Insight Focus

- After decades of strong population growth, it seems that China’s birthrate is stagnating.

- While this is normal for developed countries, China’s position as one of the world’s largest consumers means it may be cause for concern.

- With a potentially shrinking and ageing population on the cards, what does this mean for food trade dynamics?

Global Population Growth Slows

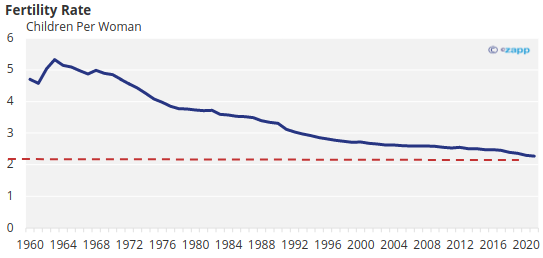

Population growth is slowing. In order for the population to remain steady, every woman on average needs to have 2.1 children. In recent years, the world is dangerously close to dipping below this barrier.

Source: World Bank

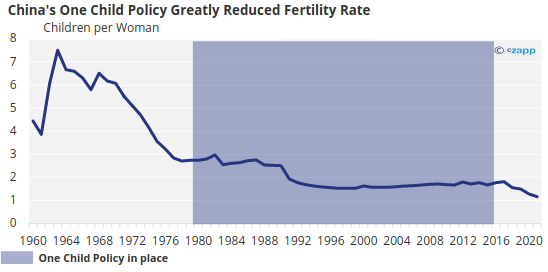

In fact, some countries have already dropped below the 2.1 rate – some quite substantially. In China, the One Child Policy that was in place for over 30 years greatly reduced the birthrate.

Source: World Bank

But even after the policy was relaxed from 2016 to allow families to have two children, China’s birthrate has continued to decline. It is now at just 1.16 – meaning the population is starting to plateau before a dip.

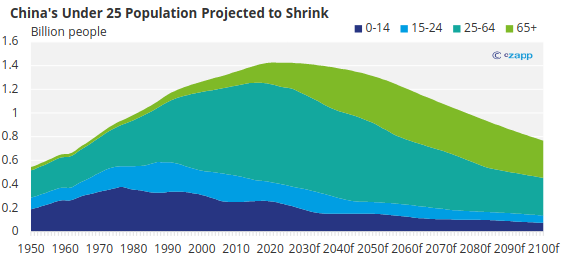

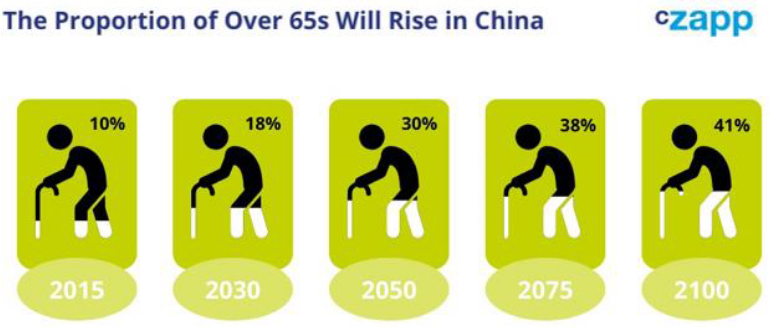

This also means the population is getting older. In China, the UN now projects that, not only will the population contract in the coming years, but the under 25 population will dramatically decline.

Source: United Nations

In contrast, by 2100, the over 65 population will account for 41% of the population.

For many years, experts had predicted a “population bomb”, whereby the number of people in the world would outstrip the available resources. Now this looks less likely, but low population growth also has implications for the economy – and for consumption patterns.

Shrinking Population Limits Economic Growth

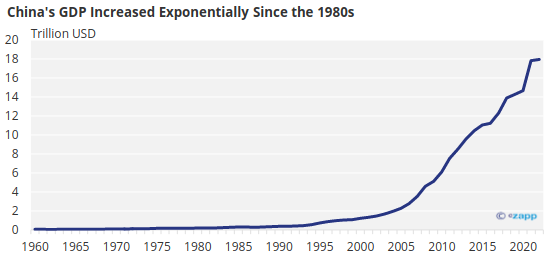

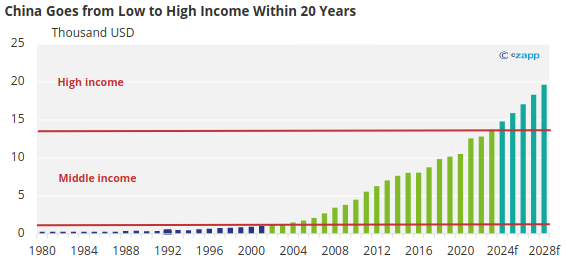

China’s growth in the past few decades has been staggering, thanks to a combination of capital investment, market-oriented reforms and a substantial pool of workers.

