most producers, while the lack of demand is helping set the tone for prices.

Import tenders in Pakistan, Bangladesh and Ethiopia did nothing to halt price declines in major markets Brazil, the US and Europe. In addition, the absence of a new import tender in India compounded the difficult situation in the urea market.

Brazil CFR prices lost a further USD 10-15/tonne this week from mid-USD 360/tonne CFR earlier this week. NOLA/US urea has lost USD 86/ton (USD 77.40/tonne) since the beginning of October and values this week were reported in the range of USD 322-325/ton (USD 290-292/tonne) FOB on the barge.

The Chinese government has now restricted exports in the hope of stemming price increases. However, this strategy appears to have failed and domestic urea prices in China continue rising. This could lead to export restrictions in China lasting well into 2024 now that inspection clearance days (CIQ) have increased to between 60 and 75 days. Domestic Chinese urea production is now reported at 182,000 tonnes/day.

Imports of urea to the Philippines through August is 579,000 tonnes, up 42.3% year over year from 407,000 tonnes.

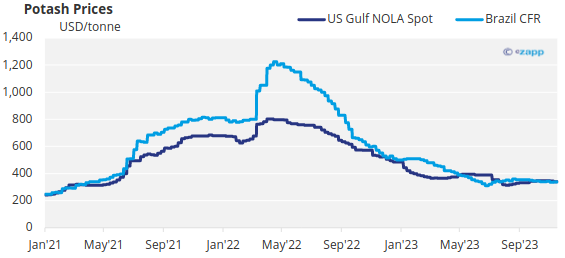

Potash

Potash prices looked weak this week amid a lack of demand and an abundance of supply including from sanctioned Belarus. Markets were muted with granular potash prices in Brazil falling a further USD 5/tonne to reach an assessed range of USD 335-350/tonne CFR. It is expected that prices could fall further in the weeks ahead on lack of demand from Brazilian farmers.

In Southeast Asia, prices are stable with limited upside. Standard grade potash prices are in the range of USD 310-330/tonne CFR. Exports of potash from Israel are uninterrupted with both export ports working well.

January to October imports of potash to Brazil are reported at 11.2 million tonnes versus 10.8 million tonnes for the first 10 months of 2022. January to September exports from Canada are recorded at 16.1 million tonnes, more or less flat on the year. US imports of potash through September ended at 8.6 million tonnes, almost equivalent to the 8.5 million tonnes reported in the same period last year. Thailand’s imports through September dropped to 474,000 tonnes from 666,000 tonnes in the same period of last year.

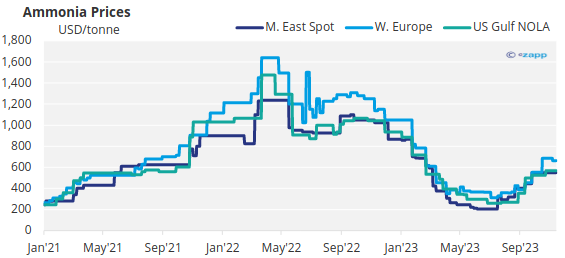

Ammonia

Ammonia prices look bearish for the remainder of the year into the first quarter of 2024. This week, the global ammonia market came to a halt with buyers reluctant to commit with the expectation of lower prices on the back of increased supplies. No spot deals were reported this week.

Yara will stop producing ammonia and urea at its downstream Ferrara facility for two months by the end of November, citing economic reasons, sources said on November 15. It is believed nitrate production at nearby Ravenna will continue using imported ammonia, rather than the ammonia that is usually sourced from Ferrara via pipeline. Yara has capacity to produce 600,000 tonnes/year of ammonia at Ferrara.