Insight Focus

- The organic food premium in the US has shrunk despite a slowdown in demand.

- Prices of non-organic products have risen more sharply than those of organics.

- If this trend continues demand for organic products could rebound.

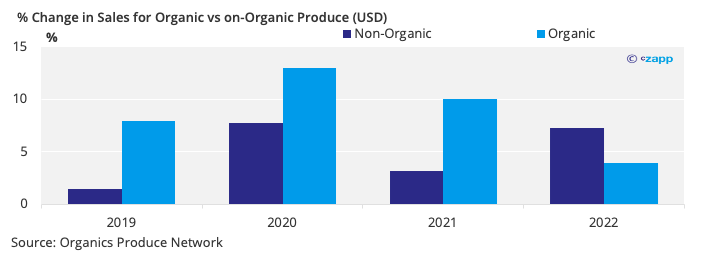

US demand for organic produce has grown over the past decade, peaking in 2020. On the surface, growth seems to have taken a hit as prices for organic produce are not immune to the current inflationary trend. In the first quarter, sales of organic produce decreased by almost 1% on the year. However, organic produce is outperforming non-organic.

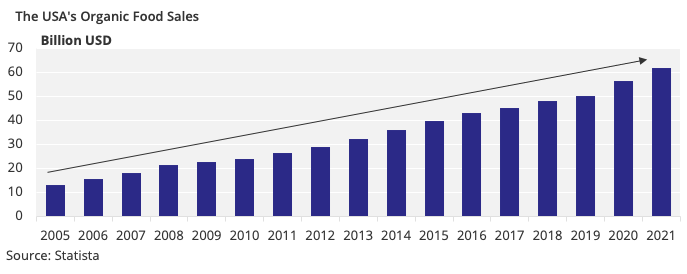

More US Consumers Go Organic in 2020, 2021

Sales of organic produce in the US hit a record high last year (USD 61.9 billion). This is perhaps because, over the past decade, consumers have become more environmentally conscious, and the organic production process is free of pesticides, residues of which pollute soil and water.

However, at the beginning of 2022 organics market seems to have peaked as consumers faced inflationary pressure. As a result, sales of organics decreased as consumers turned to less expensive non-organic produce.

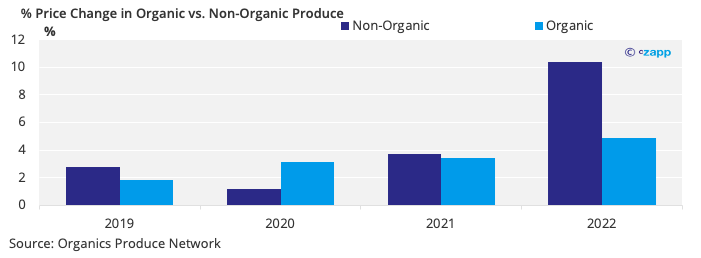

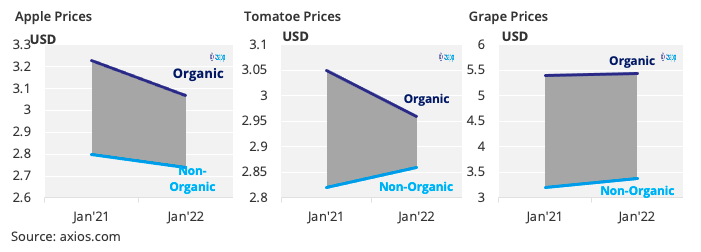

Even though on the surface non-organic seem to be outperforming organic sales, when we look at sales volumes for both markets organics come out on top. This is because prices of non-organic produce have been increasing faster than those of organic.

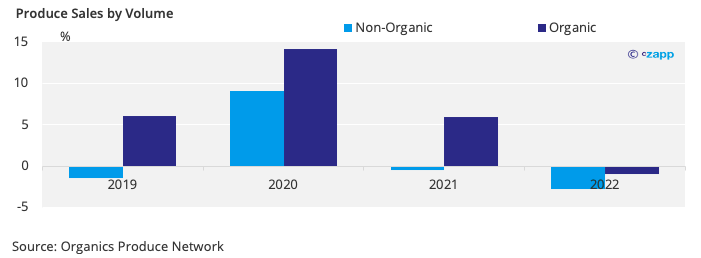

Organic, Non-Organic Sales Volumes Decrease in Q1

Looking at both markets, organic produce volumes have fallen by almost 1% but non-organic produce sales have shrunk by 2.8%.

This demonstrates that sales of non-organic produce have decreased due to higher input costs being passed on to the consumer. With fertilizer and transportation costs increasing sharply, non-organic farmers are faced with higher input costs. Since, they have smaller margins, this increase in production costs is directly reflected in the price of the finished product.

On the other hand, organic farmers are less affected by increasing input costs as they use less fertilizer and can absorb some of the rise in transportation costs due to the premium. As a result, the price gap between organic and non-organic produce is narrowing.

If organic producers can continue exploiting their lower input costs and absorbing some of the rises in other costs there could be a consumer move towards organic and away from non-organic products.

Another factor that could incentivise consumer to switch to organic produce rather than non-organic produce is government regulation. As more governments pay more attention to the environmental impacts supply chains for non-organic products have, they could decide to increase input costs (fertilizer and transportation). This could also make organic produce more competitive and further incentivise consumers to purchase organic over non-organic produce.

However, if input costs for non-organic produce return to normal, we could see price sensitive consumers move towards non-organic produce. If this is the case, organic produce prices might also decrease but still be carry a premium.

Other Insights that may be of interest