Source: St. Louis Fed

Note: Income brackets as defined by World Bank (low income = less than USD 1,036, middle income = between USD 1,036 and USD 13,845, high income = greater than USD 13,845)

Source: IMF

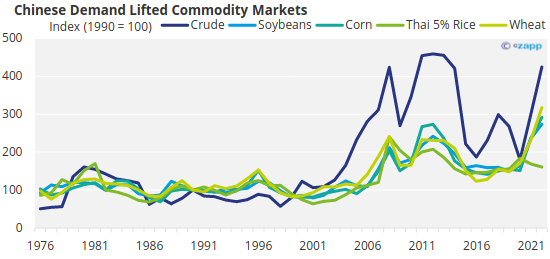

A growing middle class has been positive for consumption. In fact, the increase in China’s disposable income in the early 2000s lifted entire commodity markets.

Source: World Bank

A declining population can lead to a drop in consumption. But for an economy of China’s scale, this not only has implications domestically but also ripples all around the world.

Ageing Population Shuns Sugar?

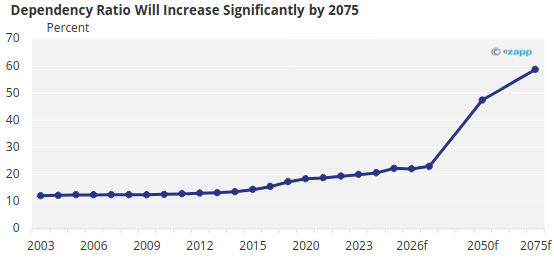

As we have seen in several sugar consumption case studies, there are links between ageing and a decline in sugar consumption. In China, the elderly dependency ratio has doubled in the past 20 years and is expected to continue growing.

Source: OECD

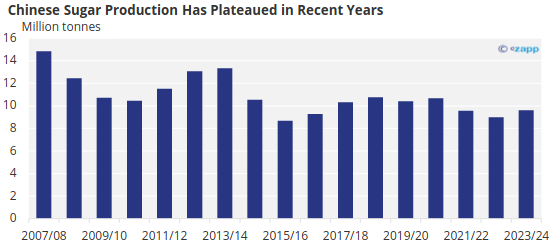

We already know that Chinese sugar consumption will barely grow between now and 2030. Chinese sugar production has plateaued, and it is likely to remain a net sugar importer

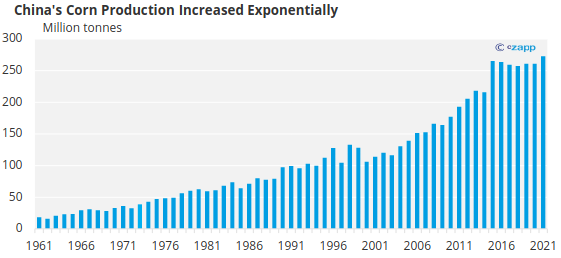

But a drop in sugar appetite has created greater opportunities for sweeteners, which are often cheaper. China’s corn production, which is used to produce high fructose corn syrup (HFCS), has risen.

Source: FAOSTAT

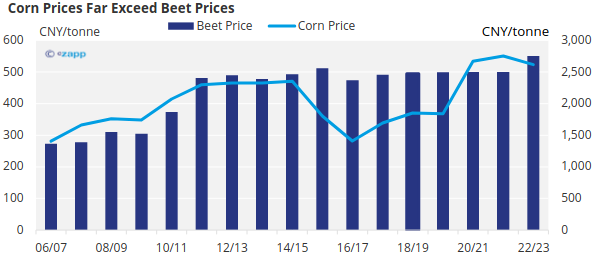

Crops such as corn and potatoes can also offer farmers better returns than sugar.

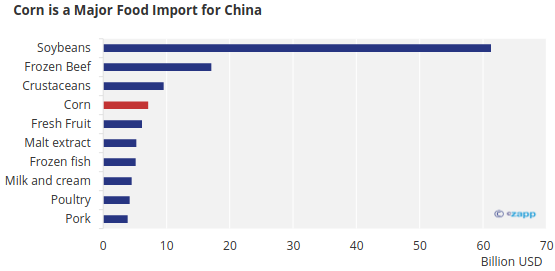

As sugar appetite declines, this will decrease the demand for sugar imports. And as corn demand increases and land becomes scarce, these imports will likely increase too.

Source: UN Comtrade

China’s corn imports were worth about USD 7.1 billion in 2022.

Chinese Consumption Ripples

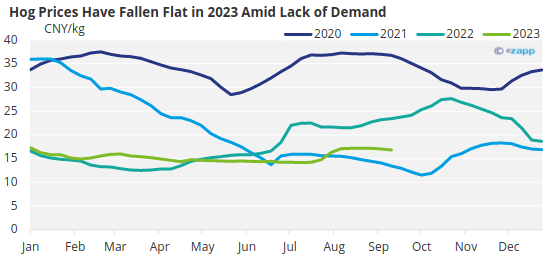

It seems that in recent years, China’s appetite for meat is dwindling. Prices of the country’s favourite meat – pork – have fallen this year amid lack of demand.

Source: Pig333

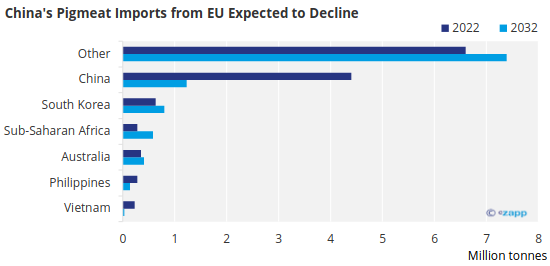

This dynamic also has an impact on pork markets globally. In 2022, China was a major importer of European pigmeat due to an Asian Swine Flu (ASF) outbreak that compromised much of China’s herd.

Source: European Commission

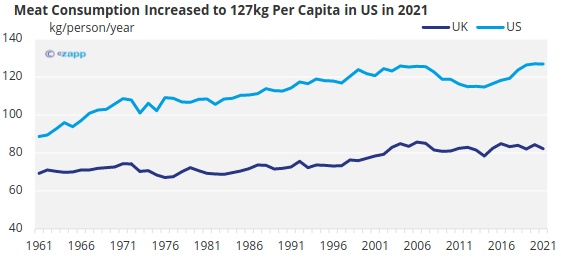

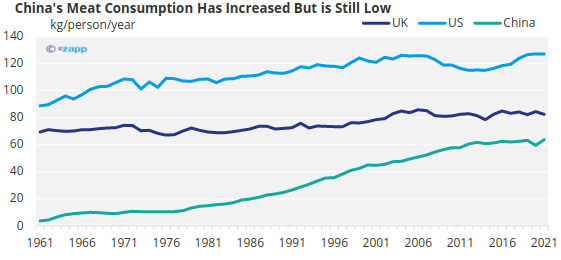

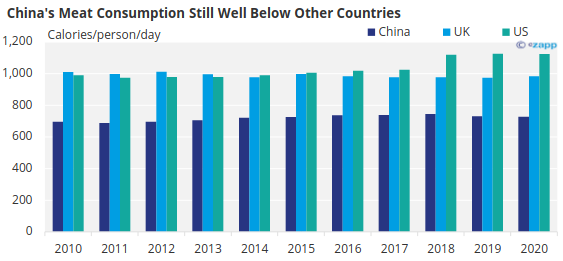

China’s production capacity is recovering, which will reduce dependence on imports. But as a country grows, so too does its meat consumption. Take the US and the UK for example – two high-income countries.

Source: FAOSTAT

While China’s income is growing, its meat consumption is still far behind that of the US and trails the UK. This implies that there is still huge room for growth in meat consumption.

Source: FAOSTAT

If China’s meat consumption were to grow to the same level as that of the US, it would have to double current consumption. Even with more conservative growth to the same level as the UK, there would be scope for an additional 20kg per person per year. That’s another 28 million tonnes of meat based on the current population.

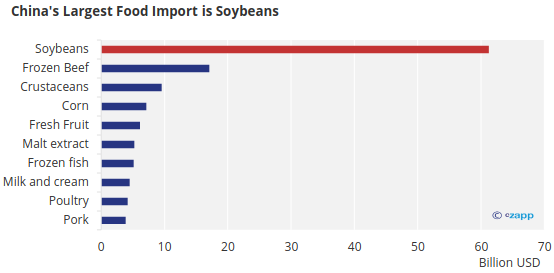

It could also have implications for soybean producers globally. China imports massive amounts of soybeans, which are primarily used for animal feed, and this could increase with higher meat consumption.

Source: UN Comtrade

It is unlikely that China would be able to produce this much meat independently, and therefore meat imports are likely to grow.

Demographics Impact Labour Availability

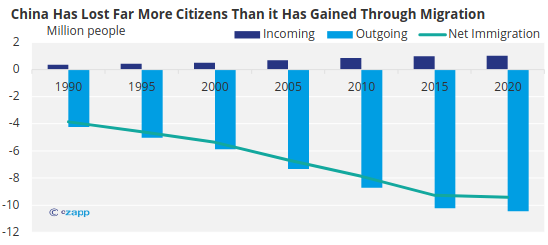

Not only does the ageing population have implications for food demand, but also for food supply. Many countries have offset low fertility rates through immigration but others, like Japan and China, don’t have high levels of net immigration.

Source: United Nations Population Division

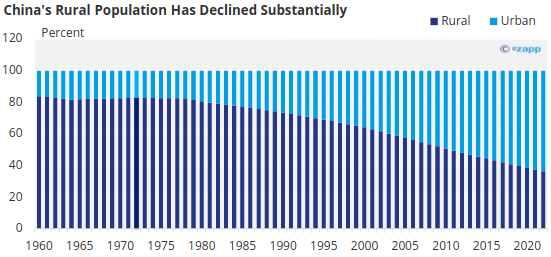

A smaller workforce suggests that the need for Chinese farming to modernize will become more urgent, especially since a greater proportion of workers are now urban.

Source: World Bank

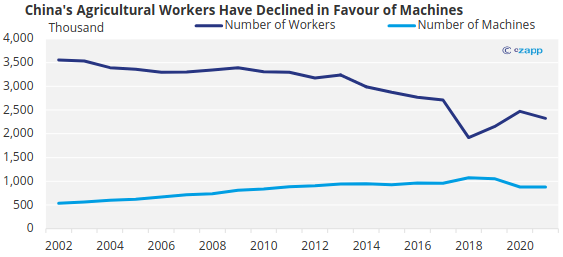

The number of agricultural workers has already declined in the past 20 years to be replaced mainly by machinery. But not all farm labour can be mechanized.

Source: China National Bureau of Statistics

And despite an increase in the number of machines on farms, productivity is lacking. At the Central Rural Work Conference in December 2022, President Xi Jinping pointed out that China’s agricultural labour productivity is only 25.3% of that of non-agricultural industries.

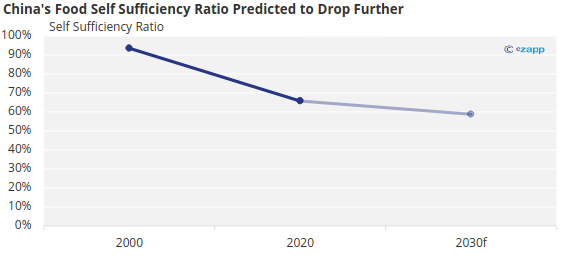

China’s food self-sufficiency ratio has already plummeted as farmland declines and dietary patterns change. The ageing population places an additional burden on the country’s ability to produce enough food.

Source: South China Morning Post

Understandably, the government has prioritized food self-sufficiency policies and at the end of 2021, The State Council issued a notice within the 14th Five-Year Plan to promote agricultural and rural modernization.

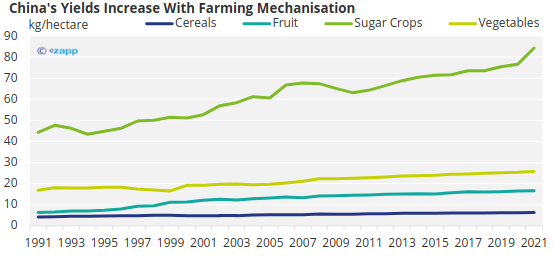

Expansion of farmland will likely be unsuccessful if there are not enough workers to tend the land. But yields are likely to improve with higher mechanisation, as they have done in the past.

Source: FAOSTAT

Urbanisation May Reverse Trend

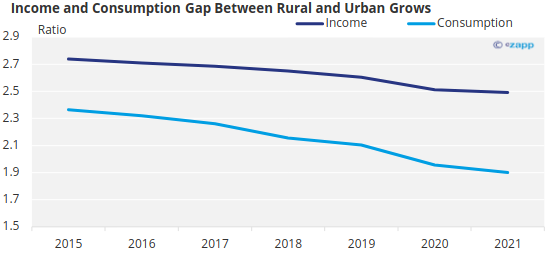

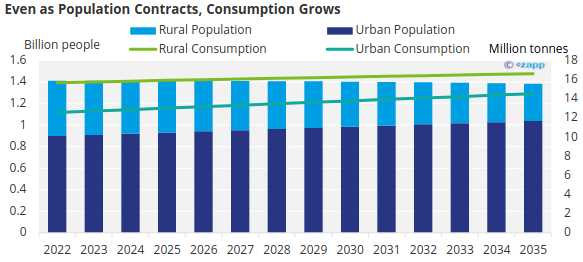

Just like many advanced economies, China’s population is likely to become more and more urbanised. In China, urban workers’ income is almost three times higher than that of rural workers, which is a boost for consumption.

Consumption for urban workers is just over double that of urban workers, according to China’s National Bureau of Statistics.

Source: China National Bureau of Statistics

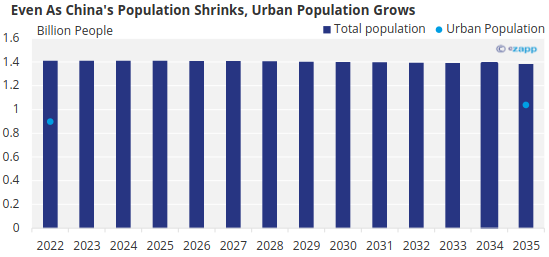

Over the past 40 years, China’s urban population has been growing by just over one percentage point per year. In other developed countries with a population of over 30 million, the urbanisation rate is over 80%. While China’s momentum will likely slow, conservative estimates place it at 75% by 2035.

This equates to adding 140 million people to the urban population. This would have major implications for consumption.

Source: Czapp calculations, World Bank

Let’s look at sugar. Right now, China consumes about 16 million tonnes across its population of 1.4 billion, which amounts to on average 11kg per person per year. Since urban sugar consumption is higher than rural sugar consumption, we estimate the typical urban consumer eats about 14kg per year, while rural sugar consumption is about 6kg per person per year.

An additional 140 million urban consumers would add about 1.5 million tonnes of sugar demand by 2035.

Source: Czapp calculations

And this 20kg per person is nowhere near the peak of sugar consumption in developed countries. In the UK, current per capita consumption is about 25kg per person per year, while in the US, sugar consumption is around 35kg per person per – and this is without adding sweeteners to the mix.

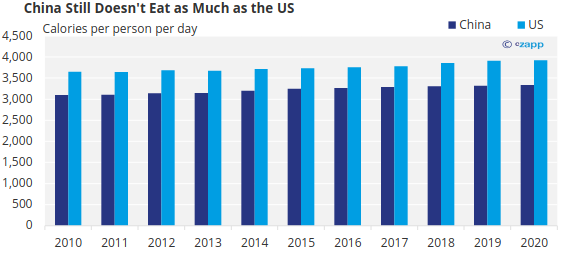

And Chinese people still don’t consume as much calories as people in certain developed countries do.

Source: FAOSTAT

Meat consumption in China is also significantly lower than in other developed countries. There is still scope for significant increases in meat consumption, meaning increases in soybean consumption.

Source: FAOSTAT

All this means there is still a lot of room for consumption growth even as the population declines.

Have We Reached “Peak China”?

- A key component of China’s explosive economic growth has been down to increasing consumption as the middle class grows.

- There have been concerns that population contraction could jeopardise this growth, undermining the global economy.

- The slowdown in Chinese growth is “casting a shadow over global growth,” according to US credit agency Fitch Ratings.

- But increasing urbanisation and a lot of headroom for per capita consumption growth could offset the impacts of a declining population.

- It looks like going forward, China’s population will be wealthier and more urban, albeit with a slowly shrinking population.

- This likely means higher meat consumption, less food self-sufficiency and therefore more imports.